OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

matt

Bill Bodnar’s Mortgage Market Recap

- Wednesday, 17 April 2019

https://youtu.be/hJ0SnZFePfU

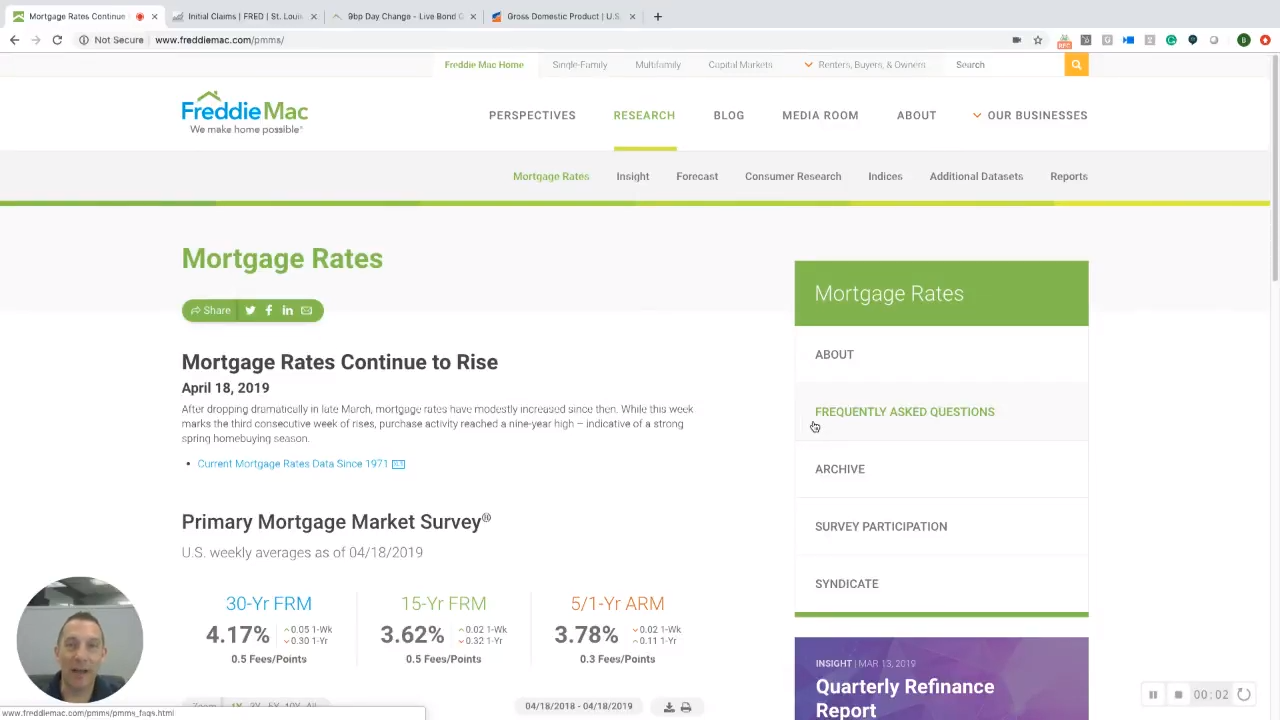

Rates rose this week and U.S. market is resurgent and so is China. The economy is reinvigorated.

The spring season is the largest in nine years. Employees are not getting fired because the job market is so tight.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Recession occur 13 months after the low, but the economy keeps making lows. In 2019 a recession is off the table.

For more, tune in to Bill Bodnar’s Market Recap Video.

Read more...Ask Brian: Creating a Networking Group

- Thursday, 18 April 2019

Dear Brian,

I love your column and you seem to be very knowledgeable and sincere. I have only been originating for a few years and it’s hard for me to network. I am considering joining a networking group and wanted your opinion.

Scott J.

Boston

Dear Scott,

I know as a reader you may find this strange, but I have to tell you that honestly, I am very shy and basically an introvert. Hard to believe but it’s true.

Honestly, I dislike networking, but of course, we all have to do it. But I particularly dislike the big well-known networking groups and feel they are a total waste of time.

They are made up of many different industries and those members are unlikely to ever be able to refer business on a consistent basis.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

The Key Word Is Consistent

Do you really think the copier sales person will be able to refer you a lead for a purchase or refinance regularly? For that matter, how many leads for copiers, do you think you can refer to him or her?

Yes, the accountant can and maybe the realtor can too, but there is no guarantee they will refer you.

That’s why I prefer much more targeted and smaller network group and opportunities.

As an example, one of the niches I target are buyers going through a divorce. So, I have created my own networking group dedicated to just this niche, including the following professionals:

-Mediator

-Divorce attorney

-Financial planner

-Therapist

-Realtor

-Accountant

-Myself

It’s a nice small targeted and focused group, and we are able to update ourselves on any new changes related to divorce in any of our respective practices.

We can easily refer each other because of our single focus on divorce.

Scott,

If you want to network you may be better off starting your very own focused group, a group where you can select the participants with a single focus and purpose.

Send me an email and let me know how that works out for you.

Dedicated to increasing your production.

Brian Sacks

About the Author: Brian Sacks is the author of 48 Proven Ways To Immediately Grow Your Production If you have a question you would like me to answer, send it to This email address is being protected from spambots. You need JavaScript enabled to view it. with the subject Ask Brian Question

Read more...A Primer for How Not to Deal with Rate Shoppers

- Sunday, 14 April 2019

One of the things we all wonder about as originators is how to compete with on-line and other lenders who simply buy the market.

There are a number of strategies for dealing with this like positioning yourself as the obvious go to celebrity originator in your market.

But one of the best ways to approach rate shoppers is to not deal with them at all.

Huh? Yes, you read that correctly. If you know that your rates are never going to beat on-line lenders, stop competing with them.

You can do that by executing the following strategy:

- Pick a niche.

- Become the expert.

- Let everyone know about it.

To put it more simply: Work with buyers who can’t shop. There are two major groups of buyers who simply can’t shop rates and points because they don’t qualify. There is also a third group of buyers who generally won’t shop because they are under a time constraint and will follow the guidance of their attorneys.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

The first two groups are buyers who have income or credit challenges. There are a number of non-quality mortgage programs now available to these buyers who don’t fit Federal Housing Authority, Veterans Affairs or Fannie Mae guidelines.

They want a loan and realize they don’t qualify with standard programs.

There are now programs for buyers with very low scores. Buyers who have had a bankruptcy, foreclosure or short sale. There are also programs for buyers who are self-employed or work on commission and have large write offs.

Here’s the formula: Learn these programs by meeting with your non-quality mortgage representatives. Let everyone know about your expertise by writing about it and teaching agents and builders about these programs. Go to the media because these programs are a great story that will get you exposure on TV, radio and print publications. You could even place ads for these buyers online and off line.

The third group of buyers who don’t shop: This group of buyers are those that are referred to you by one of their trusted advisors, such as an accountant, attorney, or financial planner. One of the best groups of clients, I have found, are those going through a divorce.

Generally, when a client is going through a divorce, there is often a home involved and one of the spouses will be leaving the home. The spouse leaving the home may want to buy, while the spouse remaining in the home may be legally obligated to refinance and get the other spouse off the mortgage and deed.

These buyers can be referred to you by their attorneys and their agreements often call for the refinance to be done within a certain time frame.

Start thinking about ways you can be unique and not be judged on the basis of your rates and points. Doing this will immediately help you close more loans, make more money, and finally, have the time to enjoy life.

About the Author: Brian Sacks is a branch manager and originator with Homebridge Financial in Baltimore, Md. Also, he is the founder of TopOriginatorSecrets.com and the author of the best-selling success manual for originators “48 Proven Ways to Immediately Close More Loans”

Read more...