-

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Gap Between Appraiser Opinions, Homeowner Perception of Value Widens: Quicken

- Tuesday, 12 March 2019

- Lending

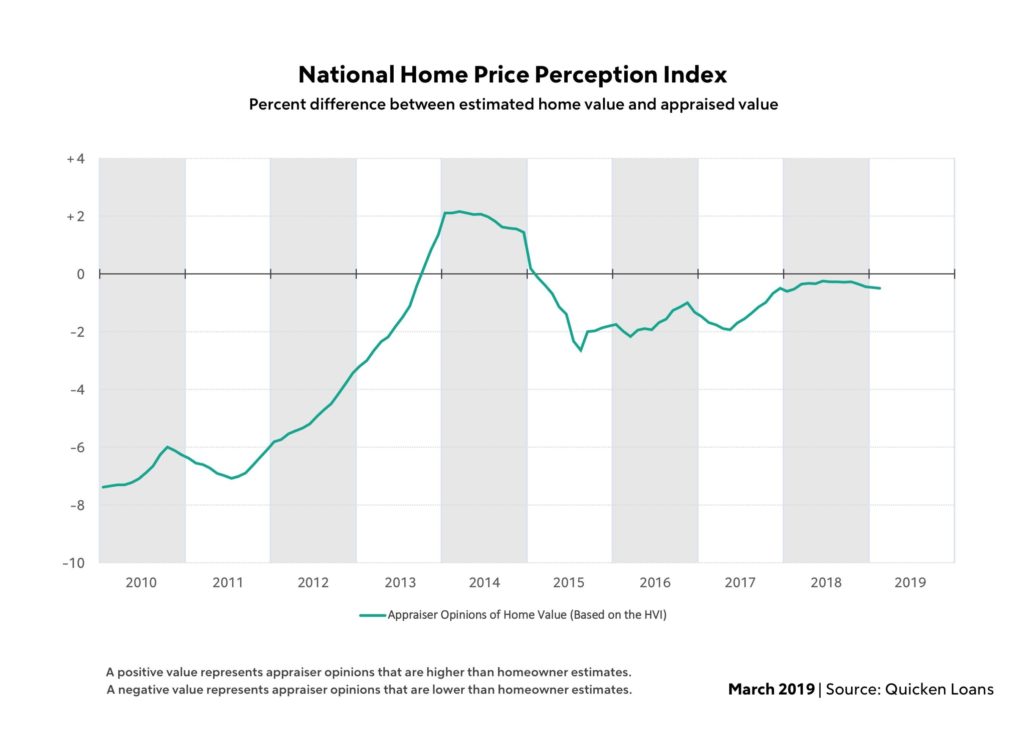

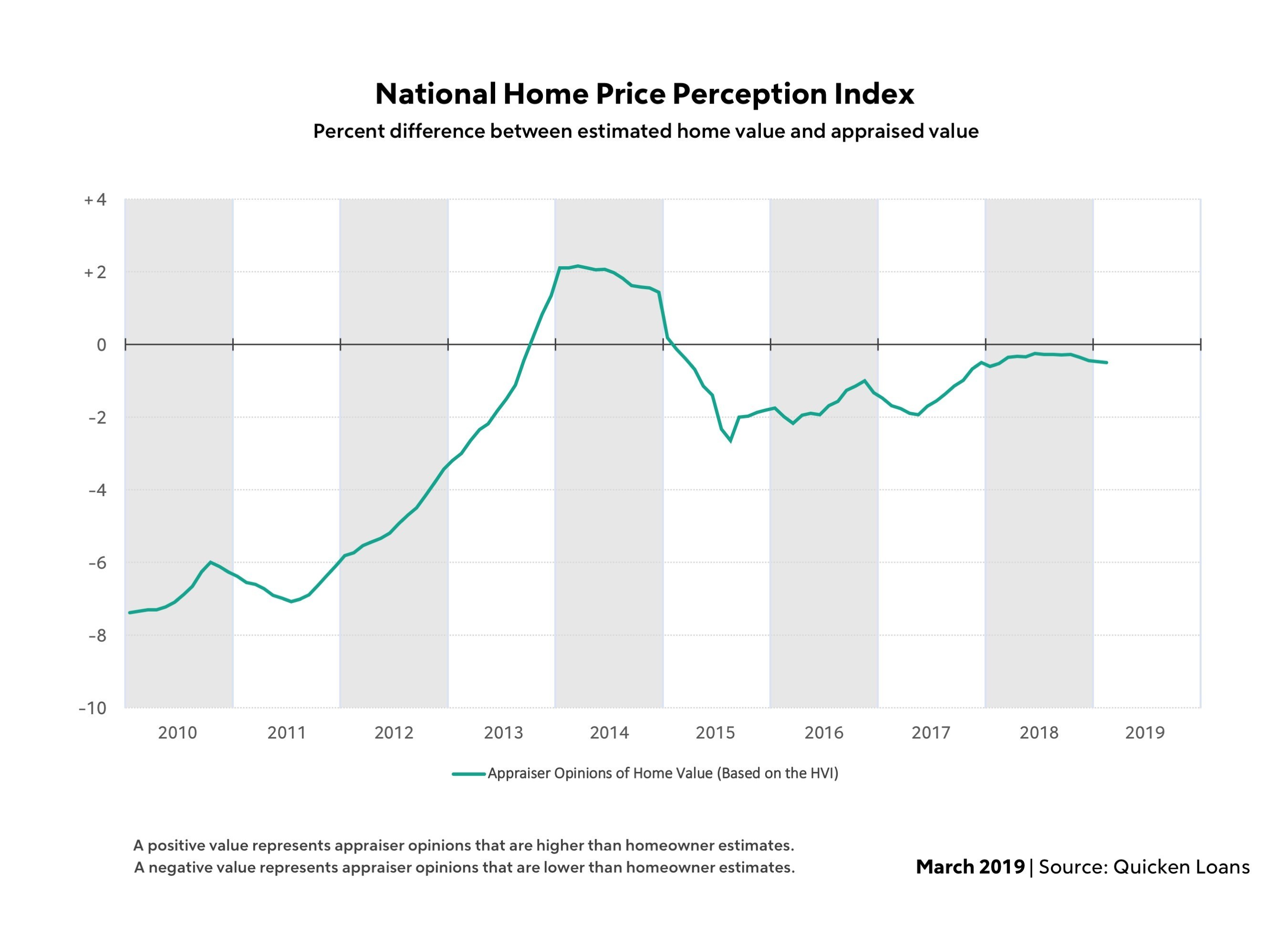

February marks the fourth consecutive month the gap between owner estimates and appraiser opinions of home value has widened, though the difference remains small at a national level.

Appraisal values in February were an average of 0.5 percent lower than what homeowners expected, according to the National Quicken Loans Home Price Perception Index. Home-value perception continues to vary at a metro level but remains in a tight band. Of the metro areas that had average appraisals lower than expected, none of them were more than 2 percent lower than the owner's estimate.

At the other side of the spectrum, Boston is the outlier with the average appraisal 2.51 percent higher than what the homeowner expected—potentially adding more than $11,000 in equity based on local median home prices.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

Charlotte follows closely behind, surprising the average homeowner with an appraisal 2.10 percent higher than what they estimated. In total, 62 percent of the metro areas are reporting average appraisals higher than expected.

"Even though the home value perceptions are declining at a national level, the majority of metro areas are getting appraisals at, or above, what the homeowner expected," said Bill Banfield, executive vice president of capital markets at Quicken Loans. "This is particularly exciting news at a time when we are seeing heightened interest in cash out refinances. More and more, owners are choosing to invest in their home by making improvements instead of moving. If appraisals are higher than expected, an owner could find it more [affordable] to do the home improvements they always had in the back of their mind."

Home values were practically frozen in the height of winter. The National Quicken Loans Home Value Index, which measures of home value changes based on appraisals, reported the average appraisal increased a mere 0.05 percent in February. Annual growth continues to be strong, with year-over-year growth of 5.47 percent--increasing at a higher clip than in January.

The regional appraisal changes are mixed.

No region saw appraisal values swinging more than half a percent in either direction. Appraisals were an average of 0.33 in the West and 0.50 in the Northeast. However, values dipped 0.25 in the Midwest and 0.56 percent in the South. On the other hand, all regions have year-over-year growth in common, from a 3.72 percent increase in the Midwest, to a 5.60 percent jump in the West.

"Home values are still making modest annual gains, despite being practically stagnant when measured monthly. What everyone has their eye on is what will happen as the spring selling season kicks off," said Banfield. "Home prices, and in turn home values, are mostly driven by the balance of how many homes are on the market and the volume of buyers vying for them. Most of the industry is expecting the demand will remain high, like in years past, but what remains to be seen is how many owners will choose to list their home, creating availability for both first time and move up buyers."

Read more...Trade Groups Urge FASB to Delay CECL

- Friday, 08 March 2019

- Lending

Nine financial services trade organizations are urging in a joint letter to the Financial Accounting Standards Board to delay implementation of its current expected credit loss standard to ensure there are no unintended consequences. Among the nine groups are CUNA and the Mortgage Bankers Association.

In response to a proposed change in implementation of CECL, CUNA filed its own comment letter.

“We believe it is important to delay implementation of CECL in order to allow for time to conduct a quantitative impact analysis and to consider potential alternatives, while allowing for post-issuance field testing,” the letter reads. “Time for further assessment will also allow regulators to better understand and address the key consequences of any proposal for capital and other regulatory purposes.”

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

CECL uses an “expected loss” measurement for the recognition of credit losses. CUNA is concerned with the effect on financial standing of credit unions and the compliance burden it is already presenting and believes the application of CECL to credit unions is inappropriate.

“While we think CECL is a well-intended effort to provide investors with better information, certain of our members—both preparers and users of such information-- have expressed concerns that the standard will have a negative impact on long-term lending, be “procyclical” and disincentivize lending particularly during economic downturns, and will exacerbate many of the hurdles to extending credit that institutions are already facing in the wake of increased capital requirements,” according to the joint letter.

The organizations state that it is important to delay implementation of CECL in order to “allow for time to conduct a quantitative impact analysis and to consider potential alternatives, while allowing for post-issuance field testing.”

Read more...

Rates Rise, Reports Freddie Mac

- Thursday, 07 March 2019

- Lending

Freddie Mac reported that mortgage rates rose after weeks of moderating, according to its “Primary Mortgage Market Survey.”

[caption id="attachment_9187" align="alignleft" width="241"] Sam Khater[/caption]

Sam Khater[/caption]

“While mortgage rates very modestly rose to 4.41 percent this week, they remain below year-ago levels for the fourth week in a row,” said Sam Khater, chief economist for Freddie Mac. “In late 2018, mortgage rates rose over a full percentage point from the prior year, which was one of the main reasons that weakness in home sales continued into early 2019. However, the impact of recent lower rates and a strong-labor market has led to a rise in purchase mortgage demand as we start the spring home-buying season.”

Other key takeaways are as follows:

- The 30-year fixed-rate mortgage averaged 4.41 percent with an average 0.5 point for the week ending March 7, 2019, up from last week when it averaged 4.35 percent. A year ago, the 30-year fixed-rate mortgage averaged 4.46 percent.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

- The 15-year fixed rate mortgage this week averaged 3.83 percent with an average 0.4 point, up from last week when it averaged 3.77 percent. A year ago, the 15-year fixed-rate mortgage averaged 3.94 percent.

- The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.87 percent with an average 0.3 point, up from last week when it averaged 3.84 percent. A year ago, the 5-year adjustable-rate mortgage averaged 3.63 percent.

.

Read more...

American Mortgage Consultants Inc. Acquires String Real Estate Information Services, LLC

- Tuesday, 05 March 2019

- Lending

American Mortgage Consultants, Inc., a leading nationwide residential and consumer loan due diligence, quality control, securitization review, MSR review, advance assessment, servicing oversight, consulting, and technology provider, has acquired String Real Estate Information Services, LLC (“String”), a leading provider of title search outsourcing services. This Strategic expansion adds title search capabilities and a variety of mortgage business process outsourcing capabilities to AMC’s core competencies.

“The combination of String’s proficiencies with the market presence, relationships, and technology of AMC will bring unique capabilities and talents for the benefit of our clients”

“The acquisition of String further enhances AMC’s ability to offer a comprehensive set of title quality control services to participants in the secondary mortgage market with the addition of title search services and other mortgage business process outsourcing capabilities,” said AMC CEO Michael Franco. “We realize that in today’s mortgage market, cost efficiency and centralization of vendor offerings are critical. Combining String’s title service offerings and labor efficiencies with AMC’s innovative technology solutions will provide comprehensive, high-quality and cost-effective solutions for AMC’s clientele.”

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

String will continue to be led by its existing senior management team, including Prashant Kothari, who will continue as its President. String has approximately 650 employees in the United States and in India. Although String will be a wholly-owned subsidiary of AMC, it will retain its separate branding.

“The combination of String’s proficiencies with the market presence, relationships, and technology of AMC will bring unique capabilities and talents for the benefit of our clients,” stated Kothari.

In addition to String, AMC acquired Meridian Asset Services, LLC in January 2019. This acquisition marks the sixth services firm acquired by AMC since December 2015. “These acquisitions, along with organic growth and IT development, allow us to support secondary market participants throughout their operations lifecycle inclusive of document hosting, transaction data rooms, rate lock and transaction management systems for managing or selling into loan aggregators, due diligence, title search and quality control reviews, broker price opinions, collateral reviews, side letter management, curative actions, REO management, servicing surveillance and quality control, and deal agent services,” stated Franco. “As the largest provider of third-party review services for private label securitization, we believe AMC is uniquely positioned to satisfy a diverse set of client needs already; however, we will continue to examine opportunities to enhance our product and technology offering depth.”

Read more...