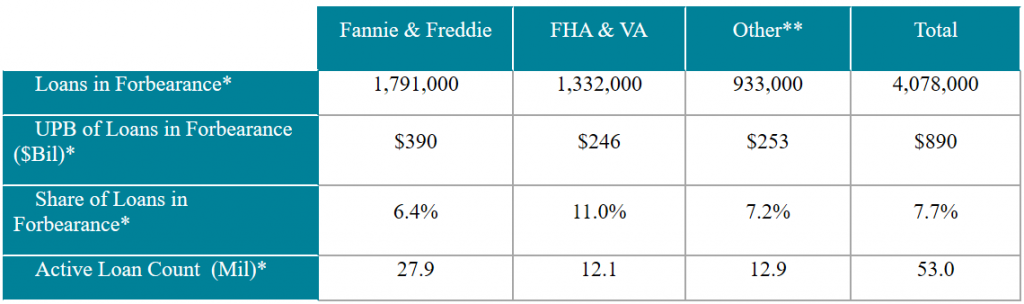

!--more--> At today’s levels, mortgage servicers need to advance a combined $4.5 billion per month to holders of government-backed mortgage securities on COVID-19-related forbearances. Another $2.1 billion in lost funds will be faced each month by those with portfolio-held or privately securitized mortgages (some 7.2% of these loans are in forbearance as well).

At today’s levels, mortgage servicers need to advance a combined $4.5 billion per month to holders of government-backed mortgage securities on COVID-19-related forbearances. Another $2.1 billion in lost funds will be faced each month by those with portfolio-held or privately securitized mortgages (some 7.2% of these loans are in forbearance as well).

Remember, FHFA has said that P&I advance payments will be capped at four months for servicers of GSE-backed mortgages. Given today’s number of loans in forbearance, servicers of GSE-backed loans face $8 billion in advances over that four-month period. There is no such cap on the additional $800 million in monthly T&I advances.