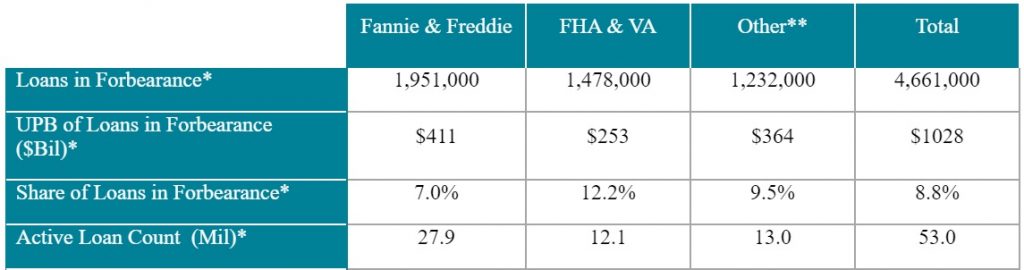

As of June 9, 4.66 million homeowners remain in forbearance plans, representing 8.8% of all active mortgages. That’s down from 8.9% last week. Together, the 4.66M represent just over $1 trillion in unpaid principal ($1,028B).

As of June 9, 4.66 million homeowners remain in forbearance plans, representing 8.8% of all active mortgages. That’s down from 8.9% last week. Together, the 4.66M represent just over $1 trillion in unpaid principal ($1,028B).

Some 7% of all GSE-backed loans and 12.2% of all FHA/VA loans are currently in forbearance plans. GSE loans saw the greatest reduction, with forbearances falling by 47,000 week-over-week, but decreases were seen across all investor classes. Last week saw a decline among government-backed mortgages partially offset by a rise in portfolio and PLS mortgages.

At today’s level, mortgage servicers need to advance a combined $3.5 billion/month to holders of government-backed mortgage securities on COVID-19-related forbearances. That’s on top of the $1.5 billion in T&I payments they must make on behalf of borrowers.