TRENDING WHITEPAPERS,VIDEOS & MORE

tim

"Doorbells Before Wedding Bells" - SunTrust Survey Finds Millennials Are Buying Homes on Their Own Terms

- Tuesday, 28 May 2019

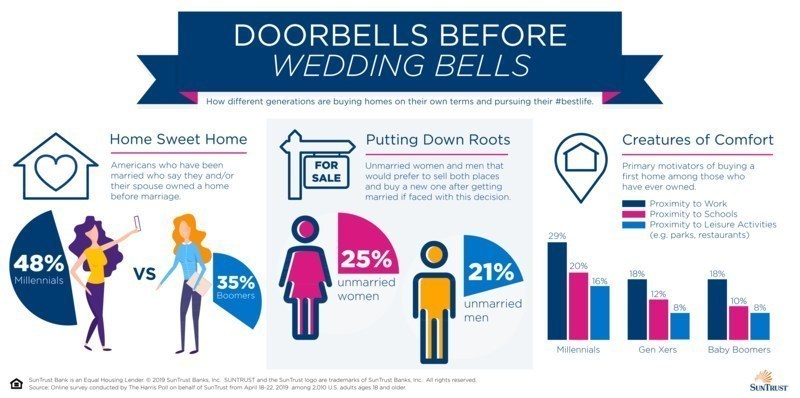

While the adage, "first comes love, then comes marriage," may ring true, for many millennials, "first comes home, then comes marriage." According to a new SunTrust survey conducted online by The Harris Poll among over 2,000 U.S. adults, nearly half of millennials (ages 22-38) who have been married say they and/or their spouse owned a home before marriage (48 percent), compared to only 35 percent of Baby Boomers (ages 55-73).

"People are choosing from many different paths and reaching common life milestones at a wider age span than before, changing when they decide to purchase a home," said Sherry Graziano, mortgage transformation officer at SunTrust.

The survey found additional trends across generations:

Putting Down New Roots

Today, it's increasingly common for both parties in a relationship to own a property when entering a marriage. However, some individuals not currently married would still prefer to start fresh with their significant other and sell both properties before tying the knot. According to the survey, 25 percent of unmarried women and 21 percent of unmarried men said if faced with this decision, they would prefer to sell both places and buy a new one after getting married.

Creature Comforts

When it comes to motivations for buying their first house, millennials seem to have been driven by convenience more so than their older counterparts. According to the survey, millennials who have owned homes were more likely than their older counterparts to cite proximity to work (29 percent, versus 18 percent of Gen X and 18 percent of Baby Boomers), schools (20 percent versus 12 percent and 10 percent), and leisure activities (16 percent versus 8 percent each) as primary motivators.

"It is easier to live life to the fullest – whether you are buying a home, downsizing, or selling – when you are financially confident. While everyone has different goals, across generations and lifestyle choices, it is important to make sure your financial habits are supporting, rather than preventing, the moments that matter most to you," Graziano said.

Read more...Getting Started with Social Media in the Mortgage Industry

- Monday, 27 May 2019

Ben Smidt, MA, Digital Strategy Manager, MGIC

Getting started with social media in the mortgage industry can be daunting. I get it, and I understand your perspective. Having talked to thousands of mortgage loan officers and real estate agents over the past few years, I hear a lot of the same things. You clearly see the value in social media, but you’re not clear on the best way of getting started with social media in your industry. Below are some of the easiest and best social media tips I have on how you can use social media to increase your business growth, in a simple, efficient way across Twitter, Facebook and LinkedIn.

Before you decide to post or take action, check out your company’s social media policy and consider social media through the lens of How can I help? or How can I provide value without selling? This is what social media is about, whether you gain business from it or not. Never talk about the Hot-Button Issues – money, politics and religion. If we all avoid these topics, we could all be friends. The goal of social media is to build relationships, not destroy them.

[caption id="attachment_12084" align="alignright" width="110"] Ben Smidt, Digital Strategy Manager for MGIC[/caption]

Ben Smidt, Digital Strategy Manager for MGIC[/caption]

Getting started with social media in the mortgage industry is challenging, so let’s start with one of the harder platforms for mortgage loan officers to grasp – Twitter. One thing I discovered early on in my digital marketing career at MGIC is, the financial services industry was much less likely to use Twitter, and more important, there was concern about the regulatory risks of “saying the wrong thing.”

As a result, I have found the best way to leverage Twitter in the mortgage industry is to use it as a listening tool. By doing so, the mortgage loan officer takes compliance concerns out of the picture completely. More important, as a loan officer you have the ability to keep your finger on the pulse with industry news outlets, current customers, referral partners and prospects you hope to win more business from.

I approach this concept with the simple idea of using Twitter notifications. A Twitter notification enables a Twitter user to be notified on any device when someone they follow (and have notifications turned on for) tweets.

Let’s unpack this idea.

Twitter built its brand on being the first to know. If you, as a mortgage loan officer, are the first to know an industry change or something that may affect a current mortgage customer or referral partner, you are the first to take action and capitalize on the change. Think about the value proposition in monitoring news outlets on Twitter. Their breaking news alerts are almost always pushed to Twitter first. This helps you keep your finger on the pulse. The same is true for current customers or referral partners you choose to follow and place on notifiers. By doing so, you may discover it’s someone’s birthday or wedding anniversary. What a great opportunity to send flowers or a note. That personal touch and staying top-of-mind is how you get more referral business from those individuals.

Pro Tip: Keep the number of people, companies, brands you have on notifiers to a reasonable amount. Depending on their tweeting frequency, you may get inundated with notifications. Good news, though, it’s just as easy to turn them off as it is to turn them on.

For all the talk of Facebook having lost its appeal with key demographics like Millennials, you still can’t ignore the fact that 2.2 billion people are actively using the platform every month. Let’s explore what you can do right now when getting started with social media in the mortgage industry on Facebook to help you drive digital word of mouth (DWM) with current customers and referral partners in the mortgage industry.

When mortgage loan officers ask me what they should consider posting or what activity they should be doing on Facebook, I start by asking them what they are doing right now, face-to-face with referral partners. If you’re looking for content to post on social media, start with what you’re already doing and simply move it to a social platform, like Facebook. Take those activities and transition them to the social space to help expand your digital footprint across social media.

Here are my 3 favorite ways to leverage Facebook for business as a mortgage loan officer when you are getting started with social media in the mortgage industry.

1. Lunch ’n’ learns:

If you are a savvy loan officer, you’re already doing lunch and learns with your referral partners. But why not complement the live event with a social (Facebook) component? Snap a few photos of the event, post to your Facebook Business Page, tag your pictures with all the people who attended and are also on Facebook and mention the location of the event. Right away you have several people interested in the success of your Facebook post because you mentioned your location and tagged the people you’re with. They’re now all more likely to engage (like, comment, share) with your post. This will help increase your visibility organically across the Facebook platform.

2. Listings:

If you have established real estate referral partners you work closely with, why not post one of their listings on your Facebook Business Page? I recommend one new listing from a different real estate referral partner once a month. (Spread the love around.) We are a visually oriented culture. We love pictures; they are a universal language. By supporting your real estate referral partners with a simple post like this on Facebook, you’re helping to spread the word across the social space. It helps a broader audience discover a potential home. And in return, I’m sure those same referral partners wouldn’t mind posting about your services to their respective audiences on their Facebook page.

3. Closings:

This is my favorite tip for mortgage loan officers who want an easy way to expand their visibility with warm leads. Next time you go to a closing of a really great customer, before you snap the classic picture of the happy homeowner on your camera, stop and ask them to use their camera for the photo. Why? Because then you can suggest when they post it out to their friends and families, they tag you in the post. Anyone on Facebook knows the posts that get the most amount of engagement are the posts about getting married, having a baby and buying a house. This is free advertising to all the homeowners’ friends and families.

There are so many ways to leverage Facebook to help generate business. Let your imagination run wild. But focus most on what’s happening in the community you serve and what you’re already doing that could work on the social channel.

Pro Tip: Create a Facebook group about the many things to do in your community. In creating a beneficial Facebook group that general users can find and join, you’re creating a pool of warm leads you can draw from and leverage for future business opportunities.

There’s a misunderstanding out there that you don’t need to care about Linkedin when you’re getting started with social media in the mortgage industry. That’s just not true. LinkedIn is a huge opportunity to grow your business. I call it your “modern day business card” for a reason. In fact, I don’t carry business cards anymore and instead connect with prospects and business partners directly on the spot. The reason is, referral business is the best way to acquire qualified sales leads.

LinkedIn is the largest professional social media platform out there. One way to approach this concept is to look closely at your profile on LinkedIn. Do you know what your personal brand is? Does your LinkedIn profile reflect it? LinkedIn is the outlet to highlight who you are as a business professional, so make it strong. There are some quick-hit areas of your LinkedIn profile you can modify to improve peoples’ perception of you and increase your visibility to a larger audience.

Here are my 3 favorite areas of a LinkedIn profile to modify when you’re getting started with social media in the mortgage industry.

1. Headshot/Headline/Background Image:

First impressions matter. If a potential borrower who has only communicated with you by phone looks you up on LinkedIn to evaluate you, what first impression as a business professional will you give? A nice business headshot helps to establish a positive first impression. Additionally, the headline is one of four areas in your LinkedIn profile that is weighted higher in search. Consider using key terms to help those searching to find someone like you find you. Branding yourself in the digital space is important. Does your background image reflect what you care about in the community you serve? Are you highlighting who you work for? Consider adding an image that represents your personal brand.

2. Summary:

Your summary section is important because it sits high on your profile page. This means anyone looking to evaluate you as a professional in your industry is more likely to absorb the information you’re sharing. The summary is also only one of two locations you can add media-rich content to your profile. Think about adding website links, PDFs, videos or images to reaffirm to a visitor who you are and what you bring to the table as it relates to your personal brand. Add important key terms you want to be found for in this section as well. It will help strengthen your profile around those terms.

3. Endorsements:

Many people used to think the endorsements/skills section of LinkedIn was a bunch of fluff. Indeed, it was. However, LinkedIn has changed this. This area of your LinkedIn profile is now the second-highest area weighted in search. The way it shakes out is, the term or terms you choose to list and the number of times you’ve received an endorsement is how the weighting is placed. So again, think about those key terms you believe consumers or referral partners are using in search to find someone like you and include them in this section. Take it a step farther and work to have co-workers endorse you for these listed skills.

These quick-hit improvements to your LinkedIn profile will help to increase your visibility in Google Search and LinkedIn search and help reduce doubt with those who land on your profile page, evaluating whether they want to do business with you. Your personal brand matters, and LinkedIn is a great opportunity to solidify it on a professional social media platform.

Pro Tip: Organize a group outing with valued customers or referral partners to tour and taste the best of something in your community … craft beer at several breweries or the best wings, tacos, gyros, burgers … the ideas are limitless. At the end of the day, have them vote on their favorites. It’s a great way to support your local community and build relationships with those who can send that valuable word-of-mouth business. Leverage video to capture the fun moments and the results to share on social media.

There’s no simple way to getting started with social media in the mortgage industry, but the social media tips I’ve shared with you will help build the foundation to a successful, meaningful experience on a variety of social media platforms in the mortgage industry. Remember to start small and stay focused on the social media sites you believe your customers, referral partners and prospects are using. Manage your time accordingly, try the suggestions, measure what works and then re-evaluate. You never know what’s possible with social media until you take the leap.

Ask the Expert - Dave Hershman Discusses Yield Spread Premiums

- Friday, 24 May 2019

I have a question regarding rebates. Why do some lenders have such low maximum above-par pricing on certain products, especially ARMs? This sometimes precludes me from offering reduced and no-closing cost loans. I was told it has to do with the investors on the secondary market. Why would the investors care? Thank you, James, Sacramento, CA

There are several reasons that lenders have maximum yield spread premiums on certain products—

- First, they may be afraid of brokers charging too much and moving in non-QM lending territory. Therefore, they may limit either rebates and/or total compensation charged by the broker.

- Second--if they can't sell the loan too far "over par" this will limit the rebate. Why would this be the case? Using hypothetical even numbers, if you had a three-one adjustable and par is 4.0% and 30-year fixed-rate par is at 5.0%, when you buy the adjustable up to 5.0%, this will likely be a short-term loan because the customer is more likely to refinance quickly if rates go down. Why would someone stay in a 5.0% three-one ARM when fixed rates are 5.0%?

- Third--accounting regulations will limit rebates when loans are originated for a portfolio rather than for sale. It is more likely that ARMs are originated for a portfolio rather than fixed rates because these loans limit the bank's future risk. If they pay you "two" and then sell the loan on the secondary market--they get that "two" right back. If they are holding it in the portfolio, the expense of paying you is up front--but they don't get that income right away. So, the loan is originated at a loss that is recovered over time through a higher rate. I am not an expert in this, but I have served on the board of a bank and have gone through the process with accounting firms. You never want to become an expert in FASB accounting standards unless you are a CPA or an auditor.

Keep in mind that secondary trends change over time. For generations, jumbo pricing was more expensive than conforming pricing. This was because the secondary markets for conforming, led by Fannie and Freddie, were more efficient. But when the secondary markets collapsed during the financial crisis, jumbo spreads went up initially. Big banks were forced to hold onto jumbo loans, and they started pricing these loans differently. Getting hungry for products, some banks offered pricing even lower than conforming. This has gone on for some time.

Likewise, the efficiency of on-line lenders such as Quicken have enabled more borrowers to refinance more quickly during the past several years. This has compressed the premiums offered above par recently – even on fixed rate loans. Will these premiums come back as rates go up and refinances diminish? Only time will tell.

Hope this helps.

Dave

Read more...