OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

Number of Homes Flipped Fell 4%: Attom Data

- Thursday, 28 February 2019

- Originating

The number of homes that were flipped in 2018 fell 4 percent, compared with the previous year.

Fully 207,957 U.S. single family homes and condos were flipped in 2018, compared with 216,537 in 2017, according to the “Year-End 2018 U.S. Home Flipping Report” from Attom Data Solutions.

The 207,957 homes flipped in 2018 represented 5.6 percent of all single-family home and condo sales during the year and was unchanged from 5.6 percent of all sales in 2017. That’s up from 5.1 percent of all sales back in 2008.

Fully 146,020 entities (individuals and institutions) flipped homes in 2018, down 0.4 percent from the 146,623 entities that flipped in 2017, but up 63.1 percent, 89,539, properties that were flipped 10-years ago.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

"With mortgage rates remaining strong and people staying in their homes longer, we have started to see a bit of a flipping rate slowdown," said Todd Teta, chief product officer at Attom Data. "However, this isn't to say home flipping is going away. The market is still ripe with investors flipping and bargains still await, especially in the lowest-priced areas of the country, where levels of financial distress remain highest."

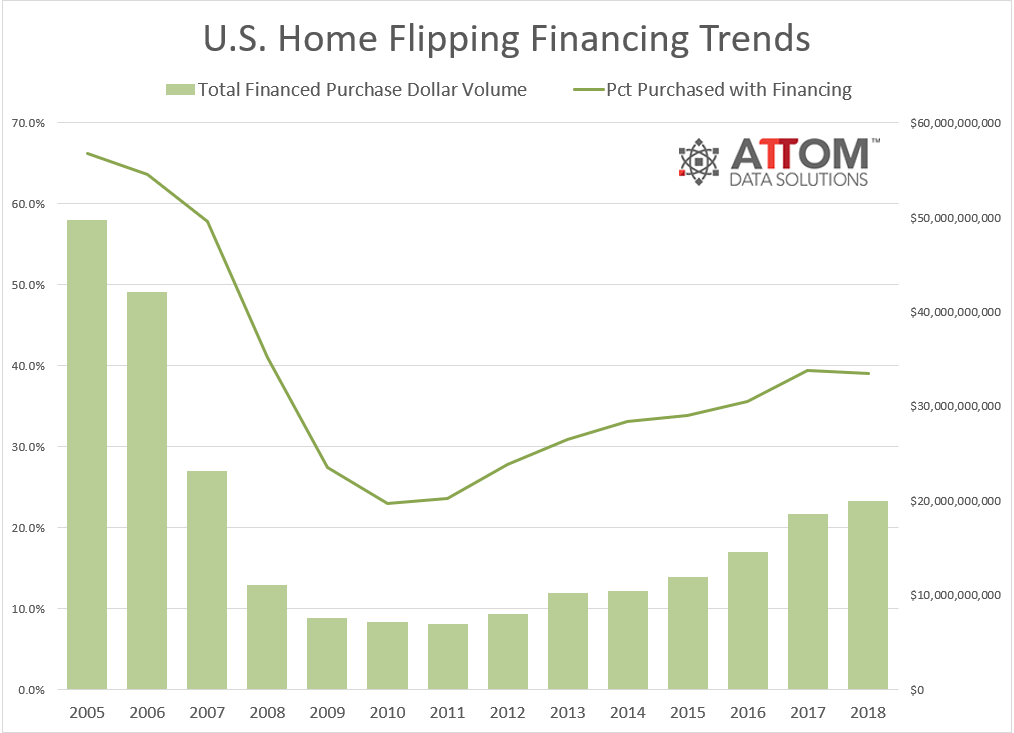

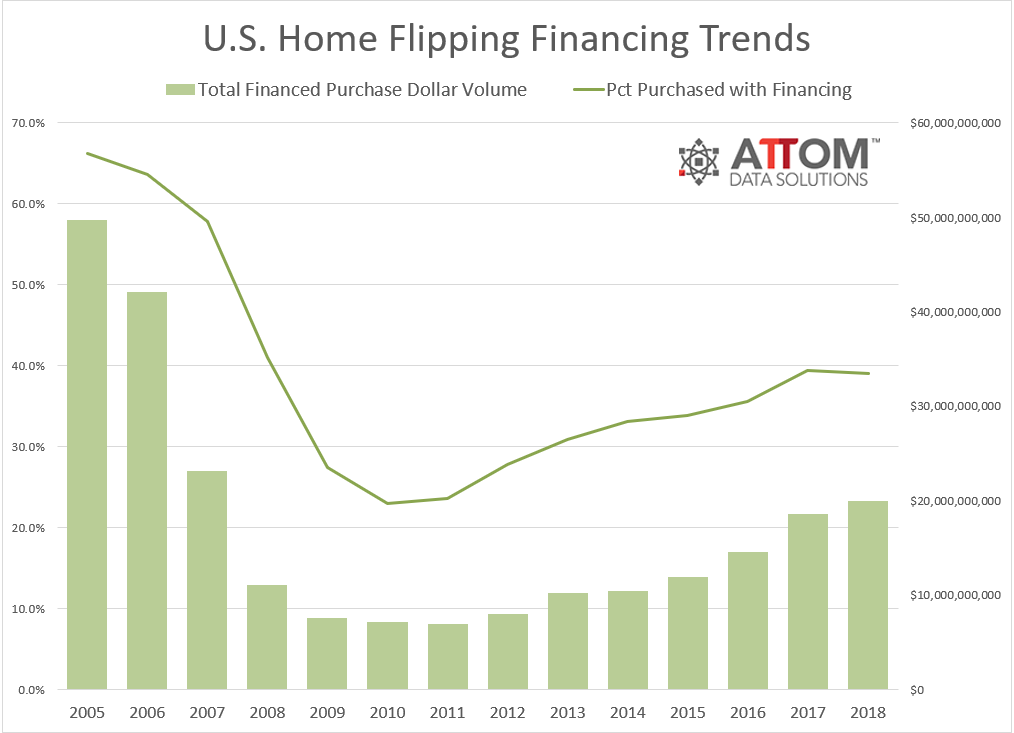

The value of financed home flip purchases was $19.9 billion for homes flipped in 2018, up 8 percent from $18.5 billion in 2017 to the highest level since 2007--an 11-year high.

Flipped homes originally purchased by the investor with financing represented 39.1 percent of homes flipped in 2018, down from 39.4 percent in 2017 and down from 41.0 percent in 2008.

Among 53 metropolitan statistical areas analyzed in the report with at least 1 million people, those with the highest percentage of 2018 completed flips purchased with financing were Denver, Colorado (53.7 percent); Providence, Rhode Island (51.8 percent); Seattle, Washington (51.8 percent); San Diego, California (51.6 percent); and San Francisco, California (50.8 percent).

Among 53 metropolitan statistical areas analyzed in the report with at least 1 million people, those with the highest percentage of 2018 completed flips purchased with financing were Denver, Colorado (53.7 percent); Providence, Rhode Island (51.8 percent); Seattle, Washington (51.8 percent); San Diego, California (51.6 percent); and San Francisco, California (50.8 percent).

Of the homes flipped in 2018, 13.8 percent were sold to FHA borrowers—likely first-time homebuyers—down from 17 percent in 2017 to an 11-year low.

Among 53 metro areas analyzed in the report with at least 1 million people, those with the smallest share of completed flips sold to FHA buyers in 2018 were San Jose, California (1.3 percent); Raleigh, North Carolina (4.3 percent); San Francisco, California (6.0 percent); Memphis, Tennessee(6.5 percent); and San Diego, California (7.2 percent).

Among the 53 metro areas analyzed in the report with at least 1 million people, those with the highest share of completed flips sold to all-cash buyers — often other real estate investors — in 2018 were Detroit, Michigan (48.8 percent); Birmingham, Alabama (42.4 percent); Jacksonville, Florida(39.8 percent); Miami, Florida (38.3 percent); and Buffalo, New York (38.0 percent).

Completed home flips in 2018 yielded an average gross profit of $65,000 (difference between median purchase price and median flipped sale price), down 3 percent from an average gross flipping profit of $66,900 in 2017.

The average gross flipping profit of $65,000 in 2018 represented an average 44.8 percent return on investment (percentage of original purchase price), down from 50.3 percent in 2017 and down from

Read more...Angel Oak Expands into Fix and Flip Financing

- Tuesday, 26 February 2019

- Originating

Angel Oak Prime Bridge LLC has expanded its wholesale options for mortgage brokers looking to expand offerings to clients that want fix and flip home financing.

The outlook for the fix-and-flip market shows an incredible opportunity for growth in the years to come. The aim is for brokers to have streamlined access to innovative solutions for borrowers looking to get financing in this space. Fundamentals remain on solid footing and markets continue to see robust demand for financing as more borrowers come off the sidelines.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

“Many brokers we work with are inundated with requests for loans as demand for financing skyrockets. It’s clear that there is an opportunity for brokers to expand their business in this area. Now with Angel Oak, brokers have a simple way to access products that fit the needs of these borrowers,” said Jackson, “Our new products are another tool in the belt for brokers looking to expand their offerings and client base.”

To spearhead this effort Angel Oak has hired mortgage and wholesale veteran Will Jackson, who has over 20 years of experience in the industry and a successful track record of managing and leading business efforts in this space, most recently at JP Morgan Chase.

“We’ve witnessed the demand from brokers looking to expand into different product offerings. Given our expertise and success in the non-QM wholesale channel this new effort will be a seamless experience for brokers. We’ve already built out our staff and support team, we’re ready to bring another great product to brokers,” says Steven Schwalb, managing partner of Angel Oak Lending Entities.

Read more...Originators Remain Trusted Advisors, Though Tech Is Changing Their Role

- Tuesday, 19 February 2019

- Originating

By Pat Sherlock

One of the most talked about topics in mortgage banking is whether the industry will evolve into a self-service business. Many managers are speculating whether purchasing a home loan will become an automated, point-and-click business similar to booking an airline flight or obtaining concert tickets.

A number of high-level executives believe that digital is the way of the future and that financial companies who do not offer online solutions will be left behind.

[caption id="attachment_9789" align="alignleft" width="247"] Pat Sherlock[/caption]

Pat Sherlock[/caption]

While technological innovations have been arriving in a fast and furious manner, digital products have focused mainly on back-office processes. From transforming documents into PDFs to paperless underwriting, the advances have been swift and impactful.

However, according to a recent PwC article, "Digital Lending Must Go Beyond Eliminating Paper," the problem is that lenders have made their online experiences follow the same work flow as their offline experiences--which means they have simply duplicated inefficient processes online vs. developing an innovative workflow.

But data mining, web analytics, artificial intelligence and other developments have opened the door for companies to engage earlier in the buyer's journey.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Banks and mortgage companies are now recognizing that the lending industry must apply digital innovation to drive the customer experience. It is no longer enough to upload and scan documents or streamline the documentation process. Lenders must deliver personalized products and service that match their customer's specific stage in the journey of life.

We are already there with black box pricing models from investors and mortgage insurance vendors. So, what is next in digital innovation and are we far from not needing a human interface or an originator in mortgage lending? While it is not clear if the originator will be completely removed from the transaction, PwC has noted that customers still value personal advice and want a person to answer questions they might have. But that doesn't mean that it must be a face-to-face interaction or a phone call. It can be done electronically.

PwC commented that historically lenders viewed the digital channel as an alternative to offline personal collaborative channels. They contend that guidance and support can be delivered through video tools which do not require a face-to-face meeting. These digital tools are becoming more sophisticated and life-like--and we are not far from digitally augmented human support and AI-powered virtual assistants and chatbots. Just see how popular SIRI is today.

So, if these new technologies can deliver scalable consumer support, do we need to have originators involved with these loan processing functions? Probably not. What will an originator be tasked with in the future?

In my opinion, originators will fulfill the role of creating loan demand. During the refinance market boom, creating loan demand took a back seat, but it is now becoming an essential component for producers.

Creating loan demand starts with building awareness, selling value and influencing a customer in their decision process. This means that once the interest has been sparked and information has been generated whether by voice or virtual reality, the originator should no longer be involved with moving the transaction through the process.

The digital tools will take over and handle it to completion. It’s obvious, we aren’t there today, but in the not too distant future we will be. As a result, we won't need individuals to handle product exceptions. We will have advanced programs performing this function. If Amazon can make personalized recommendations based on your buying history, shouldn't mortgage lenders' systems be able to review product guidelines to make the best choice for a consumer?

Having these technologies doesn't mean that we don't need someone who can start the customer's journey. We still need individuals who can sell and help someone become interested in buying a home. We still need producers to serve as trusted advisors to persuade consumers about the value of homeownership.

Read more...VA Has Established New Policies for Cash-Out Refis

- Friday, 15 February 2019

- Originating

Veterans Affairs has established new policies regarding guaranteed cash-out refinancing loans, including refinancing of construction loans.

The policies determine when Veterans Affairs can guarantee a refinancing, as required under The Economic Growth, Regulatory Relief, and Consumer Protection Act. The new policies take effect Feb. 15.

For loans being refinanced within one year from the date of closing, lenders are required to obtain a payment history, or ledger, documenting payments, unless a credit bureau supplement identifies the payments made in that timeframe. If Veterans Affairs selects the loan for a regulatory audit, the lender will have to include the payment history, or provide a credit bureau supplement of the loan being refinanced in the loan file for review.

Starting on Feb.15, applications that don’t meet the following requirements may be subject to indemnification or the removal of the guaranty:

Loan-to-Value. Veterans Affairs won’t guaranty refinancing loans when the loan-to-value exceeds 100 percent. Inclusion of any funding fee that is financed, in part or whole, cannot cause the loan to exceed the reasonable value of the property.

LTV Calculation. Divide the total loan amount, including the Veterans Affairs funding fee, by the value of the property determined by the appraiser.

Net Tangible Benefit standard applies to all Veterans Affairs cash-out refinancing loans, and is satisfied when one of the following is met:

- The new loan eliminates monthly mortgage insurance.

- The loan term of the new loan is less than the loan term of the loan being refinanced.

- The interest rate of the new loan is less than the interest rate of the loan being refinanced

- The monthly (principal and interest) payment of the new loan is less than the monthly (principal and interest) payment of the loan being refinanced.

- The monthly residual income is higher as a result of the new loan.

- The new loan is used to pay-off the veteran’s interim construction loan.

- The new loan LTV is equal to or less than 90 percent of the reasonable value of the home.

Loan Comparison Disclosure: The lender is required to provide the veteran a comparison of the new loan to the existing loan being refinanced. Veterans Affairs requires lenders to generate two loan comparison disclosures, one within three business days from the initial date of the loan application and at the closing.

The borrower must certify receipt of both disclosures--signature, e-signature, email from borrower certifying receipt, email read receipts, system time/date stamp where a borrow certified receipt. A failure to provide initial disclosures to the veteran within three business days from the initial application date and at closing could result in indemnification of the loan up to five years.

Read more...