TRENDING WHITEPAPERS,VIDEOS & MORE

tim

Redfin Survey Says Tax Reform Not Having A Big Impact On Home Searches

- Tuesday, 21 May 2019

More than a year after the historic tax code overhaul, less than half of homebuyers (47%) say that tax reform has had an effect on their home search, according to a March survey commissioned by Redfin, the technology-powered real estate brokerage. That's down from 56 percent last year, when tax reform's effects were still mostly speculative and not yet realized in people's paychecks. The tax reform law lowered the caps on the tax deductions allowed for mortgage interest payments and state and local taxes.

The Redfin-commissioned survey included more than 2,000 U.S. residents who planned to buy or sell a primary residence in the next 12 months. More than 1,800 homebuyers responded to the question: "How has the recent tax reform law affected your plans to buy a home?" Results from this survey were compared to over 1,300 responses to the same question in a similar survey commissioned in March 2018.

The most common tax-reform effect reported by homebuyers this year was that they lowered their price range because of decreased benefits on high-priced homes (14%, down from 16% last year).

Another way tax reform has been affecting the housing market is in the form of migration to places with lower taxes, a trend we've noted in reports on Redfin.com user search patterns. This March, 13 percent of buyers said they shifted their search to nearby cities with lower taxes, and 9 percent said they shifted their search to states with lower taxes, down from 16 percent and 12 percent, respectively, last year.

This year, 8 percent of respondents said they are searching for higher-priced homes because the new tax law gives them additional income, down from 17 percent last year. Eleven percent of buyers this March said they decided to buy a home because the new tax law gives them additional income, down from 19 percent in the March 2018 survey.

"Last year more homebuyers were worried that tax reform would hurt their homebuying budgets, but it turns out tax reform wasn't all bad or all good for homebuyers," said Redfin chief economist Daryl Fairweather. "Some homebuyers, especially in low-tax states, are now paying less in taxes overall, which has left them with more cash for a more expensive home. For others, not being able to deduct as much of their property taxes or mortgage interest from their taxable income was the other shoe that needed to drop to make them pick up and move to a more affordable area. In the long run, we will see demand for luxury homes in high-tax states suffer the most because those homes have been hit the hardest by this tax reform, and there's actually early evidence of that already happening."

How Were Households with Different Incomes Affected by Tax Reform?

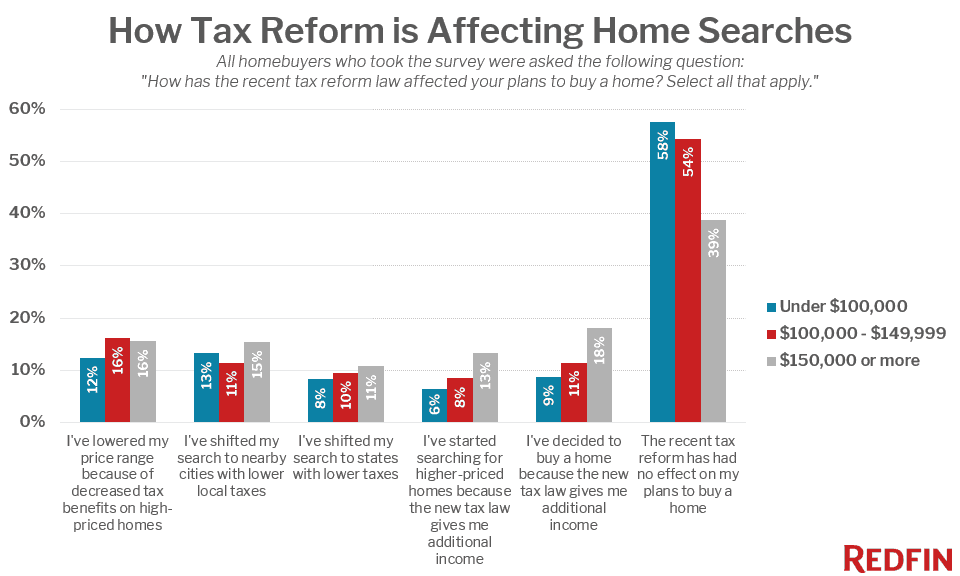

High-income homebuyers were the most likely to report in this year's survey that tax reform has had some sort of effect on their home search. Of those homebuyers earning $150,000 or more, 61 percent said that the new tax law had an effect on their home search, which was true for less than half of households earning under $150,000.

The largest reported effect on high-income homebuyers was that 18 percent said they have now decided to buy a home thanks to their extra take-home income, but 16 percent said they are now lowering their price range due to decreased tax benefits on high-priced homes.

Which States Were Most and Least Affected by Tax Reform?

New York had the largest share of homebuyers who said that tax reform had affected their home search—61 percent. Homebuyers in New York were most likely to have lowered their price range (17%) or shifted their home search to cities with lower taxes (17%). California had the next-highest share of homebuyers impacted by tax reform at 55 percent. The largest effect there was homebuyers shifting their search to cities with lower taxes (18%). Thirteen percent of both New York- and California-based respondents said they were moving to a state with lower taxes.

On the other end of the spectrum, Kansas and Indiana had the smallest share of homebuyers whose search was affected by tax reform, each at 24 percent. Washington, D.C., was just behind with 25 percent of homebuyers saying tax reform had some effect on their search.

To read the full report, complete with market-level survey data and detailed methodology, please visit: https://www.redfin.com/blog/how-tax-reform-impacts-homebuyers.

Read more...Ellie Mae Announces New Release For Encompass Digital Lending Platform

- Wednesday, 22 May 2019

Ellie Mae® has launched a new major release of their Encompass digital lending platform. The latest release is designed to help lenders of all sizes originate more loans across a wider variety of loan types, capitalize on the growing HELOC demand, sell and deliver loans more efficiently, provide a better loan officer experience and leverage the power of data to make better decisions faster.

“With this new release we’re providing lenders with enhanced support to capitalize on the growing HELOC opportunity, an expanding ecosystem of Investor Connect integrations and Loan Officer Connect updates to help lenders close loans faster while offering a best-in-class borrower experience.”

“Ellie Mae is offering a true digital mortgage solution to help our customers succeed in today’s competitive marketplace,” said Jonathan Corr, president and CEO of Ellie Mae. “With this new release we’re providing lenders with enhanced support to capitalize on the growing HELOC opportunity, an expanding ecosystem of Investor Connect integrations and Loan Officer Connect updates to help lenders close loans faster while offering a best-in-class borrower experience.”

Key changes for the Encompass Digital Lending Platform 19.2 release include:

Temporary buydown and enhanced HELOC support: The new major release helps home builders with mortgage operations originate more loans. This release offers the ability to filter change of circumstance reasons, making it easier for the lender to re-disclose to the borrower. Additionally, lenders who originate HELOCs will have enhanced payment options to provide the most accurate DTI evaluation for underwriting and sets expectations with the borrower for the initial estimated payment on their HELOC.

Expanded Investor delivery services: Lenders can significantly reduce the amount of time it takes to manually prepare loan packages with the ability to deliver secure data and documents through Encompass Investor Connect™ with a simple click of a button. Ellie Mae has established partnerships with correspondent investors AmeriHome, Flagstar Bank, Franklin American Mortgage, Mr. Cooper, NewRez (formerly New Penn Financial), TMS and Wells Fargo, as well as other top ten banks, with more partnerships to be announced in the coming quarters.

Encompass Consumer Connect Single Sign-On (SSO): Encompass Consumer Connect™ now supports Okta, Salesforce and Microsoft® Azure for SSO. This provides the ability to easily manage and secure authentication while streamlining borrower login and access between a lender’s corporate site, loan application and borrower portal.

Loan officer workflow enhancements: Lenders can close more loans and provide a better borrower experience with the 19.2 enhancements to Encompass Loan Officer Connect™. With service management capabilities, administrators can now configure each service and control to begin to automate the ordering of a service, such as credit, once a milestone has been met. This is the first phase towards the vision for a fully automated service ordering experience within Encompass Loan Officer Connect that will be delivered throughout 2019.

With new Cash-To-Close and Affordability tools in Loan Officer Connect, loan officers can provide prospective borrowers with multiple loan scenarios that they are eligible to apply for within their financial means. Loan officers will also benefit from the new at-a-glance eligibility view across all of their opportunities, with one-click ability to send eligibility letters to borrowers – all from their mobile device.

New loan audit capabilities: In addition to being the mortgage industry’s only solution that helps lenders make smarter decisions faster by providing access to all Encompass loan data fields in near real-time, with no negative impact on their production systems, Encompass Data Connect™ now helps lenders significantly improve loan quality and reduce buyback risks with the ability to track changes to loan files. The new loan audit capabilities give lenders full visibility into all changes for every loan in a single system of record, for comprehensive loan auditing, reporting and risk mitigation.

Read more...