-

Yieldstreet Buys Real Estate Investment Platform Cadre Alternative investment platform Yieldstreet has announced a deal to acquire real estate crowdfunding platform Cadre. So reports Finovate.

Yieldstreet Buys Real Estate Investment Platform Cadre Alternative investment platform Yieldstreet has announced a deal to acquire real estate crowdfunding platform Cadre. So reports Finovate.

First American Enhances Collateral Inspections with Mobile Tools

- Monday, 18 March 2019

- Lending

First American Mortgage Solutions LLC has upgraded its collateral inspection services with mobile-enabled technology.

“Valuations, like all other aspects of the mortgage lifecycle, are becoming increasingly modernized and technology-driven,” said Kevin Wall, president at First American Mortgage Solutions. “With our enhanced mobile and data delivery capabilities, we’re helping lenders and valuation professionals stay ahead of the changes and evolving inspection landscape.”

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

The enhancements include the following:

- New mobile inspection application: The new application offers enhanced mobile data capture, image and sketch options with an intuitive workflow that delivers dynamic data collection. The application works with multiple products in a collaborative environment.

- New collateral inspection portal connects appraisers and inspectors to appraisal management companies, lenders and investors, enabling efficient collaboration and data delivery. The technology allows quality control to take place much earlier in the inspection process, resulting in efficiency gains for lenders and an improved consumer experience.

- Trained, vetted national staff and panel inspection services are trained to use the latest technologies to deliver the evolving types of inspections as a result of appraisal modernization.

[caption id="attachment_11056" align="alignright" width="159"] Kevin Wall[/caption]

Kevin Wall[/caption]

“This investment in technology further strengthens our decades of inspection experience by continuing to reduce turn-times, improve the customer experience and enhance quality. We’re 'inspection ready' for all of our customer needs,” said Wall.

Read more...

A Significantly Improved Appraisal Process Has Reduced the Riskiness of Refinance Mortgages

- Friday, 15 March 2019

- Lending

By Laurie Goodman and Jun Zhu

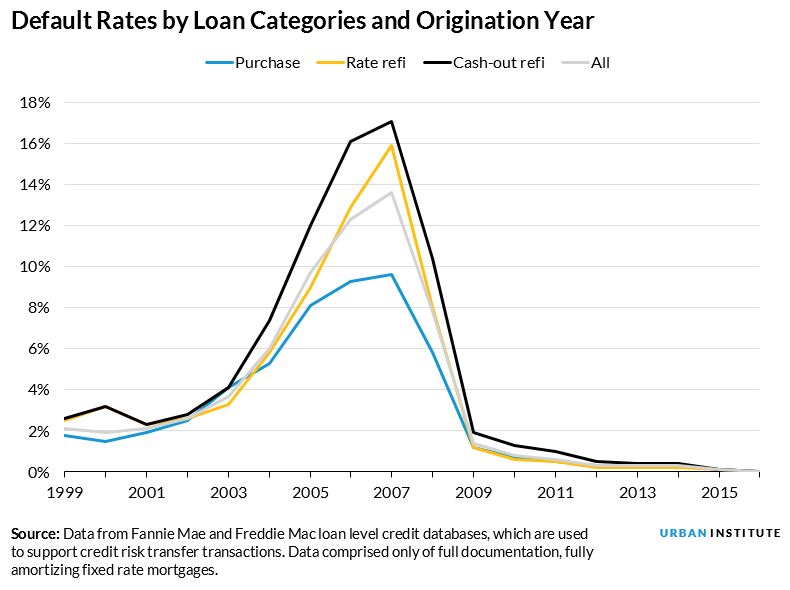

Historically, purchase mortgages have performed better than refinance mortgages, or “refis,” defaulting less often. But changes made in response to widespread appraisal bias during the crisis have improved the industry’s risk assessment and management abilities overall and, accordingly, have decreased the expected default rate on all mortgages.

We looked at the data and concluded that these improvements have reduced the difference in how purchase and refi mortgages perform. And while the models used in FHA, Fannie and Freddie underwriting systems are not public, our results suggest an update may be in order.

Reducing appraisal bias

The pervasive belief that appraisal bias, especially towards no-transaction refinances, was a significant contributor to the great financial crisis lead to a significant re-evaluation of the appraisal process after the crisis. Appraisals undergo much greater scrutiny today, and the GSEs commonly check these numbers against values generated from automated valuation models (AVMs). AVMs use mathematical modeling, drawing on a huge database of recent transactions, complete with property characteristics, to generate an estimated sales prices.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

This increased scrutiny has made for more accurate appraisals and the AVMs have enabled Fannie Mae and Freddie Mac to share concerns with lenders about an appraisal prior to the execution of a mortgage, allowing the lender to take corrective action.

It was predicted that these developments would decrease the expected default rate on all refinanced mortgages, which were particularly susceptible to appraisal fraud. The data reveals that this has indeed been the case.

The performance of refis versus purchase mortgages

We examined the characteristics of three broad categories of mortgages:

- Purchase mortgages, which are obtained when a buyer purchases a home

- Rate and term refinance mortgages, which are obtained when a homeowner wants to refinance their home to take advantage of lower rates or to change the length of the mortgage

- Cash-out refinance mortgages, which are obtained when a homeowner wants to tap the equity that has accrued in their home

In an earlier paper, we showed that the risk characteristics of these mortgages—things like loan-to-value ratios (LTV), credit (FICO) scores, debt-to-income (DTI) ratios, and the percentage of owner-occupied loans—did not match the actual performance or default of these mortgages. The loan characteristics indicated that rate and term mortgages would default the least and that cash-out and purchase mortgages should default at about the same rates. But in reality, purchase mortgages defaulted the least, followed by rate and term refis, and then cash-out refis, which defaulted the most.

In other words, the rate and term refinance is riskier for a lender than a purchase mortgage, and a cash-out refinance is the riskiest of all.

But this has been changing (see figure above). The differential between rate and term refinances and purchase loans has been narrowing. This change is exactly what we would expect: as appraisals have become more reliable and AVM models have improved, LTV ratios have become more accurate, and the default differentials have narrowed.

Using regression analyses, we were able to examine the difference in risk characteristics in 2000 to 2009 loans and 2010 to 2017 loans. We learned that the rate and term refinances were 51 percent riskier than purchase loans in the first period but only 11 percent riskier in the more recent period. Cash-out refinances were 96 percent riskier than purchase loans in the earlier period and 55 percent riskier in the more recent period.

In other words, our analysis showed that while the loan characteristics still suggested that cash-out refinance mortgages would be the riskiest and purchase mortgages the least risky, the relative riskiness of the loans had narrowed.

Why do the different default rates between purchase and refinance loans matter?

The GSEs (though Fannie Mae’s Desktop Underwriter and Freddie Mac’s Loan Prospector) and FHA (though is Scorecard) decide which loans to approve using model based inputs on the riskiness of a given set of loan characteristics. Our results suggest that there has been a structural change in the systems which has lowered defaults, especially on refinance loans, and a recalibration of existing models may be order.

Secondly, knowing the default rates for these loans has implications for the proposed capital standards for the GSEs when they emerge from conservatorship (and it has implications for pricing in the interim). Their analysis looks at historical data to determine capital requirements. The standards, as they are currently proposed, require a 1.3 times premium for rate and term refinances and a 1.4 times premium for cash-out refinances.

Our results suggest that the cash-out refinance premium may be fair or a bit low and that the rate and term premium is too high.

A closer look at our methodology

We control for the factors that could drive defaults: LTV ratios, FICO scores, DTI ratios, interest rates, loan balances, and indicators for single-family, owner-occupied, and issue years. We also include an indicator for rate and term refinances and another indicator for cash-out refinances. Purchase loans are served as the reference category.

About the Authors:

Laurie Goodman is a vice president at the Urban Institute and codirector of its Housing Finance Policy Center, which provides policymakers with data-driven analyses of housing finance policy issues that they can depend on for relevance, accuracy, and independence.

Jun Zhu is a senior research associate in the Housing Finance Policy Center at the Urban Institute. She designs and conducts quantitative studies of housing finance trends, challenges, and policy issues.

HELOC Customers Crave Alternative Funding Sources, Digital Offerings

- Thursday, 14 March 2019

- Lending

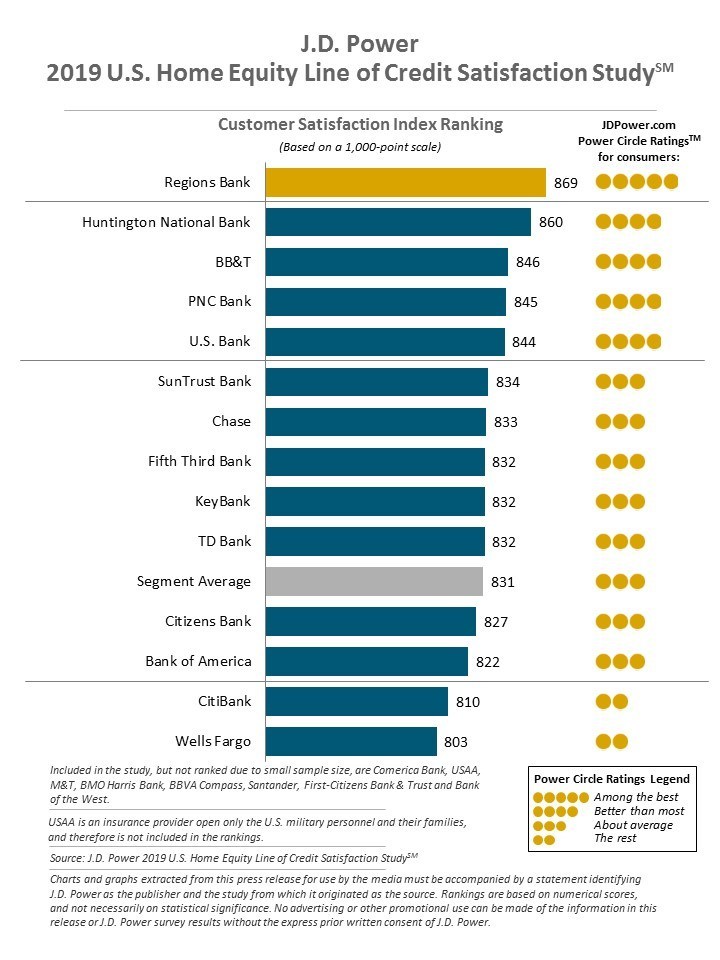

HELOC customers are more likely than ever to shop for alternative sources of funding and lenders are falling short on digital offerings, according to the “J.D. Power 2019 U.S. Home Equity Line of Credit Satisfaction Study.”

"HELOC providers have a privileged position in the consumer lending space by virtue of the relationships they already have with home loan customers, but they cannot afford to rely on those relationships alone to generate new originations," said John Cabell, Global Business Intelligence Practice Leader at J.D. Power. "Customers are being wooed by increasingly sophisticated competitors. Right now, HELOC providers are struggling to deliver digital experiences that are in line with customer expectations. That is becoming a major drag on future business as new, digital-native competitors enter the marketplace."

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

Following are key findings of the 2019 study:

- Alternative lenders pose bigger threat:Two-thirds of new HELOC customers who obtained their line of credit within the past two years considered alternative products when shopping for their HELOC, a figure that is up from 41% just a few years ago. Likewise, younger HELOC customers (under 40 years old) are far more likely to consider alternative products. On average, these customers consider 2.5 different loan products, including personal loans, credit cards and cash advances.

- HELOC providers missing the mark on digital:Despite rising use and satisfaction with digital channels in virtually every other aspect of retail banking, satisfaction is lowest among HELOC customers who gather information entirely online (819 on a 1,000-point scale) vs. those who gather information in person or via phone only (836) and those who used both online and in-person channels (864).

- Concerns about interest rates, overextending debt drive shopping behavior:Customers concerned about opening a HELOC are significantly more likely to consider HELOC alternatives. The most common concerns among those who shop for alternatives are variable interest rates, overextending debt and higher payment after draw period.

- Long-term HELOC customers less engaged than new customers:Existing HELOC customers who have had their line of credit for more than two years are notably less satisfied with their lender than are new customers. Longer-term customers also have lower levels of product understanding and awareness of offerings. Satisfaction increases the more engaged the HELOC customer is with their lender.

"There are some very obvious areas where HELOC providers could make tremendous improvement by taking certain steps," said Cabell. "One of the easiest is alleviating customer concerns during the shopping process by publishing clear information on their website about interest rates and payment schedules."

The U.S. Home Equity Line of Credit Satisfaction Study, now in its second year, measures overall customer satisfaction with the HELOC process and explores the key variables that influence customer choice, satisfaction and loyalty based on six factors: offerings and terms; application/approval process; closing; interaction with the lender; billing and payment; and post-closing and usage.

Read more...Lenders Profit Margins Improve, Stronger Demand Seen as the Reason

- Wednesday, 13 March 2019

- Lending

The net profit margin outlook for mortgage lenders, while still negative, improved significantly in the first three months of 2019, due to stronger demand expectations for purchase and refinance mortgages, according to Fannie Mae's first quarter 2019 Mortgage Lender Sentiment Survey.

[caption id="attachment_9271" align="alignleft" width="352"] Doug Duncan[/caption]

Doug Duncan[/caption]

"Lenders appear less pessimistic regarding mortgage demand expectations; thus their profit margin outlook over the next three months is also slightly improved," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "While the results seem to portray the gloomiest picture of purchase mortgage demand during the prior three months in the survey's five-year history, the net share of lenders expecting rising demand over the next three months exceeded the level recorded in the same quarter last year. Lenders' view of the refinance market was somewhat rosier, as both recent and expected demand improved to the best showing in two years, helping to support lenders' improved profit margin outlook."

Additional highlights from the survey are as follows:

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

- For purchase mortgages, across all loan types (GSE eligible, non-GSE eligible, and government), the net share of lenders reporting demand growth over the prior three months remained negative and fell further to reach a new survey low. However, demand growth expectations for the next three months improved, showing a more optimistic outlook compared with one year ago.

- For refinance mortgages, while more lenders continued to report weaker refinance demand than those seeing rising demand, the net share of lenders reporting demand growth over the prior three months increased significantly to the highest level in two years across all loan types. Similarly, the net share expecting demand growth remains negative but also improved to the highest level in two years.

- Overall, lenders on net continued to report easing lending standards at a modest pace across all loan types.

- For GSE eligible loans, the share reporting easing lending standards for the prior three months was only slightly above the share reporting tightening, with the net share reporting easing lending standards reaching the lowest level in four years.

- Lenders' net profit margin outlook has stayed negative for the tenth consecutive quarter but has improved significantly from the survey low in the fourth quarter of 2018 and one-year ago.

- For the ninth consecutive quarter, "competition from other lenders' has continued to be cited as the top reason for lenders" decreased profit margin outlook. This quarter, "consumer demand" continues to be the second most important reason.

"While more lenders anticipate declining rather than rising profit margins, continuing the trend that started in the fourth quarter of 2016, the net share expecting falling profit margins decreased from a survey high in the prior quarter to the lowest share in nearly two years," said Duncan. "Lenders' improved demand outlook going into the spring selling season bodes well for our forecast of relatively flat mortgage volume this year following the double-digit drop in 2018."

The Mortgage Lender Sentiment Survey by Fannie Mae polls senior executives of its lending institution customers on a quarterly basis to assess their views and outlook across varied dimensions of the mortgage market. The Fannie Mae first quarter 2019 Mortgage Lender Sentiment Survey was conducted between Feb. 6, 2019 and Feb. 17, 2019 by PSB in coordination with Fannie Mae.

Read more...