The updated requirements are intended to strengthen the Enterprises' Seller/Servicer requirements and provide transparency and consistency of capital and liquidity required for Seller/Servicers with different business models.

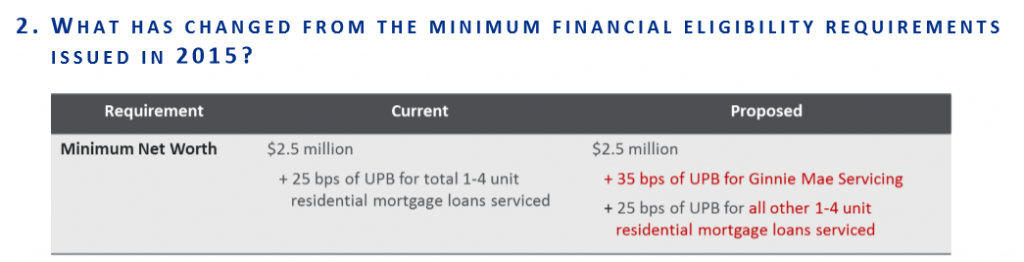

The agency points to the establishment of financial requirements for the servicing of Ginnie Mae mortgages as a key improvement. Specifically, the proposal calls for GSE customers to hold 35 basis points of the unpaid balance.

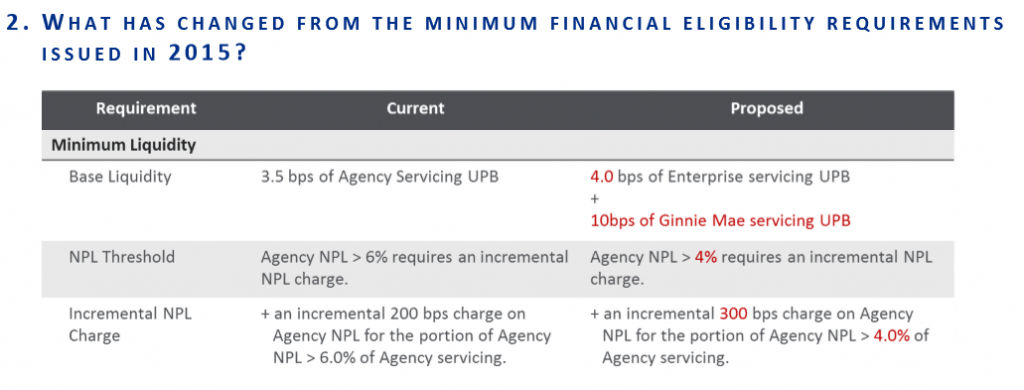

There also some changes worth noting to the minimum liquidity requirements.

FHFA will receive input on these requirements for 60 days at This email address is being protected from spambots. You need JavaScript enabled to view it..

FHFA will receive input on these requirements for 60 days at This email address is being protected from spambots. You need JavaScript enabled to view it..

After reviewing industry and stakeholder feedback, FHFA anticipates finalizing the requirements in the second quarter of 2020. The requirements are expected to be effective six months after they are finalized.