The Urban Institutes published its Monthly Chartbook for April. The data showed that a lot of loans are "in the money" when it comes to refinancing. This indicates that the increase in refinancing that that has been seen in the first quarter might be likely to continue.

According to Urban Institute "Freddie Mac’s benchmark primary mortgage market survey (PMMS) rate stood at 4.17 percent in mid-April, 2019 down significantly from nearly 5 percent in November 2018. For the majority of 2018, the PMMS rate was well above 4 percent. The most immediate implication of falling interest rates is that eligible borrowers who received a mortgage in 2018 and YTD 2019 can now save money by refinancing. Moreover, if rates stay here more borrowers will be able to refinance in the coming months, as they pass the required seasoning period. That is, to refinance a government mortgage, Ginnie Mae requires that a minimum of 210 days elapse between the first payment on the existing mortgage and the issuance of a new mortgage, as well as at least six months of payments.

The GSEs have no seasoning requirement on rate/term refinances, but some lenders do require it. Cash out refinances require that the property have been owned for a minimum of six months for conventional mortgages. How many of these borrowers actually end up refinancing will determine prepayment speeds for mortgage-backed securities in the coming months.

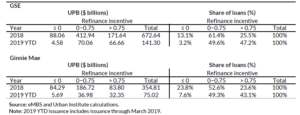

By comparing the interest rate on recently originated loans to current interest rates, we create a measure for “refinance incentive”, and can size the population of borrowers that could benefit from refinancing. Since 2018, Fannie Mae, Freddie Mac, and Ginnie Mae collectively issued $1.2 trillion in mortgage-backed securities. Approximately 85 percent, or $1.1 trillion of these loans have interest rates that are above the current PMMS rate.

However, this does not make it economical for all of these borrowers to refinance, due to both the costs and “hassle factor” of obtaining a new mortgage.

We use 75 basis points as a threshold for loans that are “in the money”-where borrowers are willing to refinance. The threshold is actually different for different borrowers, some may require less, others more.

This equates to $354 billion, or approximately 29 percent of 2018 and 2019 YTD issuance, not accounting for seasoning requirements.

Just over a quarter of GSE issuance in 2018 is now in the money; for Ginnie Mae, just under a quarter of issuance is in the money. The share is higher for 2019 YTD issuance, standing at 47.2 percent for the GSEs and 43.1 percent for Ginnie Mae.

These estimates are measured at a point in time, and are sensitive to movements in mortgage rates. If rates continue to increase, as they have been in recent weeks, the volume of loans in the money will shrink. If rates decrease again, the volume will increase."