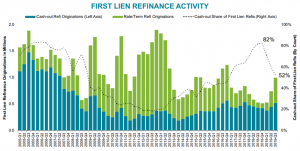

The bulk of that increase was driven by people refinancing to improve the rate or term on their current mortgage, with five times the number of rate/term refinances as in Q4 2018.

“After hitting an 18-year low in the fourth quarter of 2018, refinance lending has nearly doubled since then,” says Ben Graboske, Black Knight Data & Analytics President. “The bulk of that increase was driven by people refinancing to improve the rate or term on their current mortgage, with five times the number of such rate/term refis as there were in Q4 2018."

Cash-outs were up too (a much more modest 24% over Q4 2018), but still made up 52% of Q3 refinances, with homeowners withdrawing more than $36 billion in equity via cash-out refinances, the highest amount in nearly 12 years. Also, keep in mind that any upward movement in rates would likely drive the cash-out share of refi lending higher.

Despite all that new refinance business, servicer retention rates suffered. Just 22% of borrowers stayed with their servicer post-refinance in Q3. Even when looking specifically at rate/term refis–historically easier business for servicers to retain–servicers lost the business of nearly three out of four (74%) of these borrowers. But even that is better than the 81% of cash-out refi borrowers whose business servicers lost post-refinance.

In Q1 and Q2 2019, vintage borrowers accounted for one of every five refis. As of Q3, that share bumped up to nearly a third of all refinance originations. And while retention of 2018 borrowers is the best of any vintage, retention dropped from 35% in Q1/Q2 to just 30% in Q3.

YTD 2019 Vintage Loans Now Make Up 17% of the Total Active Mortgage Market

The data also showed that borrowers' motivations for refinancing are anything but uniform.

Newer-vintage borrowers (2017-2019) tend to carry much higher balances and are primarily refinancing to cut their rates. On average, 2018 vintage borrowers had pre-refinance balances of $380K; early-2019 loans had balances of $560k. Just 18% and 21% of these folks (respectively) withdrew equity–as compared to 52% in the market as a whole.

On the other hand, homeowners refinancing out of 2008-2011 vintages had much smaller average balances ($160K-$172K), but more than 80% of those refis were cash-outs.