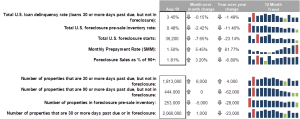

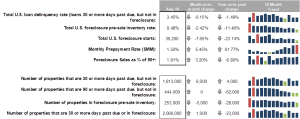

Likewise, the number of loans in active foreclosure continued to improve as well. At 253,000, that population is now the smallest it’s been since 2005.

Likewise, the number of loans in active foreclosure continued to improve as well. At 253,000, that population is now the smallest it’s been since 2005.

In the latest sign of lower interest rates’ impact on the market, prepayments increased by 5% from July to reach a three-year high. In fact, August’s prepayment rate was up 62% from the same time last year and 2.5 times the 18-year low we hit back in January.

Keep in mind that, given a 30-45 day closing window, August prepayment activity reflects June/July interest rates. Rates didn’t fall to their most recent lows until August and September, which means the peak in refinance-driven prepayments is likely still to come.

Black Knight will provide a more in-depth review of this data in its monthly Mortgage Monitor report, set for release on Oct. 7. The report, which will be available online at https://www.blackknightinc.com/data-reports/, will include an analysis of data supplemented by detailed charts and graphs that reflect trend and point-in-time observations.