TRENDING WHITEPAPERS,VIDEOS & MORE

tim

Hispanics More Than Twice As Likely To Have FHA Loans

- Wednesday, 17 April 2019

Recently the National Association of Hispanic Real Estate Professionals (NAHREP) issued their annual report on the state of Hispanic homeownership which was authored by Marisa Calderon, Executive Director, NAHREP. Below are some of the housing and mortgage related conclusions from this report.

HOUSEHOLD FORMATION

Hispanics formed 485,000 new households in 2018, accounting for 32.4 percent of total U.S. household formations. According to Harvard’s Joint Center for Housing Studies, Hispanics are projected to increase by 4.6 million households between 2015 and 2025. Hispanic household growth continues to outpace that of overall U.S. household growth and is anticipated to do so for the foreseeable future.

HISPANIC CONTRIBUTIONS OVER THE PAST DECADE

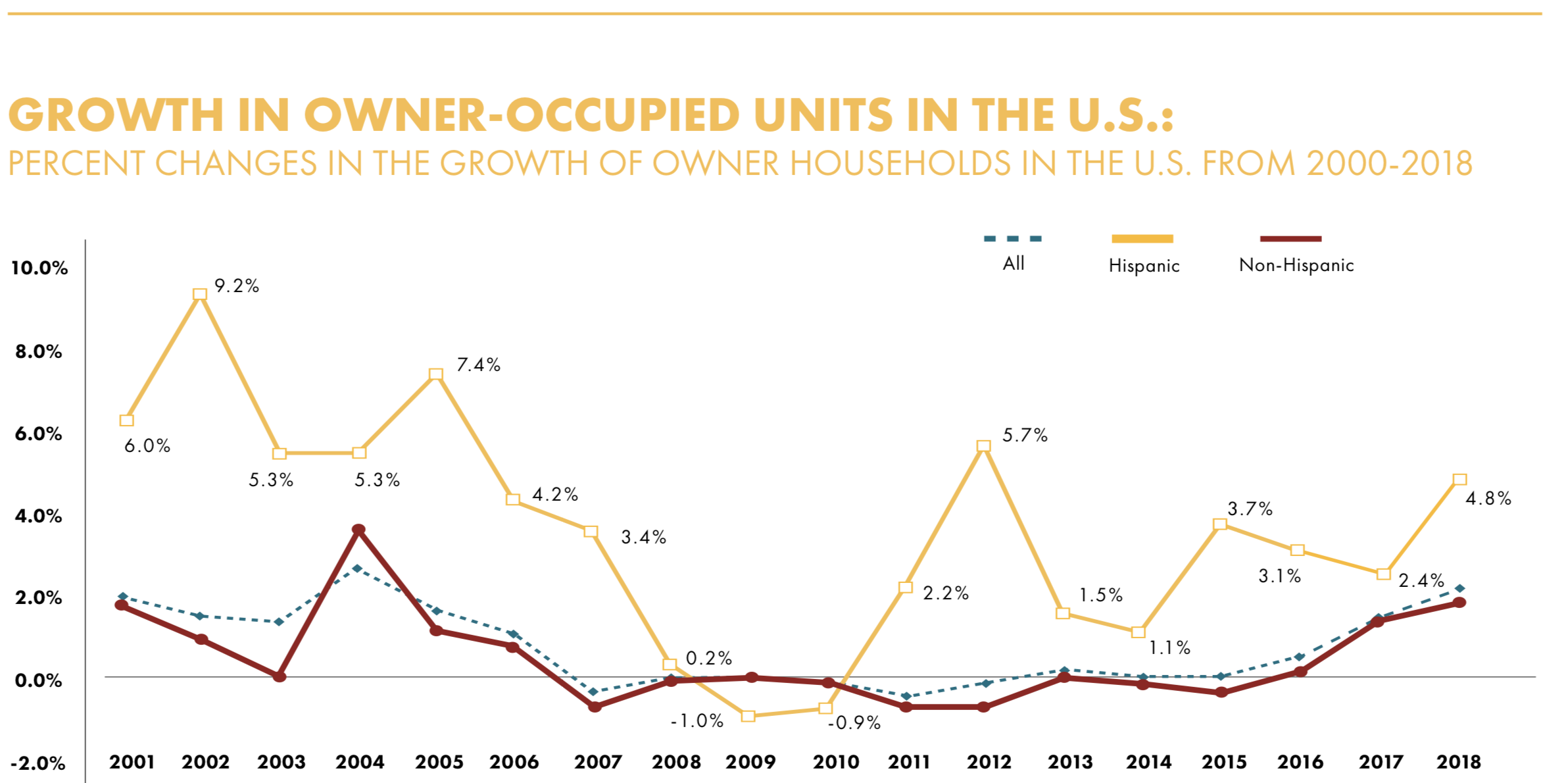

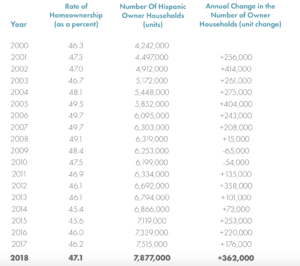

In 2018, Hispanics achieved a net gain of 362,000 homeowners. This raised the Hispanic homeownership rate from 46.2 percent in 2017 to 47.1 percent in 2018.31

Over the past decade, Hispanics have accounted for 62.7 percent of net U.S. homeownership gains, growing from 6,303,000 homeowners to 7,877,000, a total increase of 1,574,000 Hispanic homeowners.32 This growth trajectory for Hispanic homeownership is consistent with projections made by the Urban Institute that Hispanics will account for more than half of all new homeowners over the next several years and for 56 percent of all new homeowners by 2030.33

For the fourth consecutive year, Hispanics were the only ethnic demographic group to raise their rate of homeownership. At 47.1 percent, the rate of Hispanic homeownership is less than three percentage points from its all-time high of 49.7 percent. Hispanic median household income also rose to $50,486, accounting for the largest increase in income (3.7 percent) among all racial or ethnic population groups.34

In nearly every state where Hispanics account for greater than 30 percent of the state’s population, their rate of homeownership is above 50 percent. California is the only exception where Hispanics comprise 38.8 percent of the state’s population and have a 43.07 rate of homeownership. This difference is heavily influenced by the intersection of pervasive affordability challenges and inventory shortages across California.

Hispanic Homeownership by the #'s

HOUSING INVENTORY SHORTAGE

HOUSING INVENTORY SHORTAGE

The U.S. is experiencing record-level housing inventory shortages. According to Zillow, in 2018 there were 10 percent fewer homes on the market than the prior year.39 The impact is greatest in markets where home values are appreciating the fastest, with up to 40 percent fewer homes on the market. The effect is acute in markets with high concentrations of Hispanics such as Los Angeles (22 percent fewer), Las Vegas (24 percent fewer), and Denver (25 percent fewer).40

LABOR SHORTAGES AS AN INFLUENCING FACTOR

A lack of available skilled labor in the construction industry is one of the upstream contributors to the housing inventory shortage. Nearly 80 percent of construction firms plan to increase their headcount in 2019, but an almost equal percentage are concerned about finding qualified workers.41

The skilled labor shortage marks the intersection of housing and immigration policy. Hispanic men represent the largest share of construction workers, and nearly 30 percent of undocumented men work in construction. With no immediate resolution, the U.S. could continue to have a significant skilled labor gap for the foreseeable future which would have a lasting effect on the construction industry’s ability to build new housing stock.

ACCESS TO CREDIT

In 2017, both debt-to-income (DTI) ratio and credit history accounted for 40 percent of mortgage loan denials for Hispanics.51 When asked, Hispanic consumers believe their primary obstacles to getting a mortgage are an insufficient credit score, the ability to afford a down payment, and insufficient income for monthly payments.

From 2017 to 2018, unease increased regarding affordability and income-related obstacles.52 These perceptual changes are directionally aligned with the current market conditions, including increased home prices which materially affect borrower financing limits. Maintaining policy tools like the Qualified Mortgage Patch (QM Patch) in place will help as it provides an alternative calculation for consumers with DTI above 43 percent.

FINANCING VEHICLES

Hispanic home buyers are more than twice as likely (42.8 percent) to have an FHA loan, as compared to non-Hispanics (20.6 percent).53 In contrast, 79.4 percent of non-Hispanic home buyers have conventional financing, compared to 57.2 percent of Hispanics. These differences mean Hispanics are more likely to pay mortgage insurance premiums (MIP) for the life of their FHA mortgage, thereby increasing overall monthly out-of-pocket expenses. OURCE: FANNIE MAE

Read more...

Independent Mortgage Bankers’ Production Volume and Profits Down in 2018

- Wednesday, 17 April 2019

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $367 on each loan they originated in 2018, down from $711 per loan in 2017, the Mortgage Bankers Association (MBA) reported today in its Annual Mortgage Bankers Performance Report.

“Despite a healthy economy in 2018, the mortgage market suffered, as rate hikes hurt refinancing volume and low housing inventories priced some potential homebuyers out of the purchase market,” said Marina Walsh, MBA’s Vice President of Industry Analysis. “For mortgage companies, there was the perfect storm of lower production revenues combined with rising expenses, which together contributed to the lowest net production income per loan since 2008. Production revenues per loan dropped despite study-high loan balances in 2018. At the same time, production expenses per loan grew to a study-high of $8,278 per loan last year.”

Added Walsh, “For those holding mortgage servicing rights (MSR), it was the silver lining that boosted overall profitability. Including both production and servicing operations, 69 percent of the firms posted overall pre-tax net financial profits in 2018, compared to only 47 percent of firms with net servicing income excluded.”

Among the other key findings of MBA’s 2018 Annual Mortgage Bankers Performance Report:

- Average production volume was $2.0 billion (8,171 loans) per company in 2018, down from $2.13 billion (8,882 loans) per company in 2017. On a repeater company basis, average production volume was $2.07 billion (8,502 loans) in 2018, down from $2.11 billion (8,824 loans) in 2017. For the mortgage industry as whole, MBA estimates production volume at $1.64 trillion in 2018, down from $1.76 trillion in 2017.

- In basis points, the average production profit (net production income) was 14 basis points in 2018, compared to 31 basis points in 2017. In the first half of 2018, net production income averaged 18 basis points, then dropped to 9 basis points in the second half of 2018. Since the inception of the Annual Performance Report in 2008, net production income by year has averaged 49 bps ($1,020 per loan).

- The refinancing share of total originations (by dollar volume) decreased to 20 percent in 2018 from 25 percent in 2017. For the mortgage industry as a whole, MBA estimates the refinancing share last year decreased to 28 percent from 35 percent in 2017.

- The average loan balance for first mortgages reached a study-high of $251,084 in 2018, up from $245,500 in 2017. This is the 9th consecutive year of rising loan balances on first mortgages.

- Total production revenues (fee income, net secondary marking income and warehouse spread) were 362 basis points in 2018, down from 379 bps in 2017. On a per-loan basis, production revenues were $8,645 per loan in 2018, down from $8,793 per loan in 2017.

- Total loan production expenses – commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations – increased to $8,278 per loan in 2018, up from $8,082 in 2017.

- Personnel expenses averaged $5,524 per loan in 2018, up from $5,346 per loan in 2017.

- Productivity was 1.8 loans originated per production employee per month in 2018, down from 1.9 in 2017. Production employees include sales, fulfillment and production support functions.

- Net servicing financial income, which includes net servicing operational income, as well as mortgage servicing right (MSR) amortization and gains and losses on MSR valuations, was $203 per loan in 2018, up from $64 per loan in 2017.

- Including all business lines, 69 percent of the firms in the study posted pre-tax net financial profits in 2018, down from 80 percent in 2017. In the first half of 2018, 73 percent of reporting repeater firms posted pre-tax financial profits, compared to 55 percent in the second half of 2018.

MBA's Mortgage Bankers Performance Report series offers a variety of performance measures on the mortgage banking industry and is intended as a financial and operational benchmark for independent mortgage companies, subsidiaries and other non-depository institutions. Of the 280 firms that reported production, 80 percent were independent mortgage companies and remaining 20 percent were subsidiaries and other non-depository institutions.

Read more...Things to Consider When Crafting Your Servicing Strategy

- Wednesday, 17 April 2019

At IMN’s Residential Mortgage Servicing Rights Forum an afternoon panel discussed servicing related strategies.

One thing is clear, it’s a big investment to do it yourself. You have to consider infrastructure, compliance ( which has gone down recently but isn’t going away) and your ability to protect information. There are also the people issues, do you want to manage possibly thousands of people. Many of the subservicers have already made these investments.

The decision whether to do your own servicing or subservice might depend on what your business model is. Your servicing strategy has to be consistent with your loan acquisition strategy, whether your buying an originator or purchasing through portfolio or using a warehouse channel. Buyers should have a clear understanding of what they are buying and what they are good at doing and not doing form a servicing perspective.

[caption id="attachment_11882" align="alignleft" width="300"] Michael Lau, CEO, Pingora Asset Mgmt; Paul Birkett, Managing Member Automated Holdings, Jennifer McGuinness, Co-Founder Mortgage Venture Partners; Patrick DellaValle, Director, Navigant Consulting; Chris Delfs, SVP Capital Markets Suntrust Mortgage[/caption]

Michael Lau, CEO, Pingora Asset Mgmt; Paul Birkett, Managing Member Automated Holdings, Jennifer McGuinness, Co-Founder Mortgage Venture Partners; Patrick DellaValle, Director, Navigant Consulting; Chris Delfs, SVP Capital Markets Suntrust Mortgage[/caption]

“There is a difference between whole loan, wholesale and correspondent” said Jennifer McGuiness of Mortgage Venture Partners “The risk profiles for the three channels are different, the manners in which you are protected or not protected are different and then the question is do you want to buy somebody else’s wholesale risk or do you want to buy your own. Or do you want to buy somebody else’s retail risk, or do you want to buy your own. “

If you are going to be buying a company to get servicing, in the due diligence process you have core factors you look at – operations , compliance, HR. When looking at the companies servicing platform you are looking at the same attributes - are they scaleable, can they execute on the strategy, do they have the ability to source talent for their portfolio size and going forward, do they have new technology and do they have capacity.

As Paul Birkett, Managing Member of Automated Holdings LLC said “ We are buying non performing and re-performing loans and have multiple sub servicers and managed law firms on our platform. So we took a different angle. We have 35 law firms that manage the rate of recovery and servicers that mange the borrower. That accelerates the work out process. I think we could look to be a servicer at some time but that is probably way off. You make money pennies at a time and loose dollars at a time.”

Many lenders have have multiple servicers. According to Ms McGuiness there is a reason for this. " Not all servicers are created equal. They are not all meant to service the same product, They are not all good at the same thing. If you find a svcer who can do every product well at every phase I would be their partner. With that said, I think that with different businesses and execution cycles it can be hard to do it yourself. That is where the subservicer ads value."

One situation that might call for doing things in-house was if you were dealing with a large number of alternative products, products that were open ended and dynamic like building loans and products that implement a line of credit. In these loans you control the advances more pointedly. This isn’t something the standard performing servicer can take on, at least not at a price that many would find palatable.

Another argument for going in-house is the ability to control the outcome because that dictates the servicing yield on the portfolio. You want to be able to control the quality of the customer experience and directly control retention.

Read more...