-

The Rise of Modern Mortgage Lending: Embracing Digital Transformation Explore how digital transformation is revolutionizing the mortgage lending industry, with advancements in AI, blockchain, and user-friendly platforms enhancing the borrowing experience.

The Rise of Modern Mortgage Lending: Embracing Digital Transformation Explore how digital transformation is revolutionizing the mortgage lending industry, with advancements in AI, blockchain, and user-friendly platforms enhancing the borrowing experience.

Habits, Tricks and Traits of High Performing Loan Officers

- Tuesday, 30 April 2019

- Originating

Maxwell, a digital platform provider in the mortgage space, recently distributed an ebook entitled 14 Habits of High Performing Loan Officers that highlights the habits, tricks and traits loan offers use to increase performance levels. The ebook offers the results of Maxwell’s outreach to top-producing originators across the country to get their feedback on how they’ve reached such a high level of success. Here are some excerpts.

Establish a Consistent Process

Dave Gallegos, SVP & Banch Manager at Zenith Home Loans told Maxwell “ “The best performers follow a strictly defined sales process with a sales funnel to keep clients moving forward in their system. They are scripted with professional sales presentations and templates that are used consistently at every step. There are defined standards and systems for file quality so the customer experience is predictable.”

“The best underwriters follow strict checklists to do their work, and the best loan officers typically do as well. They originate in a very proactive working environment, rarely needing to request more documentation. Their goal is to originate loans that will be clear to close on the first submission. They know that reactive work cripples their productivity.”

Let Data Drive Your Decision Making

Let Data Drive Your Decision Making

A big problem loan officers have is misunderstanding what a lead measure is and figuring out what to track,” said Bryan Traeger, head of partnerships at Maxwell and former VP of marketing, IT, and business projects at HomeServices Lending. “Most believe an application is a lead measure for getting paid. NO — an app is a lag measure. What do you do that gets an app? Is it social media, coffee meetings with Realtors, community service? Those are what needs to be tracked to measure performance.”

Top performers know exactly how they’re performing and can pinpoint variables that they can experiment with to boost their performance. Selling is both a science and an art — the science portion dictates that you conduct data driven experiments, track your performance, and iterate as you prove (or disprove) your selling hypotheses.

[adbutler zone_id="325884" type="asyncjs1.1" ]

[adbutler zone_id="325888" type="asyncjs1.1" ]

Be Proactive

Maxwell suggests that “High-performing loan officers are proactive loan officers. They know how to maintain a pristine attention-to-detail without losing sight of the big picture. They hedge their bets. They deeply understand their borrowers, and are always equipped to provide options and sell multiple loan scenarios tailored to the borrower’s need. And if the borrower’s needs change? Top producers are agile and swift, able to accommodate without delay.

“Top producers are proactive. They look ahead. They have foresight and try to steer clear of problems before they arise. [They] make the hard sales calls first. They don’t put off the trouble customers. They take care of issues upfront so that the rest of their day is trouble free.” Too much procrastination can be dangerous in any role, but for originators, it’s particularly deadly.

Great loan officers are those who plan ahead, know their loan files inside and out, and take proactive measures to ensure they’re never surprised at what’s around the corner.

Embody Empathy

As a lender, it’s easy to get into our day-to-day grind and forget how difficult — both literally arduous and mentally anguishing — the mortgage process can be for our borrowers. Stagnant wages, rising costs of living, skyrocketing home prices, and crushing student loan debt are taking their toll on the American psyche.

In fact, the American Psychological Association found that 72% of Americans felt stressed about money in the past month, and 22% reported ‘extreme’ financial stress that impacts their quality of life. So, the average prospective borrower likely experiences at least some degree of regular financial anxiety. Add to that the fact that only 18% of buyers trust and respect salespeople and you’ve got quite a challenge ahead of you.

The quickest way to build trust and foster goodwill is to show you care more about the borrower than you do about your bottom line. Take the time to ask questions and understand their circumstances, and don’t treat them like just another name on a spreadsheet.

Click here to view the ebook in its entirety.

Read more...Bill Bodnar from Mortgage Market Guide Discusses Interest Rates

- Friday, 26 April 2019

- Originating

https://youtu.be/kkOva-YGbdA

Read more...Ask the Expert: Build a Relationship Before Answering Phone Questions

- Monday, 22 April 2019

- Originating

I keep getting the same question over the phone—what is your rate on a 30-year fixed mortgage? How do I reply in a way that will assure that I get the loan? Eddie from New Hampshire

This question goes to the crux of sales within the industry. It is so important that I may take two or three issues to answer the question—

- Telephone sales are an important factor in our industry. Everyone will have to sell over the phone at one point or another, even if the relationship starts online.

- If you are dealing with cold calls, you will find selling over the phone that much more difficult. It is difficult to develop a relationship in a five-minute conversation.

- If you choose to answer the question and do it honestly—you will typically lose the caller. That is because everyone else will be low-balling over the phone. Yet, if you low-ball to get the prospect’s attention you are setting yourself up for failure—you will never deliver more than you promised.

- If you start hitting them with qualification questions so you can give an accurate quote (such as—what is your credit score?)—you are putting them on the defensive. It is never a good idea to get personal before you have built a relationship.

[adbutler zone_id="325884" type="asyncjs1.1" ]

[adbutler zone_id="325888" type="asyncjs1.1" ]

So, what do you do? You start the relationship-building process. The most important question to start with is asking the prospect how they were directed to you. If there is any basis for a relationship already, this will quickly become evident. If they say—from the yellow pages—it is a cold call. If they say they were referred from a previous customer, you can start by inquiring about their relationship with that person, because that relationship is what you have in common.

You need to follow with letting them know that you will need some information in order to best serve them and ask their permission. Too many of us just seem to start “firing away” with such questions as “purchase or refinance?” or “what is your credit score”?

The purpose of these questions is to get them comfortable talking about their needs. What they ask you for initially may have nothing to do with their needs. It is your job to attain a comfort level, get them talking and then listen. The deeper you get, the better you will be able to determine their real needs, rather than the answer to the superficial rate question.

Dave

Dave Hershman is Senior VP of Sales of Weichert Financial and the top author in the mortgage industry. Dave has published seven books, as well as hundreds of articles and is the founder of the OriginationPro Marketing System and Mortgage School – the online choice for expert

Read more...LendingTree Survey: 61% of First-Time Homebuyers Struggling to Find Affordable Homes

- Tuesday, 16 April 2019

- Originating

Young adults are getting married later than previous generations. In 1980, the median age for men and women at their first marriage was 24.7 and 22, respectively. In 2018, the ages increased to 29.8 and 27.8, for men and women, respectively.

But this delay in marriage isn’t deterring them from homeownership, though. Almost a quarter of millennials say they are postponing marriage until after they buy a home, according to LendingTree’s latest survey.

Millennials make up the largest share of homebuyers at 37%, according to a report from the National Association of Realtors. This new LendingTree research suggests that even more of them are preparing to buy a home within the next two years.

We surveyed adults ages 22 and older who are thinking about entering the housing market to determine their attitudes and thoughts toward homebuying. Here’s a deeper look at the results.

Key findings

Nearly a quarter (24%) of millennial first-time homebuyers want to own a home before getting married.

On the flip side, this means just over 3 in 4 millennial buyers (76%) want a marriage before a mortgage. Additionally, 27% of millennial buyers are postponing parenthood until they’ve achieved homeownership. Among homebuyers of all ages, nearly 2 in 5 are waiting to get a pet until after purchasing a house.

First-time buyers often underestimate how long it takes to get to the closing table.

Misunderstandings about the mortgage closing process underscore the importance of homebuyer education. Nearly half of first-time buyers believe the mortgage closing process will take 15-30 days and about 14% believe it’ll take less than 15 days.

The average time to close is 43 days, according to data from mortgage tech firm Ellie Mae. Most mortgage closings happen within 45 to 60 days.

Additionally, just over a quarter (26%) have the required documents necessary to complete a mortgage application.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

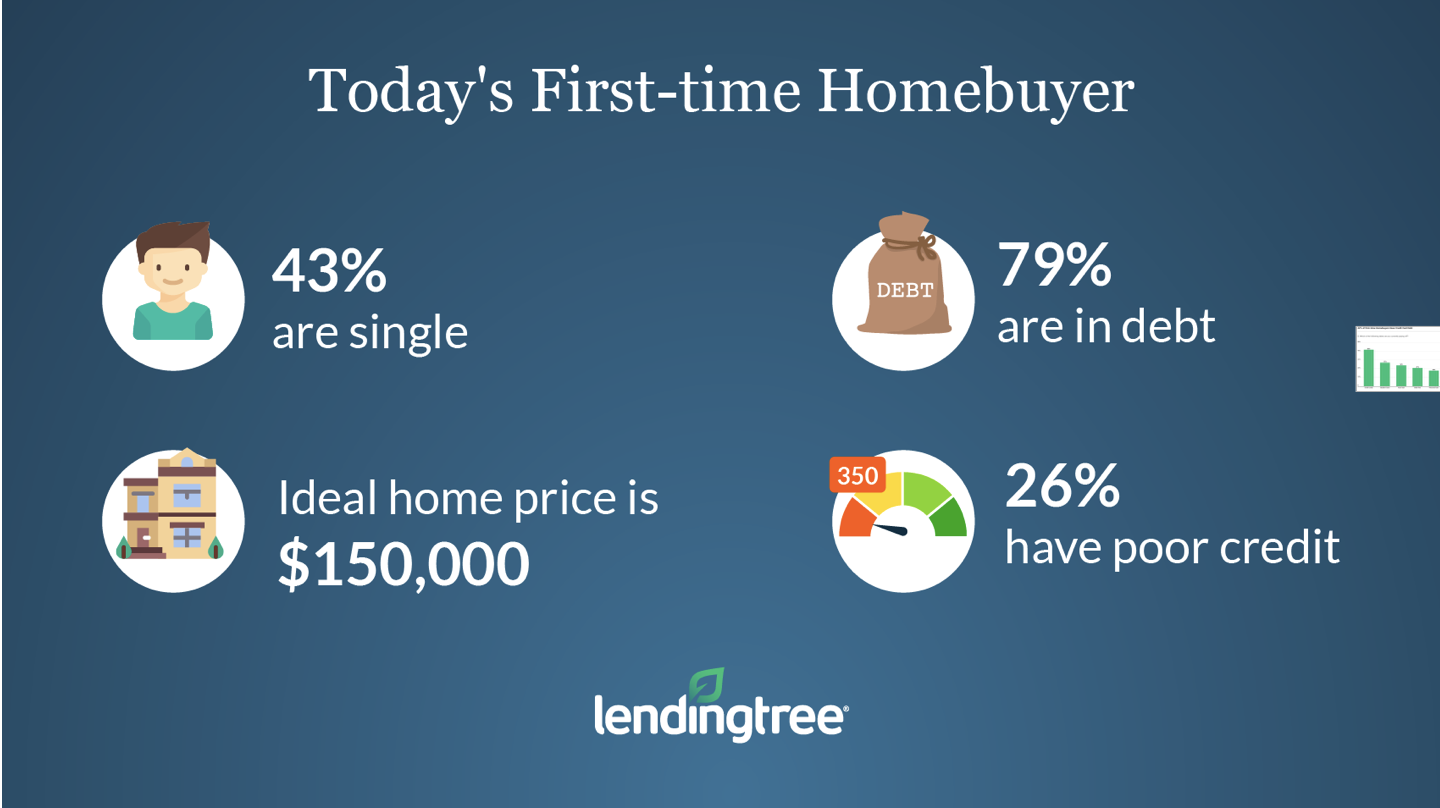

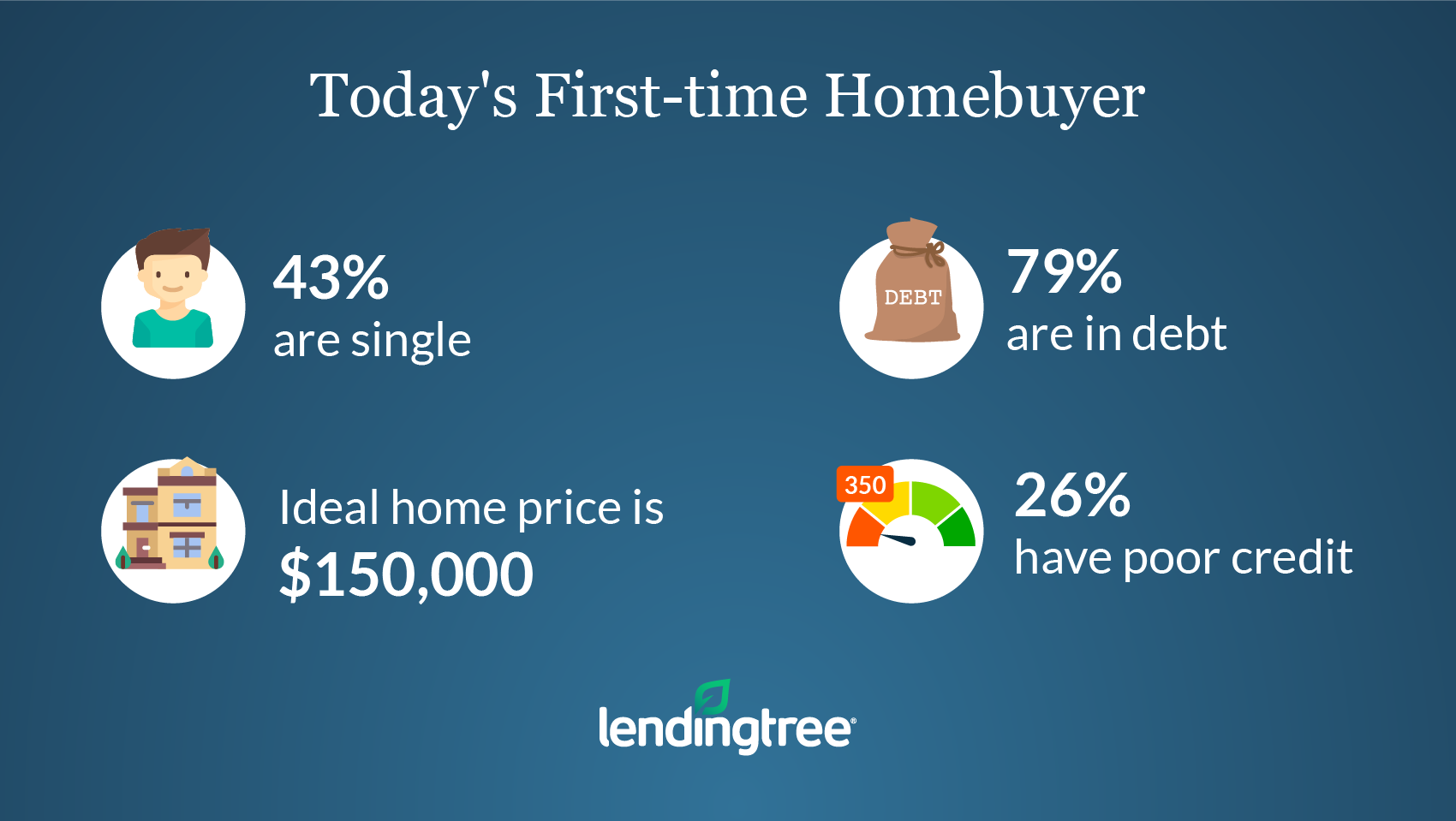

More than a quarter (26%) of first-time buyers have poor credit.

Just 15% of first-time buyers have a score of 740 or higher. Nearly 2 in 5 (38%) aren’t satisfied with their credit score, yet more than a quarter of those who are dissatisfied haven’t taken steps to improve their score. By contrast, more than 70% of repeat homebuyers are satisfied with their credit score.

Buying a home with bad credit can be difficult, but it’s not entirely impossible. For example, the Federal Housing Administration insures FHA loans for eligible homebuyers with a credit score as low as 500. However, taking the time to improve your score before applying for a mortgage will save you money in the long run.

The top two barriers to homeownership are a low income and lack of savings.

Nearly a third (32%) of first-time homebuyers say a low income has held them back from buying a home, and another 27% attribute the hold-up to not having enough savings. Other obstacles include student loan and credit card debt, as well as not being ready to commit to a mortgage and settle down in one neighborhood.

A majority of first-time buyers (61%) think there’s a shortage of homes for sale.

Nearly two-thirds of first-time buyers believe there is a shortage of affordable homes for sale in their area. This tracks with an analysis from the National Association of Realtors that reports a continued lack of housing inventory. At the end of February 2019, the latest month for which data is available, there was a 3.5-month supply of homes for sale. A six-month supply is considered a balanced market for both homebuyers and sellers.

Other takeaways

Our survey also found that today’s profile of a first-time homebuyer looks different from the profile of yesteryear. The percentage of single, first-time homebuyers is 43%, and almost half of first-timers are childless.

More than 2 in 5 (42%) first-time buyers have credit card debt. The percentage of repeat buyers with credit card debt is slightly higher at 44%. Additionally, the most stressful part of the homebuying process for nearly half of first-timers is finding a home that fits their budget.

More than 6 in 10 think mortgage interest rates are too high, which makes it challenging to stay within their budget. This is despite a downward trend in rates over the last few months. The average 30-year fixed-rate mortgage was 4.51% in early January 2019 and has since dropped to 4.12% as of April 11, according to Freddie Mac’s Primary Mortgage Market Survey.

Most first-time buyers want a home with a sticker price of $150,000 or less, and nearly 85% would consider purchasing a fixer-upper to cut costs.

We also found that 46% of first-time buyers plan to live in their home for at least 16 years.

Read more...