TRENDING WHITEPAPERS,VIDEOS & MORE

matt

Quicken: Valuations Diverge Between Appraisers, Homeowners

- Monday, 11 February 2019

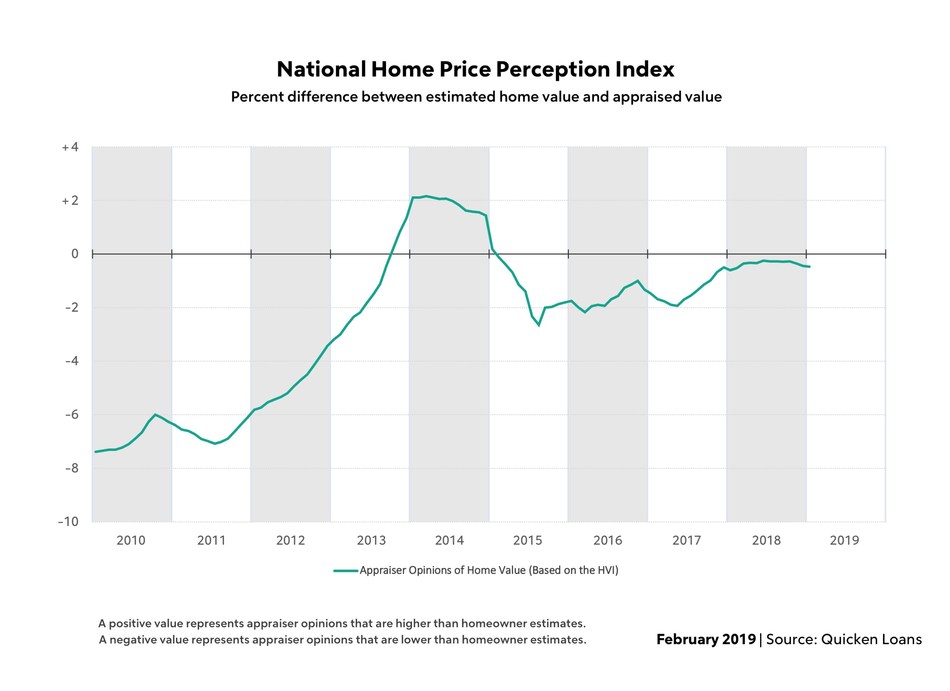

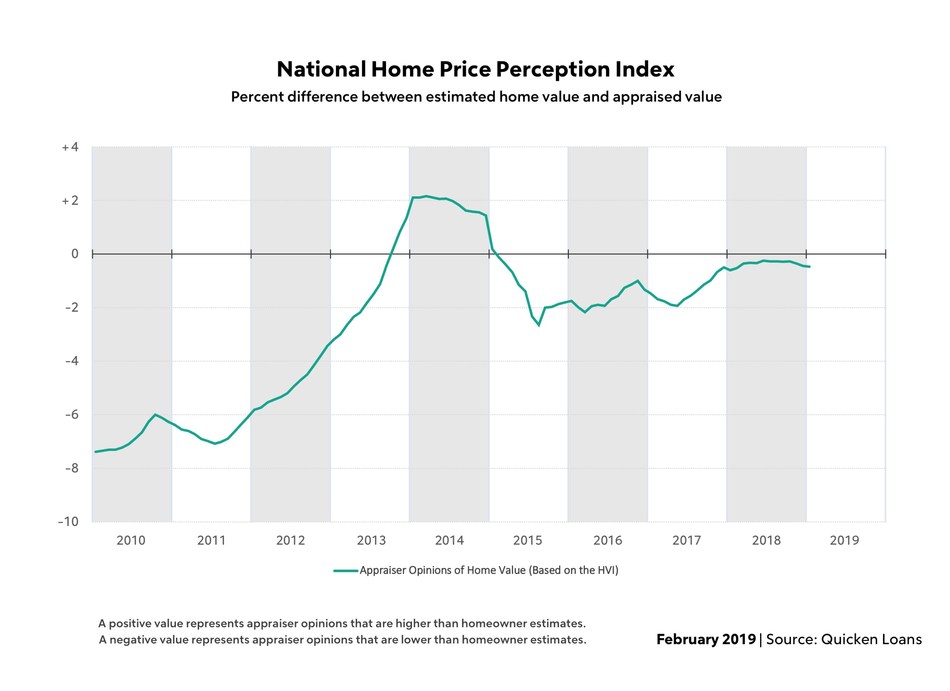

The average American homeowner thinks their home is appreciating faster than appraisers do.

Appraisal values in January were an average of 0.47 percent lower than what homeowners estimated, according the national Quicken Loans Home Price Perception Index.

January was the third consecutive month in which the gap between these data points widened from the previous month. While there is still a small gap between the two opinions, this emerging trend could be a sign that homeowners aren't aware of recent home value changes.

The metro HPPI measurements demonstrates how perception is changing across the U.S. Some of Western cities have seen their index values drop as their home-value growth slowed. San Francisco, for example, had average appraisals 2.11 percent higher than expected in January 2018. One year later, appraisals in the Bay Area are less than 1 percent higher than what homeowners estimate. All told, two thirds of the metro areas measured reported average appraisal values higher than what homeowners expected.

The metro HPPI measurements demonstrates how perception is changing across the U.S. Some of Western cities have seen their index values drop as their home-value growth slowed. San Francisco, for example, had average appraisals 2.11 percent higher than expected in January 2018. One year later, appraisals in the Bay Area are less than 1 percent higher than what homeowners estimate. All told, two thirds of the metro areas measured reported average appraisal values higher than what homeowners expected.

"It looks like the HPPI is seeing the start of a downward trend, in lock-step with pockets of moderating home values," said Bill Banfield, Quicken Loans Executive Vice President of Capital Markets. "However, with the national measure still reporting appraisals less than half of a percent lower than expected and with home values in the lowest performing metro area less than two percent lower than what homeowners estimated, the housing markets is still in a healthy place."

Even though homeowners may not have their finger on the pulse of home-value changes, appraisers have recorded fluctuations in select areas. Nationally, however, home values are still marching forward, but at a slower clip than last month. Appraisal values rose 0.65 percent January compared to December, according to the National Quicken Loans Home Value Index. In addition, the index showed healthy annual grow – with appraisal values rising 5.35 percent since January 2018.

The more notable changes to home values were reflected in the regional areas. There was a small monthly dip in appraisal values for homes in the West, 0.38 percent, and a nominal drop in the Midwest, 0.08 percent, and much more subdued annual appreciation in the West and South.

"As homes in each market adjust for the rate of price appreciation, buyers and sellers might find that there is more to negotiate--and some potential complications--if the purchase price isn't supported by the appraised value,” said Bill Banfield, executive vice president of capital markets at Quicken Loans. “The appraised value will be derived from recent, proximate sales, and are the leading indicator for the direction of the local market."

| HVI

January 2019 January 2005 = |

HVI

January 2019 vs. December 2018 % Change |

HVI

January 2019 vs. January 2018 % Change |

HPPI

January 2019

Appraiser Value vs. |

HPPI

January 2018

Appraiser Value vs. |

|

| National Composite | 111.94 | +0.65% | +5.35% | -0.47% | -0.60% |

*A positive value represents appraiser opinions that are higher than homeowner perceptions. A negative value represents appraiser opinions that are lower than homeowner perceptions.

|

Geographic Regions

|

HVI

January 2019

January 2005 = |

HVI

January 2019 vs. December 2018 % Change |

HVI

January 2019 vs. January 2018 % Change |

HPPI

January 2019

Appraiser Value vs. |

HPPI

January 2018

Appraiser Value vs. |

| West | 135.57 | -0.38% | +3.27% | -0.37% | -0.41% |

| South | 112.87 | +1.34% | +6.84% | -0.46% | -0.70% |

| Northeast | 91.47 | +0.59% | +4.74% | -0.47% | -0.72% |

| Midwest | 103.4 | -0.08% | +4.42% | -0.62% | -0.67% |

*A positive value represents appraiser opinions that are higher than homeowner perceptions. A negative value represents appraiser opinions that are lower than homeowner perceptions.

|

Metropolitan Areas

|

HPPI

January 2019

Appraiser Value vs. |

HPPI

December 2018

Appraiser Value vs. |

HPPI

January 2018

Appraiser Value vs. |

| Boston, MA | +2.76% | +2.98% | +1.90% |

| Charlotte, NC | +2.24% | +2.23% | +1.07% |

| Denver, CO | +2.17% | +2.36% | +2.18% |

| San Jose, CA | +1.91% | +1.86% | +2.58% |

| Minneapolis, MN | +1.70% | +1.91% | +1.02% |

| Seattle, WA | +1.64% | +1.69% | +1.96% |

| Dallas, TX | +1.39% | +1.37% | +2.83% |

| Las Vegas, NV | +1.13% | +1.10% | +0.60% |

| San Diego, CA | +0.94% | +1.10% | +1.13% |

| Atlanta, GA | +0.86% | +0.93% | -0.09% |

| Kansas City, MO | +0.76% | +1.04% | +0.80% |

| San Francisco, CA | +0.74% | +1.14% | +2.11% |

| Phoenix, AZ | +0.73% | +0.60% | +0.59% |

| Washington, D.C. | +0.60% | +0.74% | +0.33% |

| Sacramento, CA | +0.46% | +0.55% | +0.84% |

| Portland, OR | +0.26% | +0.51% | +1.05% |

| Los Angeles, CA | +0.10% | +0.31% | +0.93% |

| Riverside, CA | +0.02% | +0.27% | +0.54% |

| Houston, TX | -0.23% | -0.35% | -0.61% |

| New York, NY | -0.27% | -0.18% | +0.13% |

| Miami, FL | -0.35% | -0.17% | +0.75% |

| Detroit, MI | -0.59% | -0.18% | +0.41% |

| Tampa, FL | -0.69% | -0.73% | +0.44% |

| Baltimore, MD | -1.28% | -1.24% | -1.53% |

| Philadelphia, PA | -1.30% | -1.31% | -1.87% |

| Cleveland, OH | -1.64% | -1.33% | -1.95% |

| Chicago, IL | -1.87% | -1.96% | -1.35% |

*A positive value represents appraiser opinions that are higher than homeowner perceptions. A negative value represents appraiser opinions that are lower than homeowner perceptions.

Read more...KeyBank Has Deployed Black Knight's MSP

- Tuesday, 12 February 2019

KeyBank has implemented the Black Knight MSP servicing system for its mortgage portfolio. The aim was to drive efficiency and improve risk management at the bank.

MSP delivers a scalable system, which helps clients manage all servicing processes--from payment processing to escrow administration, customer service, and default management. It was engineered to support almost any size portfolio and includes client support services.

Also, the bank deployed components of the new Black Knight Actionable Intelligence Platform to help the bank proactively monitor and manage its servicing portfolio through the use of strategic, proactive analytics.

"As a result of the Black Knight team's extensive servicing experience and skillful execution, the entire implementation process was [well] planned and managed," said Amy Brady, CIO, KeyBank. "Black Knight's ability to support our growing servicing operations and help enhance our compliance processes, were important factors in our decision to expand our current relationship with Black Knight."

The Black Knight AIP is a unified framework for delivering strategic, proactive and actionable analytics to the right people within an organization at the right time, so they know the right actions to initiate next.

The AIP components that were deployed are Portfolio Insight Suite, which helps servicers monitor and manage their operations through the use of key performance metrics, and Lien Alert, which provides servicers with instant notifications about key lien-related indicators. Also, KeyBank will use Black Knight McDash, providing data and analytics capability on a majority of active mortgages as well as historical data on 180 million first-mortgage loans and more than 20 million home equity loans.

Read more...Black Knight, Others Complete D&B Acquisition; Foley Ascends to Chairman

- Monday, 11 February 2019

An investor group led by Black Knight Inc. and others has completed the acquisition of Dun & Bradstreet Inc., which had already been announced. The other lead investors include Cannae, CC Capital Partners, Bilcar, and funds affiliated with Thomas H. Lee Partners.

William P. Foley, was appointed executive chairman of the board for Dun & Bradstreet. Also, he will remain as chairman of the board of Cannae Holdings and Fidelity National Financial as well as executive chairman of the board of Black Knight. It provides integrated software, data and analytics solutions mortgage lenders and servicers.

Anthony Jabbour, chief executive officer at Black Knight, will serve as chief executive officer of Dun & Bradstreet, remaining in his current role at Black Knight.

Also, Stephen C. Daffron, a co-founder of Motive Partners and former president and chief executive officer of Interactive Data Corp., will serve as president of Dun & Bradstreet, which is now a private company and will no longer trade on the New York Stock Exchange.

“As a private company, Dun & Bradstreet is well positioned to reinvigorate growth and I look forward to partnering with Anthony, Stephen and the board in my new role,” said Foley. “Building on Dun & Bradstreet’s strong platform as a global leader in business insights, I look forward to improving growth and customers’ experience, while increasing operating efficiencies to deliver enhanced business solutions across the world."

Black Knight invested most of the $375 million paid for the transaction to purchase the equity interests of another consortium member. Of that investment, $250 million was used to purchase the ownership interest of QIA FIG Holding, a Doha, Qatar-based financial company, according to a Form 8-K it filed with the Securities and Exchange Commission.

The remaining $125 million is an equity commitment to the consortium, Star Parent LP. The investment in Dun & Bradstreet would yield less than a 20-percent share in Dun & Bradstreet. As a result of the completion of the transaction, shares of Dun & Bradstreet stock ceased trading on the New York Stock Exchange.

Cannae has acquired over 100 companies worth more than $30 billion along with Fidelity National Financial and others over the past 20 years. CC Capital is a private investment firm founded in 2016, which invests in and operates high-quality companies.

William and Carol Foley own Bilcar, a partnership that invested in the D&B transaction. He and his team achieved $312 million in cost reductions from the Lender Processing Services acquisition, surpassing a $150 million target. Foley has achieved around 1.3 times synergies in more than eight large transactions. Also, under his stewardship, Fidelity National grew into one of the largest title-insurance companies in the U.S. Thomas H. Lee Partners L.P. is a private equity firm that invests in growth companies in the U.S.

Read more...