TRENDING WHITEPAPERS,VIDEOS & MORE

tim

Mortgage Credit Availability Decreased in December

- Thursday, 10 January 2019

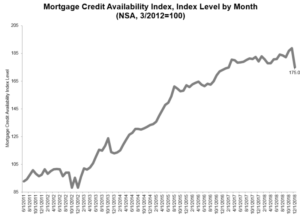

WASHINGTON, D.C. (January 10, 2019) — Mortgage credit availability decreased in December according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from Ellie Mae’s AllRegs® Market Clarity® business information tool.

The MCAI decreased 7.3 percent to 175.0 in December. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI decreased (14.5 percent) and the Government MCAI increased slightly (0.1 percent). Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 14.9 percent, while the Conforming MCAI decreased by 14.0 percent.

“The supply of credit dropped in December to its lowest since February 2017. The decline was driven by a sharp decrease in the conventional credit space, as we saw the expiration of the Home Affordable Refinance Program (HARP),” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Credit availability in government loans was stable over the month, ticking up slightly. We also saw a decline in high balance and super conforming programs, which drove the decline in the jumbo index.”

Source: Mortgage Bankers Association; Powered by Ellie Mae’s AllRegs® Market Clarity®

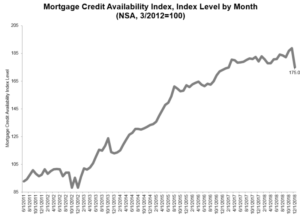

CONVENTIONAL, GOVERNMENT, CONFORMING, AND JUMBO MCAI COMPONENT INDICES

The MCAI decreased 7.3 percent to 175.0 in December. The Conventional MCAI decreased (14.5 percent) and the Government MCAI increased slightly (0.1 percent). Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 14.9 percent, while the Conforming MCAI decreased by 14.0 percent.

Source: Mortgage Bankers Association; Powered by Ellie Mae’s AllRegs® Market Clarity®

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

The Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted “base levels” in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

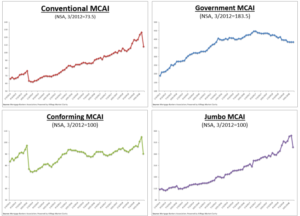

EXPANDED HISTORICAL SERIES

The Total MCAI has an expanded historical series that gives perspective on credit availability going back approximately 10-years (expanded historical series does not include Conventional, Government, Conforming, or Jumbo MCAI). The expanded historical series covers 2004 through 2010, and was created to provide historical context to the current series by showing how credit availability has changed over the last 10 years – including the housing crisis and ensuing recession. Data prior to March 31, 2011, was generated using less frequent and less complete data measured at 6-month intervals and interpolated in the months between for charting purposes. Methodology on the expanded historical series from 2004 to 2010 has not been updated.

Source: Mortgage Bankers Association; Powered by Ellie Mae’s AllRegs® Market Clarity®

Data prior to 3/31/2011 was generated using less frequent and less complete data measured at 6-month intervals interpolated in the months between for charting purposes.

ABOUT THE MORTGAGE CREDIT AVAILABILITY INDEX

The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via the AllRegs® Market Clarity® product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

The MBA updated its methodology in August 2016 which produced an updated set of index values (historically and moving forward), for more information on this updated methodology please visit www.mba.org/MortgageCredit and read the FAQ and Methodology documents. Any historical data obtained prior to August 2016 is not comparable to the current, revised index and should be replaced with the new history.

For more information on the Mortgage Credit Availability Index, including Methodology, Frequently Asked Questions and other helpful resources, please click here or contact This email address is being protected from spambots. You need JavaScript enabled to view it..

Read more...DocMagic Teams with the Art To Grow On Children’s Art Center to Provide 100 Customized Holiday Art Boxes for Patients at Children’s Hospital Los Angeles

- Monday, 31 December 2018

Coordinated by Art To Grow On Children’s Art Center Inc. and sponsored by DocMagic Inc., the unique art boxes were prepared and delivered to patients with assistance from Girl Scout and Brownie Troops, community patrons, families, grandparents, students, and local community volunteers

TORRANCE, Calif., Dec. 21, 2018—DocMagic, Inc., a comprehensive eMortgage software solutions provider, announced that it has purchased 100 custom designed Art Boxes to Art To Grow On Children’s Art Center Inc., which delivered the Art Boxes to patients being treated at the Children's Hospital Los Angeles (CHLA), a non-profit, pediatric academic medical center that provides patient care, education, and leading-edge research to help children in need.

Each Art Box contains a master artist lesson inspired by architect Frank Lloyd Wright, a holiday frame, a journal, a sketchbook, colorful markers, wooden cars, hearts or animals for coloring and decorating, and foam snowflakes or snowman with holiday stickers.

“We are grateful to DocMagic for realizing the immense value that our Art Boxes provide children who are being cared for at Children's Hospital Los Angeles,” said Lauren Dennis-Perelmuter, founder and president at Art To Grow On Children’s Art Center, Inc. “These Art Boxes accomplish something that other gifts such as one-time use toys and electronic devices are unable to do. They give children a respite from the daily realities of staying in a hospital, inspiring and allowing their imagination to soar, their critical thinking skills to be exercised and refined, and their self-esteem and self-confidence to be elevated. These essential life skills are critical not only in the healing process, but brings joy and relief to them directly during their stay at the hospital.”

Notable is that the Children’s Art Center worked tirelessly for more than a year prior to creating and packaging the Art Boxes, going through an extensive vetting process to ensure that they were non-toxic and environmentally safe for patients residing in a medicinal setting. The Girl Scouts and other community volunteers joined forces to assemble to boxes, which was a very hands-on and involved group effort. Video here: https://www.youtube.com/watch?v=rUhMt1MNDMI&feature=youtu.be

Perelmuter says that the Art Boxes become a one-of-a-kind, very rewarding memory not only for the children, but for their families trying to bring a sense of normalcy to their lives while in a hospital. She adds that the right kind of exposure to art not only gives children opportunities to invent, create, innovate and discover, but also allows them to become optimal, independent thinkers and problem solvers who possess strengthened imaginations.

“We are honored to participate and happy to help with this noble and highly creative cause that Art To Grow On Children’s Art Center is providing kids at Children's Hospital Los Angeles,” stated Dominic Iannitti, president and CEO of DocMagic. “DocMagic is proud to be a part of having a very unique and positive impact on the lives of these children, opening up a new world of creativity and imagination that they themselves construct.”

DocMagic is an award-winning Southern California-based software firm that automates key parts of the mortgage lending process, ensuring compliance, increasing efficiencies, making what can a confusing and complex undertaking for borrowers much easier, while at the same time removing enormous amounts of paper that lenders and borrowers traditionally deal with. The company is known for its charity work and philanthropy efforts both locally and nationally.

Perelmuter says that the art boxes will be delivered through January 1 for the holiday season but they can also be purchased anytime throughout the year. They are ideal for a myriad of different occasions. Anyone can order the boxes from individuals, to families, schools, Girls Scouts, Boys Scouts, organizations, companies, and other entities.

Read more...Security National Implements Paperless Closing Process Via DocMagic’s Total eClose

- Monday, 31 December 2018

DocMagic, Inc. and SecurityNational Mortgage Corporation (SNMC), an independent national mortgage banker, have rolled out DocMagic’s comprehensive Total eClose platform.

Since rolling out Total eClose in September, SNMC has reduced borrower time at the closing table to as little as 15 minutes, and become one of the first national lenders to offer a true eClosing solution that involves no paper whatsoever. It has dramatically sped up the closing process, ensuring accuracy and loan quality, and delivering newfound efficiencies for borrowers, notaries and settlement providers. Total eClose enables SNMC’s customers to preview documents prior to closing, eSign all documents, and complete both remote and in-person eNotarizations. As a result, SNMC is now positioned to capture more market share, reduce operational costs, expedite closing times and elevate the borrower experience.

“Our goal was to perfect a completely digital eClosing process, not to be just another lender offering a basic hybrid closing,” said Steve Johnson, president of SNMC. “Achieving our goal required a powerful end-to-end technology, a perfectly executed seamless implementation, and an intuitive interface that everyone—staff, settlement service providers and borrowers—could use immediately, without a steep learning curve. We got that and more with DocMagic. Plus, the DocMagic implementation team was with us all the way. We never had to worry about a thing.”

The two companies approached the project as partners to ensure swift adoption and a quick understanding of the new workflow-driven eClosing process for both SNMC’s staff and customers. DocMagic worked hand-in-hand with the lender, leveraging its vast eMortgage expertise to help sculpt a unique strategy and a successful go-to-market launch. Unlike other document and eClosing solution providers, DocMagic takes an ultra hands-on approach to implementations, from developing the project roadmap, to training all parties—such as staff, title agents and notaries—to synchronized testing of each facet of the Total eClose platform.

“Our implementation teams function like expert consultants—we work very closely with each client, guiding them literally every step of the way,” said Dominic Iannitti, president and CEO of DocMagic. “There is a huge number of moving pieces in an eClosing solution. As a single source solution, we have intricate knowledge of every one of them, so there are none of the issues that plague other providers—not only immediately after the implementation, but over the long haul as well. In contrast, lenders who choose incomplete or cobbled-together eClosing technologies may have to hit the restart button within 12 to 18 months and search for a comprehensive solution.”

DocMagic is a recognized eClosing pioneer, and has been a part of virtually every state-first eClosing in the U.S.

“We’re pleased to work with companies like SecurityNational Mortgage that truly understand the value of implementing a 100 percent paperless eClosing process,” said Iannitti. “They have taken a leadership position in facilitating eClosings and are ready for an inflow of new business that will be conducted very efficiently.”

DocMagic’s comprehensive suite of eSolutions and eServices also includes SMARTDocs, eNotes capability, eVault technology, eWarehouse lending, and even loan servicing.

Read more...