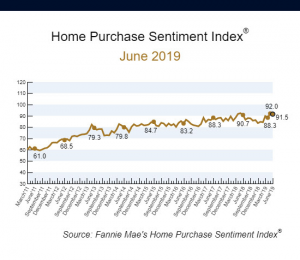

An 8-percentage point increase in the net “Mortgage Rates Will Go Down” component was more than offset by the index’s other five components, all of which were either negative or flat in June. This was highlighted by “Good Time to Buy,” which fell 4 percentage points this month.

“Growing expectations that mortgage rates will remain steady suggest improved stability for housing affordability and hel ped keep the HPSI relatively flat this month, despite modest declines in other components,” said Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae. “Regional variations in housing optimism appear to be tied to a divergence in housing affordability."

ped keep the HPSI relatively flat this month, despite modest declines in other components,” said Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae. “Regional variations in housing optimism appear to be tied to a divergence in housing affordability."

Highlights from the Home Purchase Sentiment Index include:

- The net share of Americans who say it is a good time to buy a home decreased 4 percentage points to 23%.

- The net share of those who say it is a good time to sell a home remained unchanged at 43%.

- The net share of those who say home prices will go up over the next 12 months decreased 3 percentage points to 38%.

- The net share of Americans who say mortgage rates will go down over the next 12 months increased 8 percentage points to -29%.

- The net share of Americans who say they are not concerned about losing their job over the next 12 months decreased 3 percentage points to 73%.

- The net share of those who say their household income is significantly higher than it was 12 months ago decreased 1 percentage point to 20%.