Black Knight defines tappable equity as the share of equity available for homeowners with mortgages to borrow against before reaching a maximum total combined LTV of 80%.

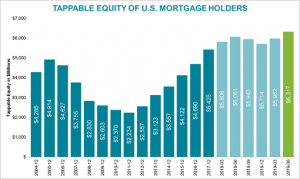

In the second quarter, tappable equity grew by > $335 billion. Tappable equity growth had been slowing in recent quarters due to rising interest rates and slowing home price growth. However, its second quarter growth rate (+4.2%) was slightly above its rate from the first quarter (3%). A total of $6.3 Trillion in tappable equity is now held by 45 million U.S. mortgage holders. That’s the highest volume ever recorded, and 26% above the mid-2006 peak of $5 Trillion.

In the second quarter, tappable equity grew by > $335 billion. Tappable equity growth had been slowing in recent quarters due to rising interest rates and slowing home price growth. However, its second quarter growth rate (+4.2%) was slightly above its rate from the first quarter (3%). A total of $6.3 Trillion in tappable equity is now held by 45 million U.S. mortgage holders. That’s the highest volume ever recorded, and 26% above the mid-2006 peak of $5 Trillion.

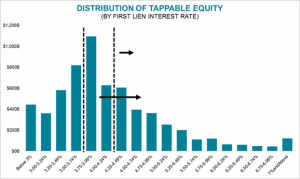

Nearly half (49%) of the 45 million homeowners with tappable equity have first lien interest rates of ≥ 4.25%, making refinancing an attractive option (most also fall into the population of refinance candidates we’ve been tracking). Meanwhile, 76% have rates at or above 3.75%–these folks could potentially tap into home equity with little change to their existing 30-year rate, or perhaps even a slight improvement.

Nearly half (49%) of the 45 million homeowners with tappable equity have first lien interest rates of ≥ 4.25%, making refinancing an attractive option (most also fall into the population of refinance candidates we’ve been tracking). Meanwhile, 76% have rates at or above 3.75%–these folks could potentially tap into home equity with little change to their existing 30-year rate, or perhaps even a slight improvement.

This is also a relatively low risk group, including the majority of those with interest rates above today’s prevailing rate. 55% of tappable equity holders with current interest rates of 4.25% and above have credit scores ≥760. Another 16% have credit scores between 720 and 759.