OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

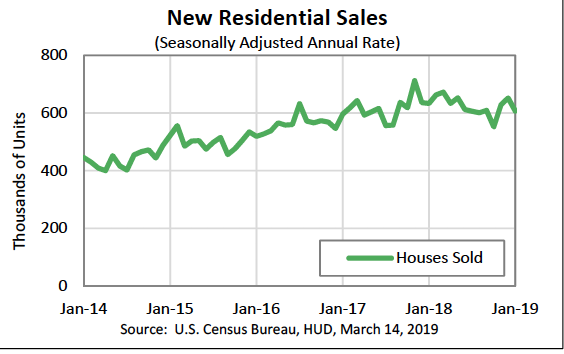

New Home Sales Statistics Show a Slow Start to 2019

- Thursday, 14 March 2019

- Originating

The U.S. Census Bureau and the Department of Housing and Urban Development jointly announced their residential sales statistics for January 2019. This comes on the heels of their announcement six days ago of the December statistics as the government entities try to make up for time lost due to the government shutdown.

Sales of new single‐family houses in January 2019 were at a seasonally adjusted annual rate of 607,000. This is 6.9 percent below the revised December rate of 652,000 and is 4.1 percent below the January 2018 estimate of 633,000. The fact that sales fell off in January doesn’t come as much of a surprise to many nationwide players in the real estate and mortgage industry who have seen reduced activity levels early in the year. Interest rates, however, have been falling and might provide some relief for a market looking to regain momentum. With the economy expected to continue to grow, albeit at a slow rate, Freddie Mac is still predicting the total housing market will bounce back and post a modest growth for 2019 ( $6.1M total sales in 2019 vs $5.97M in 2018). So maybe it’s just a slow start or maybe existing home sales can make up the difference.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

The median sales price of new houses sold in January 2019 was $317,200, down from a 2018 median price of $325,300 and a December median price of 319,100. The average sales price was off similarly. Most experts are forecasting annual price growth in the 4%-4.5% range this year. But with a 6.6 month supply of houses on the market in January 2019 vs a 5.6 month in January 2018 you have to wonder if the slowdown in sales and increased inventory will continue to put downward pressure on prices like we saw in 2018.

Regionally, the west was the only bright spot rising 27.8 percent from December, although still down 3.2 percent vs year prior. Northeast sales were consistent, if nothing else, falling by 11.4 percent both month over month and month vs year prior. The Midwest sales were down 28.6 percent month over month and 41.9 percent vs year prior while sales in the south declined by 15.1 percent vs December but grew year-over-year by 6.2 percent.

Read more...

Deliberate Practice Separates Successful Originators—from Average Ones

- Monday, 11 March 2019

- Originating

By Pat Sherlock

I just watched the Oscar and BAFTA award-winning documentary "Free Solo" which follows Alex Honnold as he climbs Yosemite's El Capitan, a 3,000-foot granite monolith, without ropes.

This is an incredible story as Honnold becomes the first person ever to accomplish the feat. The film is breathtaking and gives viewers the feeling that you are actually climbing with him. The beauty and danger of El Capitan is on full display.

[caption id="attachment_9789" align="alignleft" width="266"] Sherlock: The best students are successful originators who want to improve their skills.[/caption]

Sherlock: The best students are successful originators who want to improve their skills.[/caption]

You cannot watch the documentary without being overwhelmed by his achievement. But, what struck me most about Honnold's story is the intense preparation and practice he put in before attempting to scale the wall. Honnold analyzed the climb in great depth. He kept a journal of his observations, visualized what he was going to do and then practiced scaling the wall with ropes.

He fell many times during the practice sessions which says something about his courage. In my view, the most interesting part was that he didn't wing it. I believe there is an important lesson here for those of us in mortgage banking.

Although Honnold is known as one of the world's best free solo climbers, he was smart enough to practice deliberately. His practice sessions went on for months because he knew that one mistake on the wall and he would be dead.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Obviously, in a life-and-death matter one would expect that anyone would be as diligent as he was; but as we often see, that is not always the case. Honnold's challenge was to align his thinking with his muscles to execute unconsciously during his scaling of El Capitan.

Mastering difficult techniques until they become second nature isn't easy, but it is what above-average originators do to win in today's marketplace. For top producers, succeeding in origination is their own version of climbing El Capitan. I know from conducting sales training for many years, the best students are always the most successful originators who still want to get better. These individuals work hard, ask the best questions, practice their new skills and implement what they have been taught.

In my recent sales training program on social media and lead generation, it was the top producers who used the new information quickly and applied it to their business models. They did not argue that social media is bad as low-performing originators often do.

Instead, the top producers recognized that first-time home buyers and referral sources are using social media platforms more frequently and that using these communication tools in their prospecting efforts is imperative if they want to be successful.

Originators who resist the new selling methods will inevitably be left behind and before they realize it, they also will be out of a job. The reason is simple: Lenders will no longer be able to afford to carry them.

It is clear to me that mortgage banking is at a crossroads where costs are high and production is difficult. Every day I speak with lenders and hear the same things about how business is really hard with many firms conducting price wars.

The reasons why this has happened can be debated, but the reality is that mortgage banking firms must scale the "granite wall" or cease to exist. This isn't gloom and doom, but simply a fact that companies must reinvent themselves to stay competitive. This takes hard work and encompasses installing perpetual change in their culture and implementing changes with a disciplined approach.

Yes, it is a tough environment. Managers who once held high-level positions are now realizing that there are not a lot of these jobs available today. Many hold on to the status quo hoping they can weather the storm. The same goes for originators and back-office personnel.

But the good news is as an industry, below-average performing companies and vendors will be replaced by firms that are innovative in their marketing and processes. We are already seeing some real innovation: Chase is guaranteeing to close a loan in 21 days. Hopefully soon, some other lender will guarantee 10 days for all loans. It is clear that new ideas are needed in the industry and not just the traditional response of taking on greater credit risk to generate business. We have seen what happens when that is the dominant strategy.

We need, instead, more managers and originators who are willing to deliberately practice new selling techniques.

About the Author: Pat Sherlock is the founder of QFS Sales Solutions, an organization that help sales organizations improve their sales talent management and performance. For more information, visit https://patsherlock.com

Read more...

Millennials’ Appetites for Refinances Grow, as Rates Decline

- Wednesday, 06 March 2019

- Originating

Millennials took advantage of slightly lower interest rates in January to refinance their mortgages. Refinances by Millennial borrowers accounted for 13 percent of all closed loans, the highest percentage since February 2018, according to the “Ellie Mae Millennial Tracker.”

Also, refinances climbed to 35 percent of closed loans in January, up from 29 percent in December of 2018, according to the January “Origination Insight Report” from the company, which explores trends among borrowers of all ages.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Refinances also made up a larger share of each type of loan in January. Refinances for Conventional loans for Millennial borrowers rose to 14 percent, up from 11 percent in December, while Federal Housing Administration refinances rose to 7 percent in January, from 6 percent. During that same time period, Veterans Affairs refinances rose to 35 percent, up from 27 percent the month prior.

[caption id="attachment_9345" align="alignleft" width="200"] Joe Tyrrell[/caption]

Joe Tyrrell[/caption]

“With average interest rates slightly falling in January, Millennials took advantage of refinance opportunities,” said Joe Tyrrell, executive vice president of strategy and technology at Ellie Mae. “While we continue to see Millennials enter the housing market and exercise their purchase power, the uptick in refinances may indicate maturity among this generation who previously purchased a home and are looking for an opportunity to take advantage of lower monthly interest payments.”

In January 2019, the average Millennial primary borrower refinancing their home was 33 years old, with a FICO score of 728. Two-thirds of those who refinanced were married (66 percent) while one-third were single (33 percent), and one percent were unspecified. Additionally, the majority of primary borrowers who refinanced were male (63 percent).

Other key findings from the January 2019 Ellie Mae Millennial Tracker include:

- The share of conventional loans increased to 69 percent of all closed loans, slightly up from 68 percent the month prior, while Federal Housing Administration loans held steady at 27 percent from December.

- The average FICO score of Millennial borrowers who closed on loans in January increased slightly to 722, up from 721 in December.

- The top five markets for Millennial borrowers in January were Warrensburg, Mo.; Somerset, Pa.; Ottumwa, Iowa; Minot, N.D.; and Williston, N.D.

Read more...

Home Affordability Improves

- Thursday, 07 March 2019

- Originating

Home prices are still up year-over-year in all 50 states and the nation's 100 largest markets, slowing is noticeable nationwide, and combined with recent interest rate reductions, is helping to improve the overall affordability outlook, according to the “Mortgage Monitor Report” from Black Knight Inc.

"At the end of December, home prices at the national level had fallen 0.3 percent from November for their fourth consecutive monthly decline," said Ben Graboske, president of Black Knight's Data & Analytics division. "As a result, the average home has lost more than $2,400 in value since the summer of 2018. And while home prices are still up on an annual basis, the slowdown continues nationwide and, importantly, is not being driven by seasonal effects.”

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

December marked the 10th straight month of slowing annual home price appreciation, falling from a high of 6.8 percent annual growth in February to 4.6 percent at year-end.

Nonetheless, annual growth is still outpacing the 25-year average of 3.9 percent--although the gap is closing quickly. Also, it's yet to be seen what impact the recent pullback in interest rates might have on the national home price growth rate.

"There is good news in these numbers for prospective homebuyers, though. Combined with the average 30-year fixed rate declining by more than half a point over the last three months, housing is now the most affordable it's been since early in the 2018 homebuying season. It currently requires 22.2 percent of median income to purchase the average home with a 20 percent down payment on a 30-year fixed-rate loan. That's down from a post-recession high of 23.4 percent just a few months ago.”

According to Black Knight, the recent decline in rates has translated into a more than 6 percent increase in a homebuyer's purchase power--while keeping monthly payments the same--or a decrease of $62 a month in principal and interest on the average home bought with 20 percent down.

While this is all welcome news for consumers heading into the spring homebuying season, it remains to be seen whether recent rate declines and easing affordability will be enough to halt the deceleration in home price growth.

Deceleration in home price appreciation is seen most acutely on the West Coast, particularly Washington State, and even more so in California, which has seen its annual rate of appreciation fall from over 10 percent in February 2018 to just 3 percent as of the end of 2018.

The slowdown has been most apparent in San Jose, Seattle and San Francisco, which have gone from being ranked first, third and fourth by annual home price appreciation, respectively, to all three being in the bottom 25 percent of markets within the past 10 months.

After seeing annual home price appreciation rates above 20 percent in 2017, prices in San Jose are now nearly flat from where they were one year ago. Home prices in San Francisco are up just 1.9 percent, while in Seattle home prices are up 3.1 percent from one year ago, whereas both metro areas had until recently been experiencing double-digit growth.

Read more...