-

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

matt

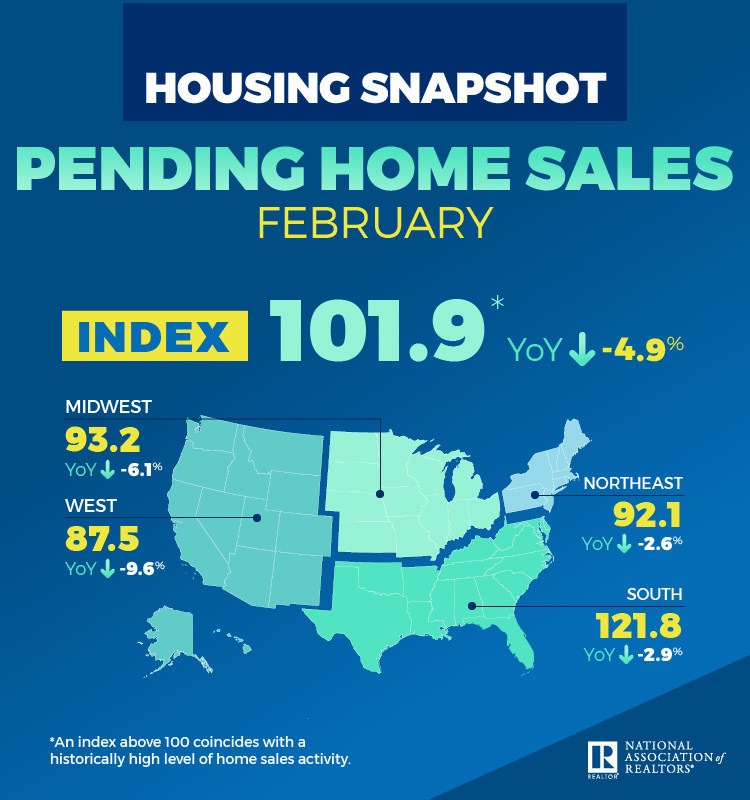

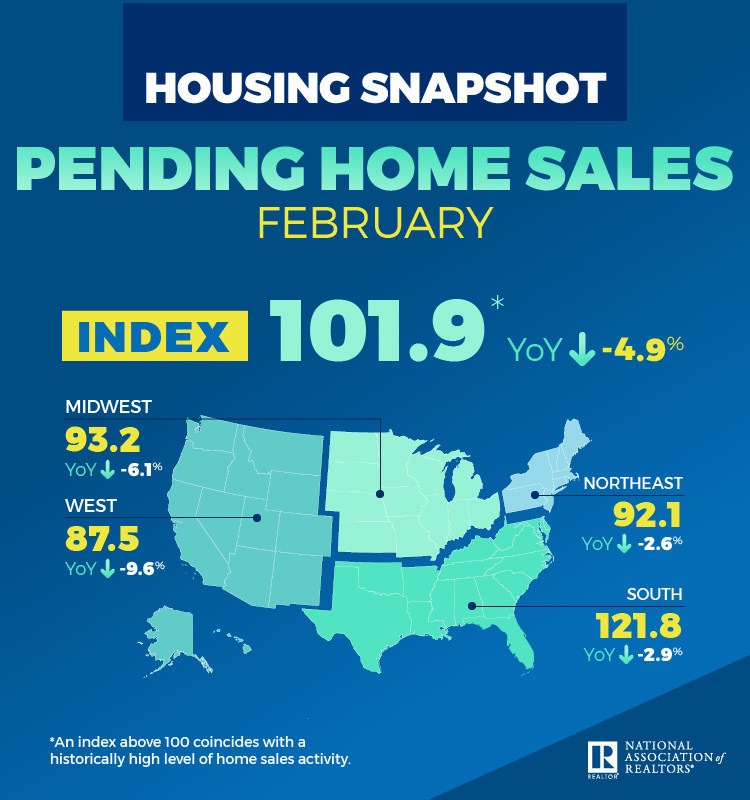

Pending Home Sales Dropped in February

- Friday, 29 March 2019

Pending home sales suffered a minor drop in February, according to the National Association of Realtors. On a regional basis, the South and West saw a bump in contract activity and the Northeast and Midwest reported slight declines.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 1.0 percent to 101.9 in February, down from 102.9 in January. Year-over-year contract signings declined 4.9 percent, making this the fourteenth straight month of annual decreases.

Although pending home sales declined in February, in the same time period one month earlier sales reported a solid gain. "In January, pending contracts were up close to 5 percent, so this month's 1 percent drop is not a significant concern," said Lawrence Yun, chief economist at NAR. "As a whole, these numbers indicate that a cyclical low in sales is in the past but activity is not matching the frenzied pace of last spring."

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Despite the growth in the West, the region's current sales are well below the sales activity from the same time period one year earlier. "There is a lack of inventory in the West and prices have risen too fast. Job creation in the West is solid, but there is still a desperate need for more home construction," said Yun.

[caption id="attachment_11413" align="alignleft" width="327"] Pending Home Sales for February[/caption]

Pending Home Sales for February[/caption]

There markets with the largest increase in active listings compared with a year ago are as follows: Denver-Aurora-Lakewood, Colo.; Seattle-Tacoma-Bellevue, Wash.; San Diego-Carlsbad, Calif.; Portland-Vancouver-Hillsboro, Ore.-Wash.; and Nashville-Davidson-Murfreesboro-Franklin, Tenn.

Yun doesn’t anticipate any interest rate increases from the Federal Reserve in 2019.

"If there is a change at all, I would say the Fed will lower interest rates in 2019 or 2020. That would stimulate the economy and the housing market," Yun said. "But the expectation is no change at all in the current monetary policy, which will help mortgage rates stay at attractive levels."

Yun expects existing-home sales this year to decrease 0.7 percent to 5.3 million, and the national median existing-home price to increase around 2.7 percent. Looking ahead to 2020, existing sales are forecast to increase 3 percent and home prices are also around 3 percent.

The Pending Home Sales Index in the Northeast declined 0.8 percent to 92.1 in February and is now 2.6 percent below a year ago. In the Midwest, the index fell 7.2 percent to 93.2 in February, 6.1 percent lower than the same time period one year earlier.

Pending home sales in the South inched up 1.7 percent to 121.8 in February, which is 2.9 percent lower compared to this time last year. The index in the West increased 0.5 percent in February to 87.5 and fell 9.6 percent below a year ago.

Read more...

Mid American Mortgage Conducting Online Notarizations

- Friday, 29 March 2019

Mid America Mortgage is now using NotaryCam’s integration with DocMagic Inc., a provider of fully-compliant loan document preparation, to conduct remote online notarizations through DocMagic’s Total eClose platform. Mid America will leverage the integration throughout its retail, correspondent and wholesale channels.

“Since 2016, Mid America’s strategy has been digital first. As a result, we have been able to condense our application-to-closing time down to just two weeks and our closing ceremony to 30 minutes or less with our digital mortgage product Click n’ Close,” said Mid America’s CEO Jeff Bode. “Remote online notarizations allows us to double down on our closing efficiency while also providing additional convenience to our customers. The addition of NotaryCam’s remote notary services through our established eClosing partner DocMagic enables us to extend the value we’ve experienced to date through our digital mortgage strategy.”

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

According to NotaryCam, the company has completed more than 160,000 remote online notarizations transactions for individuals located across the U.S.

“Until recently, mortgage closings still required participants to physically congregate in a single location to complete the transaction. Today, remote online notarization enables lenders and settlement agents to eliminate the closing table without losing the personal connection of the closing ceremony,” said NotaryCam’s founder and CEO Rick Triola. “The value of the convenience that remote online notarization provides cannot be overstated, and it would behoove mortgage and settlement professionals to incorporate RON into their existing closing process.”

Total eClose is DocMagic’s comprehensive end-to-end eClosing solution. The integration with NotaryCam allows Mid America Mortgage and Click n’ Close to eNotarize documents remotely using NotaryCam’s remote online notarization service, eliminating the need for home buyers and sellers to physically appear before a notary to wet-sign loan documents.

“We continue to focus on implementing seamless digital closing solutions for our customers,” stated Dominic Iannitti, president and CEO of DocMagic. “Mid America’s accelerated processes highlight the benefits DocMagic delivers for both lenders and borrowers. The added efficiency of NotaryCam’s remote online notarization solution is the logical next step and a key component to achieving 100% paperless eClosing transactions.”

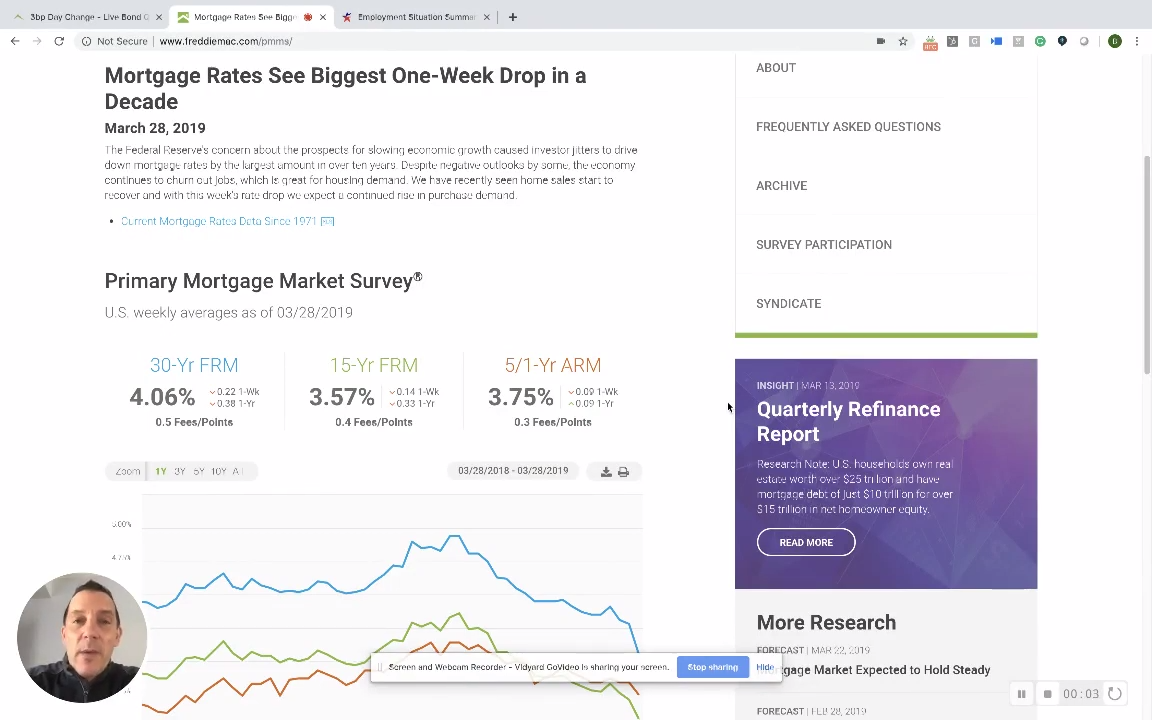

Read more...Mortgage Rates Have Largest One-Week Drop in a Decade

- Thursday, 28 March 2019

https://youtu.be/gchIC9xNux0

Hi, it’s Bill Bodnar from the Mortgage Market Guide, and thanks for tuning in to our weekly recap.

So up on the screen some good news came out on Thursday.

That mortgage rates had their biggest one-week drop in a decade, and that coincided with that breakout. You know we've been talking about how the 10-year note has seen support at 260.

Goodness, when the yield finally punched through 260, we've seen to 230s in the middle of the week. Pretty remarkable. And it's something we've seen over and over when these barriers are broken—how bonds can really take off.

So that's what happened this past week, so really interesting. I think you know some of the fuel to this decline in rates, and raising prices, was this economic slowdown that's not only a concern abroad. It’s well documented what's going on in Europe and negative yields in Germany's 10-year bonus is yielding you know beneath zero--which is just really remarkable.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

But you know some of that slowdown was even kind of showing here in the U.S. And so what was the real catalyst was that in the middle of the week Steven Moore, who's been nominated to the Federal Reserve. He said if he gets on the Fed they’re going to vote to cut rates by 50 basis points, which is pretty remarkable, and a real departure from where the Fed was just last year.

You may recall back in the fall there was a lot of volatility right. Where the stock mark was declining significantly, and the bond market was kind of rallying a little bit. Because the Fed said, “Hey, we're going to hike rates three times in 2019, regardless of what the data shows.”

And so boy did they back off of that. Not only are they not hiking rates in 2019, but they came out and said that there's a 75% chance they will actually cut rates this year, which is just remarkable. And just shows the change how things changing while you need to be watching this stuff closely because it does move.

We were having a tough time at these ceilings; we broke out above it and this doesn't look like much in a two-year chart, but that's a pretty material price move. That's why we have seen the sharpest decline in rates in a decade.

Because it was a breakout above a ceiling, prices are at levels we haven't seen in 14 months, which is beautiful. There's a lot of complacency, especially in the bond market, but that can change quickly. It's almost like a rubber band being wound tight, eventually it kind of snaps.

So we need to watch, especially after our rally in bond market.

With an extended bond market rally, there can be a turnaround, and it can reverse quickly, so there are some headline risk events happening this week that you need to be reminded of. But you need to be thinking that we’ve got retail sales Monday. So right out

of the gate retail sales comes up, but then you can see here up on the screen we have the Bureau of Labor Statistics. They report the jobs report next Friday.

Now the previous jobs report was a stinker, only 20,000 jobs created. You could probably get a good bet that will be upgraded, or it will be revised higher. But there are some other readings within the report that can create a surprise and negative surprise that bonds can react: One is hourly earnings are currently running at three to four percent year-over-year, the highest in a decade.

If that ticks up higher because of this tight labor market we're seeing, you know the bond market may react negatively to that, so we need to watch that one carefully.

Read more...