OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

matt

Gen Xers Buying Multi-Generational Homes

- Monday, 01 April 2019

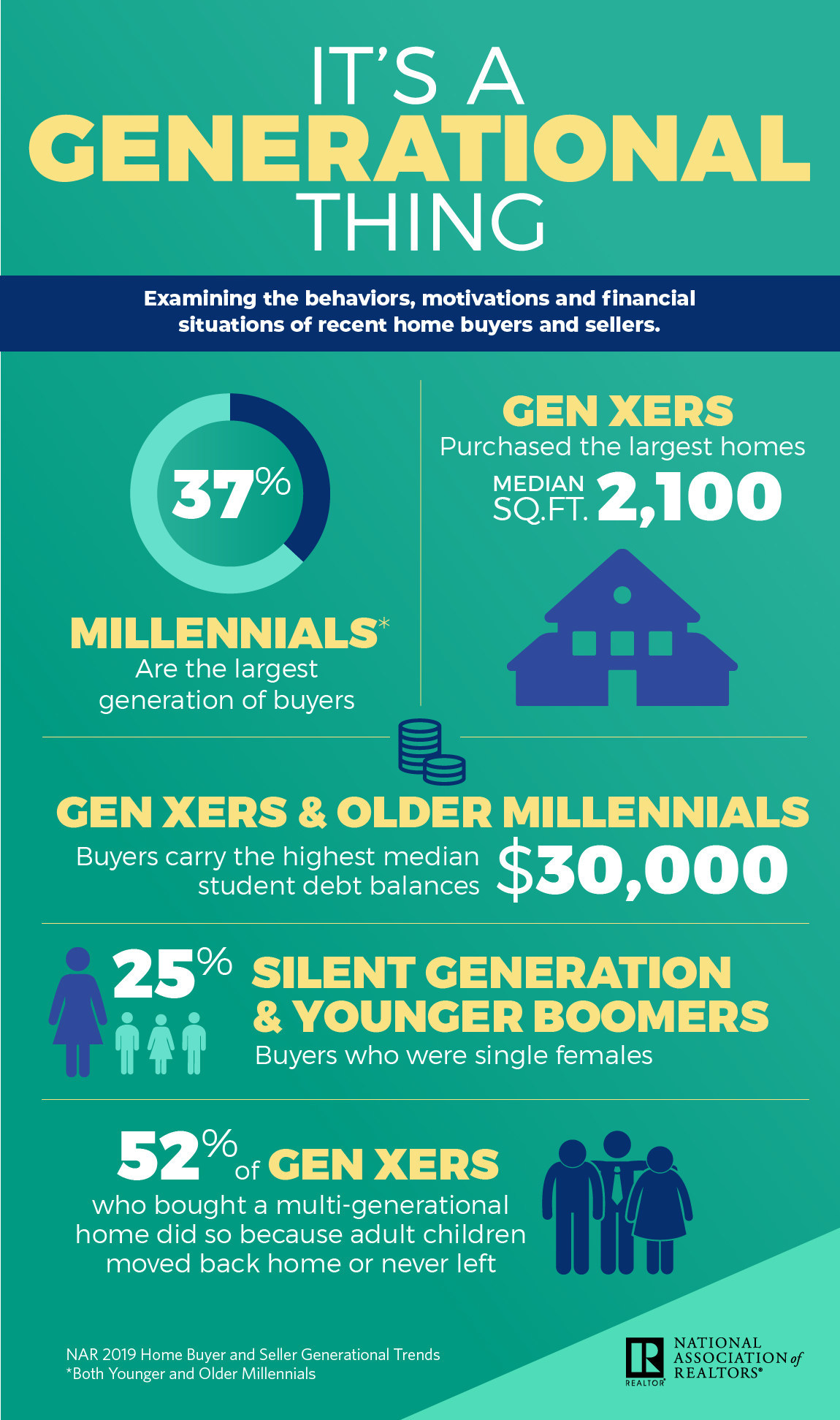

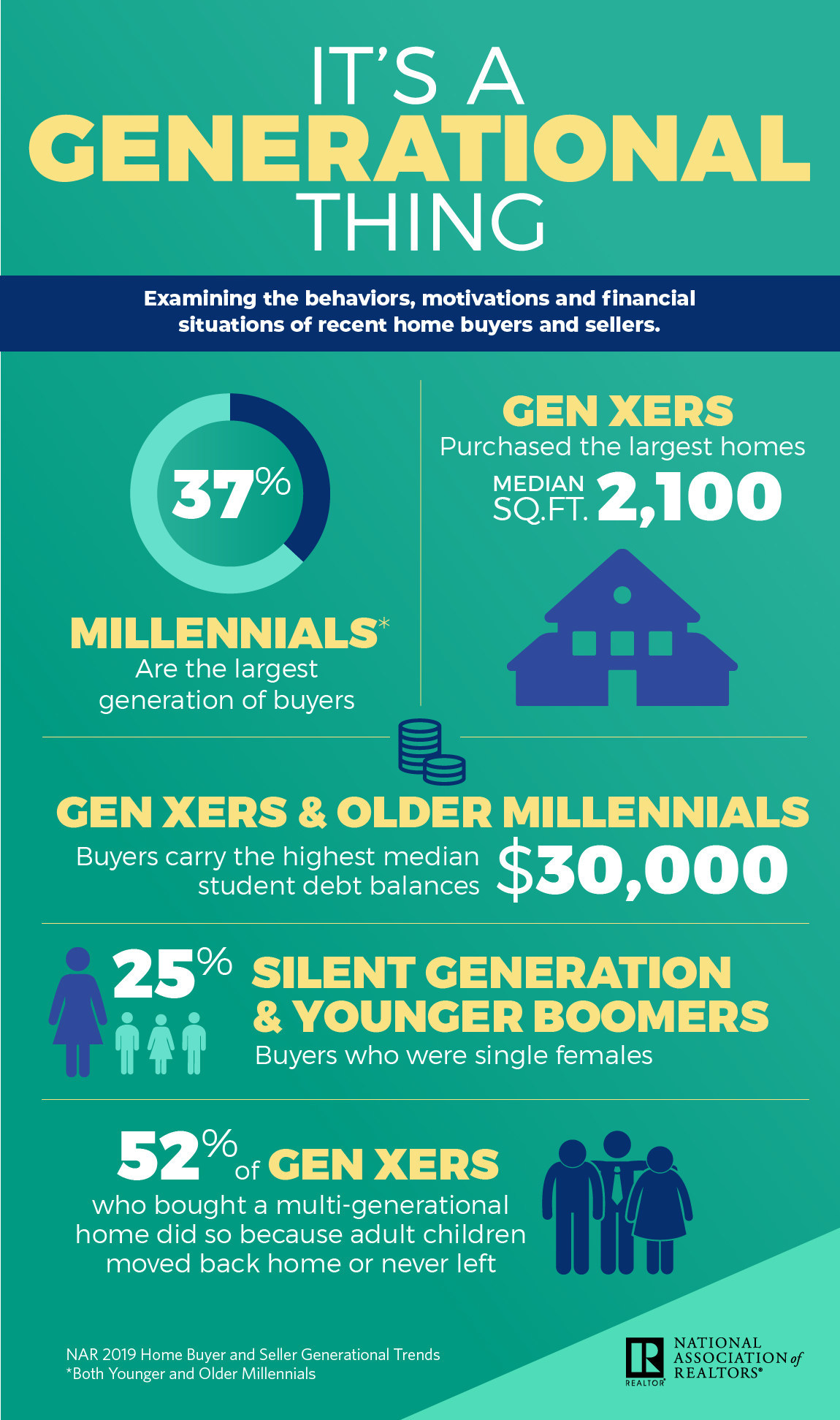

One in six Gen Xers purchased a multi-generational home, overtaking younger boomers as the generation most likely to do so.

Fully 52 percent of those buyers did so because their adult children have either moved back or never left home, according to the National Association of Realtors' 2019 Home Buyer and Seller Generational Trends study, which evaluates the generational differences of recent homebuyers and sellers.

The report also found that older millennials who bought a multi-generational home, at 9 percent, were most likely to do so in order to take care of aging parents (33 percent), or to spend more time with those parents (30 percent).

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

"The high cost of rent and lack of affordable housing inventory is sending adult children back to their parents' homes either out of necessity or an attempt to save money," says Lawrence Yun, NAR’s chief economist. "While these multi-generational homes may not be what a majority of Americans expect out of homeownership, this method allows younger potential buyers the opportunity to gain their financial footing and transition into homeownership. In fact, younger millennials are the most likely to move directly out of their parents' homes into homeownership, circumventing renting altogether."

[caption id="attachment_11431" align="alignleft" width="309"] House Buying Trends[/caption]

House Buying Trends[/caption]

Millennials as a whole accounted for 37 percent of all buyers, making them the most active generation of buyers for the sixth consecutive year. In fact, 2019 is the first year the report separated younger and older millennials, accounting for 11 and 26 percent of buyers respectively. This separation was deemed necessary as younger millennials now account for a larger buying share than the silent generation (7 percent). Gen X buyers were the second largest group of buyers (24 percent), followed by younger boomers (18 percent) and older boomers (14 percent).

Dividing millennials into younger and older cohorts highlights the disparities between the two age groups and paints a picture of older millennials that is much closer to Gen Xers and younger boomers. Older millennials have a median household income of $101,200 and purchase homes with a median price of $274,000, comparable to Gen Xers ($111,100 income, $277,800 median home price) and younger boomers ($102,300, $251,100 respectively).

Yun says this is to be expected as millennials continue to age and advance through various stages of their lives and careers. "Older millennials are now entering the prime earning stages of their careers, and the size and costs of homes they purchase reflect this. Their choices are falling more in line with their Gen X and boomer counterparts."

Younger millennials, meanwhile, are purchasing the least expensive homes and smallest homes ($177,000 and 1,600 square feet), meaning they face the greatest challenge in finding affordable inventory. They also report a median household income of $71,200.

Downsizing to a smaller home is not common among any of the generations. Sellers over the age of 54 only downsize by a median of 100 to 200 square feet. Gen Xers and boomers who may have been interested in downsizing could have been hindered by a lack of smaller inventory; or may have been impeded by the increase in multi-generational living these generations are reporting to accommodate the needs of adult children and aging parents.

Read more...

MISMO To Expand Standards for Mobile Devices

- Friday, 29 March 2019

MISMO, the mortgage industry's standards organization, is expanding its JavaScript Object Notation initiatives designed for mobile use and some transactions.

A new group, known as the JSON Development Workgroup, will create guidelines for implementing JSON in business-to-business and business-to-consumer environments. It will also as well as to develop example JSON reference implementations.

“JSON is the technology of choice for mobile devices and lightweight transactions,” said Richard Hill, executive vice president of MISMO and vice president for industry technology at the Mortgage Bankers Association. “Technologists have embraced JSON as a faster means of exchanging smaller pieces of information in innovative new ways to serve the mortgage industry and our customers. As mortgage lenders, software companies and third-party service providers collaborate to provide the ultimate consumer experience. MISMO standards will ensure that everyone is speaking the same language.”

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

JSON is a lightweight language for structuring data that is frequently used to exchange information through application programming interfaces and mobile platforms. It use has grown throughout the mortgage industry as more technology companies leverage application programming interfaces to share data. For example, JSON can be used to share information between different systems when lenders order mortgage insurance through an application programming interface that links a lender's loan origination system with a vendor.

This activity builds upon MISMO’s first JSON initiative to develop standards for consumer transactions. With this expanded effort, MISMO plans to create consistency within the growing number of transactions taking place in JSON format.

The MISMO JSON Development Workgroup will be responsible for creating:

- MISMO guidelines for naming and structuring information in the JSON format.

- Example JSON reference implementations.

- Guidelines for maintaining conformance with the MISMO data standard, and

- Educational materials and guidelines for implementing JSON standards.

Read more...

Transworld Systems to Acquire Altisource’s Financial Services Business

- Friday, 29 March 2019

Transworld Systems Inc., a provider of analytics-driven accounts receivable management, healthcare revenue cycle and loan servicing solutions, has entered into a definitive agreement to purchase the financial subsidiaries of Altisource Portfolio Solutions for $44 million.

The acquisition is expected to close before the end of the third quarter and is subject to customary closing conditions including regulatory consents.

TSI will acquire the Altisource Financial Services business, including Nationwide Credit Inc., a provider of collections, customer relationship management and call center outsourcing for financial, retail credit, mortgage servicing, insurance, utility, and hospitality industries, with approximately 2,300 employees and operations centers in the U.S., India and the Philippines.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

"The acquisition of the Altisource Financial Services business broadens TSI's customer base, expands our offerings into customer relationship management, and grows our global operations in India and the Philippines,” said Joseph Laughlin, chief executive officer of TSI. “This carve out is a perfect example of our strategy to leverage acquisitions to add new technological capabilities while improving scale in our core businesses. We look forward to partnering with the Altisource management team to affect a smooth transition and we welcome the Altisource Financial Services customers and employees to the TSI family."

Ready Capital, Owens Complete Merger

Ready Capital Corp. and Owens Realty Mortgage Inc. have completed the merger between the two companies.

The combined company will conduct business under the name "Ready Capital Corporation" and will continue to trade on the New York Stock Exchange under the ticker symbol "RC."

As a result of the merger, Ready Capital's board was increased from six to seven members upon,and Gilbert E. Nathan, an independent director of Owens, was appointed to the board.

“The growing breadth of the combined businesses will continue to allow us to effectively deploy capital across attractive asset classes and economic cycles,” said Thomas Capasse, chairman and chief executive officer. “This investment approach, which emphasizes return consistency and downside protection, will provide all our shareholders with the most attractive risk-adjusted returns over the long-term."

Read more...