Regardless of a borrower’s forbearance status, servicers of loans in government-backed securities must make advance principal and interest (P&I) payments each month for these loans.

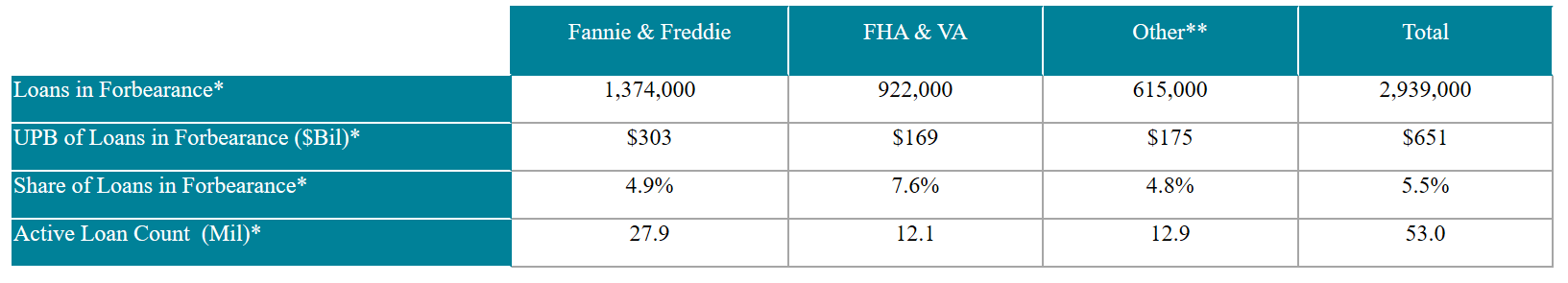

At today’s level, mortgage servicers would need to advance $2.3 billion a month to holders of government-backed mortgage securities on COVID-19-related forbearances. Another $1.1 billion in lost funds will be faced each month by those with portfolio-held or privately securitized mortgages (nearly 5% of these loans are in forbearance as well).

At today’s level, mortgage servicers would need to advance $2.3 billion a month to holders of government-backed mortgage securities on COVID-19-related forbearances. Another $1.1 billion in lost funds will be faced each month by those with portfolio-held or privately securitized mortgages (nearly 5% of these loans are in forbearance as well).

While Ginnie Mae has announced a pass-through assistance program through which it will advance principal and interest payments to investors on behalf of servicers, at present there is no such program in place for mortgages backed by the GSEs.

Due to the significant impacts the COVID-19 pandemic is having on the U.S. mortgage market, Black Knight has begun tracking loan-level forbearance data on a daily basis through its newly introduced McDash Flash data set.

Leveraging its loan-level mortgage data and proprietary analytics, Black Knight has created the high-level McDash Flash Forbearance Tracker report, which will be made available to all Black Knight MSP servicing clients and McDash loan-level performance data set contributors on a daily basis beginning this week.

Additionally, multiple government agencies and the government sponsored enterprises (GSEs) will be able to receive these updates as well. Deeper insights, including industry aggregate, custom reporting and daily loan-level performance data will be offered.

“In these times, it is essential to both our industry and for the benefit of the entire U.S. economy to have a clear understanding of the magnitude of the mortgage forbearance situation,” said Black Knight CEO Anthony Jabbour.

McDash Flash Solutions are built leveraging daily loan-level dynamic mortgage servicing data. These solutions can be used to track forbearance, originations, late or delayed payments, delinquency, foreclosure, loss mitigation workouts, as well as voluntary and involuntary runoff. Like McDash Primary data, McDash Flash data is anonymous and does not contain any nonpublic personal information (NPI) or personally identifiable information (PII).

For contributing servicers, however, McDash Flash data can be benchmarked and/or extrapolated for a full market picture. As of April 16, 2020, the McDash Flash Forbearance Tracker found the following:

Black Knight will continue to provide weekly McDash Flash Forbearance Tracker updates via Vision, the Black Knight blog.

Black Knight will continue to provide weekly McDash Flash Forbearance Tracker updates via Vision, the Black Knight blog.