TRENDING WHITEPAPERS,VIDEOS & MORE

tim

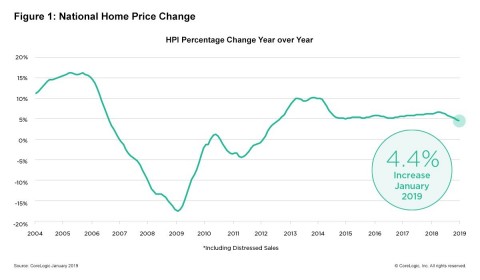

CoreLogic Reports January Home Prices Increased by 4.4 Percent Year Over Year

- Tuesday, 05 March 2019

CoreLogic released the CoreLogic Home Price Index and HPI Forecast for January 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 4.4 percent year over year from January 2018. This represents the slowest twelve-month home price growth rate since August 2012. On a month-over-month basis, prices increased by 0.1 percent in January 2019.

“As we head into 2019, we can expect continued strong employment growth and rising incomes which could support a reacceleration in home-price appreciation later this year.”

Looking ahead, the CoreLogic HPI Forecast indicates that the 2019 annual average home price will increase 3.4 percent above the 2018 annual average. On a month-over-month basis, home prices are expected to decrease by 0.9 percent from January 2019 to February 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

“The spike in mortgage interest rates last fall chilled buyer activity and led to a slowdown in home sales and price growth,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Fixed-rate mortgage rates have dropped 0.6 percentage points since November 2018 and today are lower than they were a year ago. With interest rates at this level, we expect a solid home-buying season this spring.”

According to the CoreLogic Market Condition Indicators (MCI), an analysis of housing values in the country’s 100 largest metropolitan areas based on housing stock, 35 percent of metropolitan areas have an overvalued housing market as of January 2019. The MCI analysis categorizes home prices in individual markets as undervalued, at value or overvalued, by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals (such as disposable income). Additionally, as of January 2019, 27 percent of the top 100 metropolitan areas were undervalued, and 38 percent were at value.

When looking at only the top 50 markets based on housing stock, 40 percent were overvalued, 18 percent were undervalued and 42 percent were at value in January 2019. The MCI analysis defines an overvalued housing market as one in which home prices are at least 10 percent above the long-term, sustainable level. An undervalued housing market is one in which home prices are at least 10 percent below the sustainable level.

Since peaking at 6.6 percent last April, annual home price gains have declined or held steady each month. “The slowing growth in home prices was inevitable in many respects as buyers pull back in the face of higher borrowing and ownership costs,” said Frank Martell, president and CEO of CoreLogic. “As we head into 2019, we can expect continued strong employment growth and rising incomes which could support a reacceleration in home-price appreciation later this year.”

Read more...

ComplianceEase names Michael Jackman as CEO, John Vong to become Executive Chairman

- Tuesday, 05 March 2019

ComplianceEase, a provider of automated compliance solutions to the financial services industry, announced today that its Board of Directors has appointed Michael Jackman as chief executive officer. Jackman replaces Anita Kwan, co-founder and chief executive officer, who is retiring.

John Vong, ComplianceEase’s other co-founder, has been named executive chairman of the board. In this role, he will be responsible for setting the company’s overall vision and strategy, as well expanding partnerships, broadening government outreach and establishing ComplianceEase as a leader in GRC technology.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

A veteran technologist, Jackman was part of the team at TRW Real Estate that developed the first software for the online ordering of title, tax, appraisal and credit services: technology that was integral to the growth of First American and later, CoreLogic. Over the course of his 30-plus year career, Jackman held division president positions at HNC Software (now part of Fair Isaac) and Fiserv’s LOS division. He was also CIO of Accredited Home Lenders and president and CEO of INTERLINQ Software, which was acquired by Harland Financial Solutions, then D+H Financial Technologies and is now part of Finastra.

Jackman is not new to ComplianceEase. In 2006, he was the acting-CTO of ComplianceEase, as the company searched for a permanent CTO. Since 2005, he has been a member of ComplianceEase’s board of advisors.

Commenting on the transition, John Vong said, “Michael is one of our industry’s true visionaries and a leader who has great credibility in the marketplace. I’m looking forward to working with him to help our clients and industry partners as they transition to the coming digital future.”

Read more...

New Rent Rules In NY Pose Risk To Multifamily Lenders Says Fitch Study

- Tuesday, 18 June 2019

The New York tenant protection legislation enacted last week by the state Legislature has negative credit implications for multifamily lenders with concentrated exposure to the NY metropolitan area, Fitch Ratings says. The new laws, which strengthen tenant protections in New York City (NYC) and the state, do not necessarily translate into immediate ratings revisions for impacted banks. The new law limits the circumstances, frequency and amount by which landlords can raise rents on rent-stabilized units in NYC apartment buildings. This will translate into lower growth in rental and operating income, less room for capital improvements and potentially result in declining property values.

To the extent that loans secured by stabilized apartments have been underwritten to in-place rents, the impact on default risk is relatively neutral over the near term. However, the law may deter investment and reduce investor appetite for rent-stabilized apartments, resulting in downward pressure on property values.

If realized, a significant decline in property values, and hence borrower equity, presents refinancing risk for highly leveraged borrowers, which Fitch views as the primary downside credit impact associated with the new law. The typical tenor of multifamily loans securing rent-stabilized properties is five years to seven years; potential losses associated with such an outcome will likely only manifest over time.

Concentrated NYC multifamily lenders have been sensitive to changes in rent regulations for some time, which Fitch has factored into current ratings. The stable cash flow generation demonstrated by rent-stabilized multifamily properties over economic cycles has historically been viewed positively. The proven stability of through-the-cycle occupancy rates relative to more expensive luxury apartments has supported the ratings of concentrated multifamily lenders. Stable occupancy in these buildings is expected to be maintained in light of the tenant-friendly proposals. However, over the longer term, to the extent that these regulations deter maintenance and capital expenditure needed to maintain these properties, occupancy rates and property values may also be negatively affected.

The new law abolishes certain provisions that have allowed landlords to remove units from rent stabilization when a unit becomes become vacant and the rent is above the statutory high-rent threshold. It also abolishes deregulation when a tenant's income exceeds $200,000 in the preceding two years.

Preferential rents are set below the legal maximum that can be charged. For lease renewals, owners who have offered tenants a preferential rent below the legal rent are prohibited from raising the rent up to the full legal rent upon lease renewal. However, once a tenant vacates, the owner can charge rent up to the full regulated rent if the tenant did not vacate due to the owner's failure to maintain the unit in habitable condition. The law also eliminates the "vacancy bonus" rule that have allowed landlords to raise rents by up to 20% upon vacancy as well as the "longevity bonus" that allows rents to be raised by additional amounts based on the previous tenancy's duration.

Landlords' ability to impose rent increases after major capital improvements (MCI) has also been hindered. Rent increases for MCI have been capped at 2% from 6% with qualifying expenditures significantly curtailed. Unlike loans funding rent-stabilized properties, loans that back apartment capital improvements tend to be higher risk. Absent significant creditor protections, exposure to such loans is viewed as incrementally credit negative in light of the MCI proposals.

Read more...