OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

HSBC Bank USA Launches New Digital Mortgage Solution with Roostify

- Wednesday, 19 June 2019

- Uncategorized

-HSBC Bank USA, N.A., (HSBC), part of the HSBC Group, one of the world’s largest banking and financial services organizations, today announced that it has launched a digital home lending experience powered by Roostify. The partnership provides customers with a digital loan transaction experience that is faster, easier and less stressful than before, while enabling HSBC to process and close loans more efficiently with fewer manual touches.

“Digital plays a crucial role in supporting, enabling and driving our ambition of customer experience-led growth,” said Raman Muralidharan, Head of Mortgage, Retail Banking and Wealth Management, HSBC Bank. “Customers are looking for the same ease-of-use and convenience for large transactions like financing a home that they’ve come to expect in other buying experiences. Roostify is able to accelerate our deployment timeframe with a solution that provides a superior experience for our customers and our mortgage consultants.”

“Digital plays a crucial role in supporting, enabling and driving our ambition of customer experience-led growth,” said Raman Muralidharan, Head of Mortgage, Retail Banking and Wealth Management, HSBC Bank. “Customers are looking for the same ease-of-use and convenience for large transactions like financing a home that they’ve come to expect in other buying experiences. Roostify is able to accelerate our deployment timeframe with a solution that provides a superior experience for our customers and our mortgage consultants.”

The platform offers a streamlined loan application and fulfillment process for home buyers and owners during a purchase or refinance. Customers are able to submit a loan request online, share documents digitally and securely, and track the status of their loans from application through to closing, in real time. Roostify integrates with HSBC’s loan origination system, allowing the bank’s lending team to more easily transfer information and more effectively communicate with customers, driving quality and efficiency in the loan-origination process.

“HSBC has been a great partner in driving innovation to improve their customer experience,” said Rajesh Bhat, CEO and Co-Founder of Roostify. “Information exchange is a vital part of the home-buying experience, and it can be a game changer when done right. This solution provides HSBC’s customers with a modern, improved way of applying for and closing a mortgage and delivers transparency to both the customer and lending team from start to finish, for an optimal experience.”

Read more...Survey Reveals That Consumer Knowledge about Credit Scores Has Steadily Declined over the Past Eight Years

- Wednesday, 12 June 2019

- Uncategorized

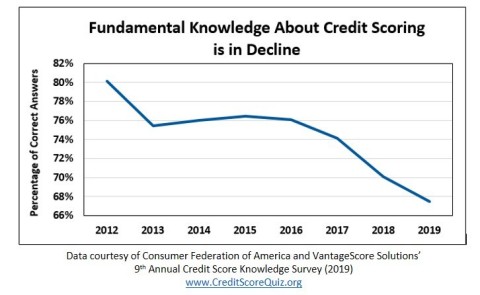

The ninth annual credit score survey, released today by the Consumer Federation of America (CFA) and VantageScore Solutions, LLC, shows that consumer knowledge about credit scores is at the lowest level in the past eight years. On most knowledge questions (as the enclosed table and charts show), correct scores declined by more than ten percentage points, and sometimes by more than 20 percentage points. For example:

- 78% of respondents in 2012, but only 62% in 2019, correctly indicated that people have more than one credit score.

- 85% in 2012, but only 66% in 2019, correctly answered that keeping a low credit card balance helps raise a low credit score or maintain a high one.

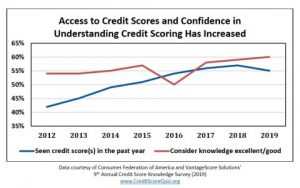

However, in the same period, the proportion of respondents who said they considered their knowledge of credit scores excellent or good rose from 54% to 60%.

“Consumers know less about credit scores but think they know more,” said Stephen Brobeck, CFA senior fellow. “Taking our online credit score quiz provides an easy way for consumers to update their credit score knowledge,” he added. More than 230,000 individuals have taken the Credit Score Quiz, developed and maintained by CFA and VantageScore.

“We are pleased that many consumers now have free access to their credit scores, but consumers must also take advantage of all the additional information about credit scores and credit files in order to make better credit decisions,” said Barrett Burns, president and CEO of VantageScore Solutions.

Consumer knowledge levels may have deteriorated, in part, because of improvements in the overall economy and consumers’ financial condition. In 2012, large numbers of Americans faced challenging credit card and mortgage debts, so consumers may have been especially concerned about credit scores. Since then, as the nation’s economy and family finances recovered, and as consumers reduced unsustainable credit card and mortgage debts, consumers may have felt that it was less important to fully understand credit scores. Reports of increases in average credit scores nationwide may also have lessened people’s feelings of financial vulnerability and the need to fully learn about their scores and its impact.

Despite overall rising score levels – now averaging 680 according to Experian – a large minority of consumers have fair or poor scores (below 670). Low scores can especially harm these people by:

- Denying then access to needed credit

- Increasing the costs of consumer and mortgage credit that can obtain. Subprime auto loans will likely cost several thousand dollars more, and subprime mortgage loans can cost over ten thousand dollars more compared to conventional loans.

- Increasing deposits required by utilities and cell phone companies to obtain service

Low credit scores also are an indicator that people may have difficulty obtaining a job. While credit scores themselves are not used by employers, the credit reports the scores are based on are frequently utilized. “Those with low credit scores should be aware that they are at risk not only for paying higher costs for credit and utility services, but may also struggle to obtain a good job with which to afford those higher costs,” noted CFA’s Brobeck.

While consumers’ knowledge of their actual credit scores has declined overall, the latest survey shows large majorities of consumers did correctly answer key knowledge questions related to important facts:

- Mortgage lenders and credit card issuers use credit scores (83% and 82% respectively).

- Missed payments are used in calculating credit scores (86%)

- Making all loan payments on time helps a consumer raise a low credit score or maintain a high one (87%).

However, significant minorities of respondents did NOT know other key facts, for example:

- Cell phone companies might use credit scores in pricing services (41%).

- Borrowing from a 401k retirement account or paying a parking ticket late will not lower your credit scores (30% and 22% respectively).

- Opening several credit card accounts at the same time might lower scores (38%).

- Frequently checking credit scores will not lower their scores (38%).

- Checking the accuracy of one’s credit reports is very important (33%). Lenders may have provided inaccurate information or failed to supply accurate information to credit bureaus; thus, the bureaus may have made mistakes such as adding information to the wrong file of a person with the same name.

In brief, consumers can raise their credit scores or maintain high scores by:

- Consistently making loan payments on time every month. A late payment may lower one’s credit scores by dozens of points.

- Using a small portion of the credit available on a credit card. In general, the higher the percentage of credit line that is drawn down, the lower one’s credit scores.

- Paying down credit card debt rather than just shifting it to another credit card or to a home equity loan.

- Regularly checking one’s credit reports to make sure they are error-free. This can be done for free annually by going to comor by calling 800-322-8228.

The survey was conducted by the Engine Telephone CARAVAN survey, who on April 25-28, 2019, interviewed 1,002 representative adult Americans by landline or cell phone. The survey’s margin of error is plus or minus three percentage points.

Read more...ComplianceEase names Michael Jackman as CEO, John Vong to become Executive Chairman

- Tuesday, 05 March 2019

- Uncategorized

ComplianceEase, a provider of automated compliance solutions to the financial services industry, announced today that its Board of Directors has appointed Michael Jackman as chief executive officer. Jackman replaces Anita Kwan, co-founder and chief executive officer, who is retiring.

John Vong, ComplianceEase’s other co-founder, has been named executive chairman of the board. In this role, he will be responsible for setting the company’s overall vision and strategy, as well expanding partnerships, broadening government outreach and establishing ComplianceEase as a leader in GRC technology.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

A veteran technologist, Jackman was part of the team at TRW Real Estate that developed the first software for the online ordering of title, tax, appraisal and credit services: technology that was integral to the growth of First American and later, CoreLogic. Over the course of his 30-plus year career, Jackman held division president positions at HNC Software (now part of Fair Isaac) and Fiserv’s LOS division. He was also CIO of Accredited Home Lenders and president and CEO of INTERLINQ Software, which was acquired by Harland Financial Solutions, then D+H Financial Technologies and is now part of Finastra.

Jackman is not new to ComplianceEase. In 2006, he was the acting-CTO of ComplianceEase, as the company searched for a permanent CTO. Since 2005, he has been a member of ComplianceEase’s board of advisors.

Commenting on the transition, John Vong said, “Michael is one of our industry’s true visionaries and a leader who has great credibility in the marketplace. I’m looking forward to working with him to help our clients and industry partners as they transition to the coming digital future.”

Read more...