OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

matt

Getting a Stuck Loan Originator Back on Track

- Monday, 18 March 2019

By Brian Sacks

I had an interesting conversation yesterday with an originator who is stuck.

I'm not sure how he found me, but he did, and continued to call my office until I agreed to finally meet with him for a consultation.

[caption id="attachment_7900" align="alignleft" width="332"] Brian Sacks[/caption]

Brian Sacks[/caption]

He worked locally for a large bank and had a specialty niche. Because of his expertise in this niche, all of the other originators in the company sent him deals since they didn’t like to do these loans. Most didn’t understand the program.

Well the bank stopped doing this program, and he was forced to go elsewhere. He went to work for a big independent mortgage company, but to his horror his deal flow has slowed down to a trickle because he is no longer getting these referrals from other loan originators.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

He scheduled a one-on-one session with me; he does want to succeed, and I respect that.

During our session, he explained that he has been calling realtors and visiting open houses and doing lots of the things he has been told to do. By the way, he’s been originating for almost 10 years, so he isn’t exactly a rookie, right?

Calling realtors or going to open houses uninvited is chasing business and doesn’t work long term at building profitable relationships.

You are seen as an annoying pest instead of being embraced as an invited guest.Your goal needs to be getting them to chase you, not the other way around. You can do this by teaching classes or having pre-approved buyers you can connect them with, or even by being the celebrity originator in your town. I do all of these, and you can too.

He is a perfect case of someone having all of their eggs in just one basket which never ever ends well. Instead, diversify and develop multiple sources of business that come in at all times, have a plan and track where the business comes from.

The business I focus on comes from the follow areas.

- Realtors.

- Past client referrals.

- Professionals, such as accountants and attorneys.

- Direct to consumer via free public relations and direct mail.

- Other loan officers will help, if you have a specialty niche.

Let’s say the goal is 10 loans a month: You could focus on getting four deals from realtors, three from direct to consumers and public relations, two loans from professional referrals and one from other originators.

Each month you need to go back and see how your actual volume did compared to your goal. What worked? What didn’t? Now you know where to focus your energy and marketing efforts for the coming month. If you don’t have a goal, and you don’t track, you simply can’t succeed.

The most important aspect of this is the following: You can only achieve to the level of your own self-image. He’s frustrated and truly can’t even see the forest for the trees, so he is simply going out and begging.

Make sure your business is well diversified. That you have a plan, that you can track your progress, as well as multiple tactics, strategies and sources that can deliver a constant business flow. But always make sure that your self-image is in the right place and you use tactics that make you an invited guest --instead of an annoying pest.

About the Author: Brian Sacks is a branch manager and originator with Homebridge Financial in Baltimore Md. Also, he is the founder of TopOriginatorSecrets.com and the author of the best-selling success manual for originators “48 Proven Ways to Immediately Close More Loans"

Read more...

Work smarter, Commit to Performing the Right Sales Activities

- Monday, 18 March 2019

By Pat Sherlock

It seems that every time production gets more difficult, originators and their managers request training on how to increase their sales results.

While it is reasonable to think that originators simply need to work harder to generate better results, this often isn’t enough to correct a sales slump. In my experience, the real solution is to work smarter. It is not so much about conducting more sales activities but performing the right sales activities that will create new referral sources and customers.

In my consulting practice, what I see repeatedly is that mediocre originators may work hard but they are spending time on the wrong things. Not only does this waste precious time but it instills false hope that performance will improve.

The mediocre originators tend to be great at pipeline management but poor in scaling their selling activities. Many of these originators are the first to say they can’t go to training to learn new ways of selling or they don’t have time to learn new technology that would help them become more effective.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Frankly, they are stuck and yet they fail to commit to changing their sales performance. For originators who do not update and adapt their selling skills to changing marketplace conditions, a decline in production is inevitable.

Consider the example of an originator who would rather send handwritten notes to past customers versus outsourcing this activity to vendors who will send handwritten notes on your behalf. While writing personal notes is definitely a good thing, how scalable is it if an originator is doing it themselves?

When the originator becomes too busy, will he or she still send handwritten notes? Probably not. Sure, they might do it once in a while but not consistently enough to really matter and change their sales results.

Many sales managers recommend that originators block time to become more efficient, but they often fail to tell producers what they should be doing during the time block. Time-blocking is a great strategy but setting aside time on the wrong activities won’t change sales results. Managers and originators must understand what sales activities matter most before implementing time-blocking in a way that will improve production.

When conducting sales audits in the field, I find that originators spend their time on what is important to them not necessarily on the activities that will boost results. Mediocre originators will often blame lack of production on factors such as their lender’s pricing or rising interest rates instead of inability to use their selling time well. While they can’t control external factors such as pricing or interest rates, they can control their own actions and how they spend their day.

Purposeful time management can make all the difference. Originators who proactively dedicate time to daily sales activities that cultivate new referral sources and customers will always outperform sales professionals who spend their time reacting to the day’s problems and demands.

About the Author: Pat Sherlock is the founder of QFS Sales Solutions, an organization that help sales organizations improve their sales talent management and performance. For more information, visit https://patsherlock.com

Read more...

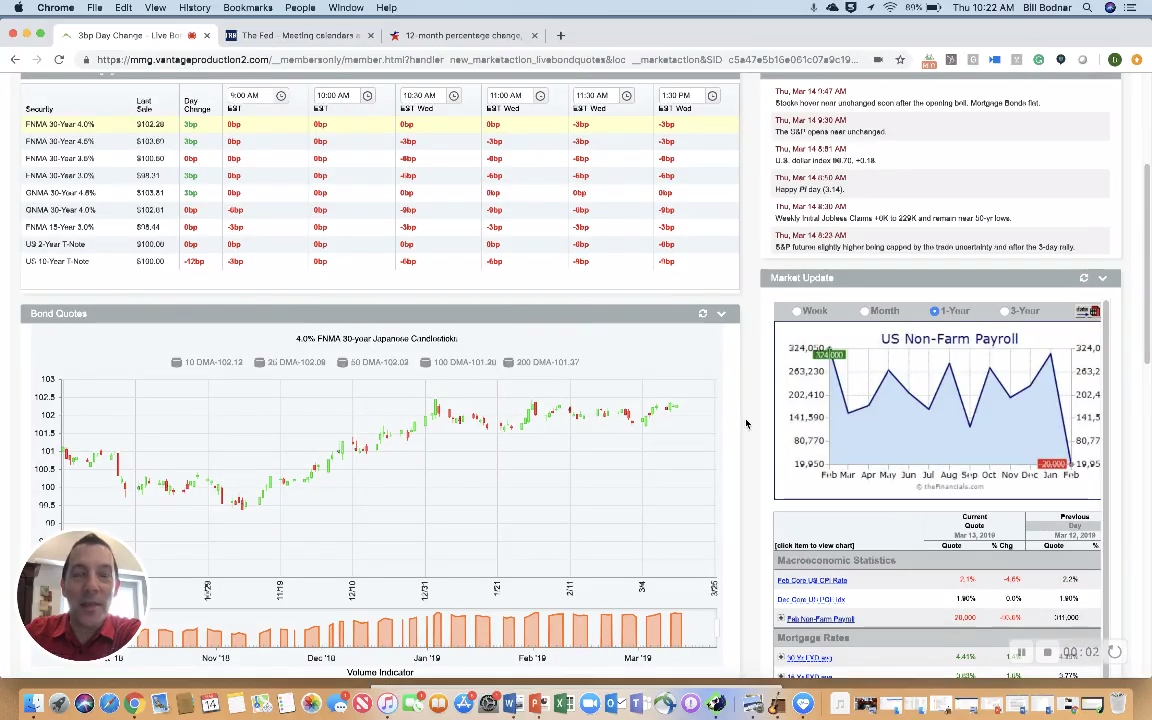

Mortgage Market Guide's Bodnar: Smooth Sailing Ahead, Unless Inflation Returns

- Thursday, 14 March 2019

https://youtu.be/l8RisdUNEpw

Hi, Bill Bodnar here from the Mortgage Market Guide. Thanks for tuning in for our MMG weekly recap.

So there's a trend developing right now, or has developed, that we want to make you aware of

heading into the spring market. And there's one word: It's called complacency, so we're going to talk about the charts and the price action because it really does highlight the complacent nature of the bond market.

Right now, you can see we are moving pretty much in a sideways trend. Volatility has gone away a lot.

And, we are right now again on the right side of the chart, right near 2019 highs as it relates to price, which is also a one-year high in price. At the same time watching stocks power higher, so you have this beautiful market of people's 401(k)s and portfolios moving higher in value. And you have interest rates

moving sideways in a beautiful trend worldwide.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Let's take a look back in October and November, the Fed was very hawkish, talking about hiking rates three times in 2019 reckless abandon. You know we talked about it and said it can't happen. Well they did

a 180, and since December 24th stocks have been in a rally mode.

Why? Because the Fed you know they're sitting on their hands right now waiting to see what happens with the global slowdown.

And then the second thing is inflation. We talk about inflation a lot. Inflation is the driver of interest rates. You can see after peaking out, this is CPI, you can see here in recent months that has ticked down. You can see the trend here in recent times is lower or the rate of inflation is slowing.

Disinflation is kind of kicking in, and we're seeing that around the globe. So, there is a search of global

yield that makes the U.S. Treasury market kind of attractive compared to other bonds around the country. It also makes mortgage-backed securities rather attractive.

It also makes high yielding stocks attractive. So right now with low inflation, a Fed out of the picture, and interest rates stable that's keeping stocks moving higher. It's keeping bonds at an elevated level, but

it's complacent for now.

What will be the trigger? What could change this story? It’s inflation. So that’s what we are watching, or wages. It's the one piece that is starting to emerge that the Fed has always looked at and said, “Hmm, it would be nice to see wages grow.”

And they're growing at around 3.4 percent year-over-year, the highest in a decade. And something we need to watch carefully, that if we get one inflation print higher sparked by wages, and it could certainly happen in months ahead.

This complacent trend will end like this [in an instant], so we need to be mindful in the months

ahead. We're watching inflation carefully but right now it is low to non-existent threat and that is really

fueling this beautiful, complacent trend, and interest rates are moving sideways at the best levels of the year.