!--more-->It now takes 21.3% of the median monthly income to make the P&I payments on the average home purchase. That’s down from 23.3% in November 2018, more affordable than long-term (1995-2003) average of ~25%, and much more affordable than the 34.5% seen at the height of the pre-crisis market.

Home prices began to react sharply when we hit a 23.3% payment-to-income ratio, suggesting heightened sensitivity to affordability concerns in today’s market… much more so than during that long-term period. Remember that home prices didn’t drop (except in a few notable markets), but the rate at which they had been rising had slowed considerably.

Despite the average home price rising more than $12K from that point, though, today’s rates have worked out to a $108 monthly payment cut on the average home purchased with 20% down. They’ve also boosted the buying power of prospective homebuyers by 15%, which means they could effectively buy $45K “more house” for the same monthly payment they’d have been making last fall.

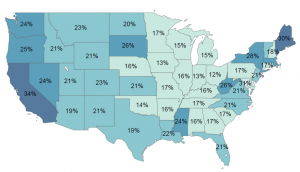

The map shows a quick look at payment-to-income ratios across the country.

The map shows a quick look at payment-to-income ratios across the country.

When it comes to home prices, it appears that the deceleration has leveled off, driven by the aforementioned falling interest rates and improved affordability.

After 15 months of declines in the rate of annual home price growth, June’s Y/Y appreciation held steady from May at 3.78%, according to the Black Knight HPI.

Keep in mind that impacts from rate declines take time to show up in housing market numbers due to contract, offer, closing and recording timelines. So, this stabilization could just be the beginning of things to come. Since rates didn’t hit 3.75% until the end of June, we may not really see any resulting home sale and price changes until August or September.

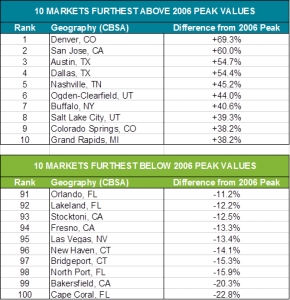

The report also undertook some deeper geographical dives, including a look at the markets furthest above or below their pre-crisis peaks. Check out Denver in the chart.

Finally, the report includes an update on the “refinanceable” population.

Finally, the report includes an update on the “refinanceable” population.

It is no surprise that as mortgage rates have held steady, so has the refi candidate population–some 8.2M 30-year mortgage holders could likely both qualify for a refi and save at least 0.75% off of their current interest rate by doing so. But, the size of this population remains extremely sensitive to even slight interest rate movements.

If rates were to fall just 1/8 of a point, another 1.5M folks would become eligible, bringing the total to 9.7M. Likewise, an eighth of a point increase would knock 1.3M right out of the running.