-

The Shift in Commercial Lending: How Financial Institutions Are Adapting to a New Era Explore the transformative trends in commercial lending, including digital innovations, sustainable finance practices, and strategic fintech partnerships reshaping the lending landscape.

The Shift in Commercial Lending: How Financial Institutions Are Adapting to a New Era Explore the transformative trends in commercial lending, including digital innovations, sustainable finance practices, and strategic fintech partnerships reshaping the lending landscape.

Commercial Lending (340)

Finance Pros Ring Alarm About Real Estate Fractional Ownership

- Sunday, 15 March 2020

- Commercial Lending

- Written by Chris Frankie

Tagged under

New Rent Rules In NY Pose Risk To Multifamily Lenders Says Fitch Study

- Tuesday, 18 June 2019

- Commercial Lending

- Written by tim

Tagged under

MBA Survey on LIBOR Transition Finds a Mix of Preparation and Uncertainty Among Commercial and Multifamily Real Estate Firms

- Tuesday, 04 June 2019

- Commercial Lending

- Written by tim

Tagged under

Commercial/Multifamily Originations Increase 12 Percent in the First Quarter

- Tuesday, 14 May 2019

- Commercial Lending

- Written by tim

Tagged under

Commercial/Multifamily Originations Rise to Record $573.9 Billion in 2018

- Thursday, 11 April 2019

- Commercial Lending

- Written by tim

Tagged under

Greystone Provides $58.8 Million in HUD-Insured Financing

- Wednesday, 10 April 2019

- Commercial Lending

- Written by matt

Tagged under

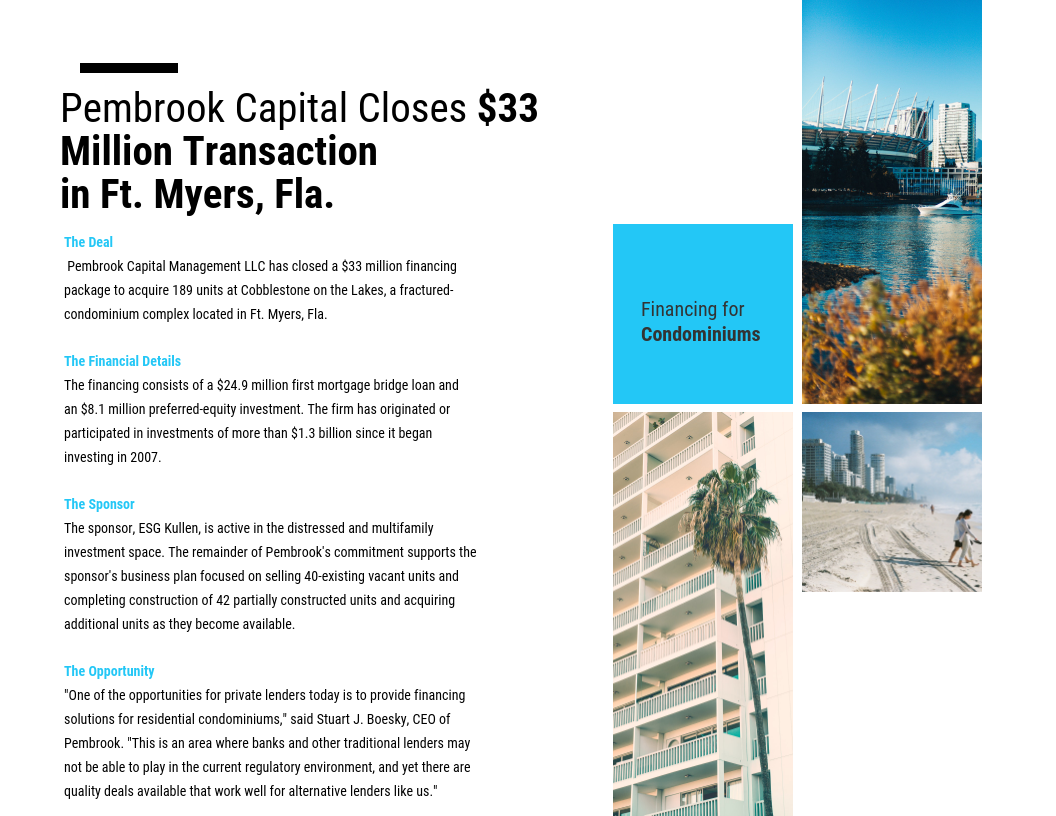

Pembrook Closes $33M Deal in the City of Palms

- Monday, 08 April 2019

- Commercial Lending

- Written by matt

Tagged under

Hunt Finances Acquisition of a Multifamily Property in Crab-Cake Capital

- Thursday, 04 April 2019

- Commercial Lending

- Written by matt

Tagged under

MBA's 2018 Rankings of Commercial-Multifamily Origination Volumes

- Monday, 01 April 2019

- Commercial Lending

- Written by matt

Tagged under

Fannie Mae Completes $11.7B Credit Risk Transfer Deal

- Tuesday, 26 March 2019

- Commercial Lending

- Written by matt

Tagged under

Blaze Partners Acquires Apartment Community in Charlotte, N.C.

- Sunday, 24 March 2019

- Commercial Lending

- Written by matt

Tagged under

Brickstone Partners, Deutsche Recapitalize Student Housing

- Monday, 18 March 2019

- Commercial Lending

- Written by matt

Tagged under

MOST READ STORIES

Fast,Easy & Free