-more-->

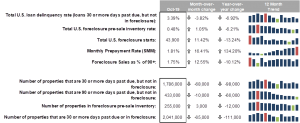

The data showed strong improvement in the national delinquency rate (down 3.8% from September and nearly 7% from last year). At 3.39%, the delinquency rate is now within 0.03% of the record low set back in May.

The data showed strong improvement in the national delinquency rate (down 3.8% from September and nearly 7% from last year). At 3.39%, the delinquency rate is now within 0.03% of the record low set back in May.

Furthermore, serious delinquencies (all loans 90 or more days delinquent but not yet in foreclosure) continue to improve. Down 10,000 from last month and 66,000 from last year, there are now 433,000 serious delinquencies–a low not seen in more than 14 years.

Spurred by the low interest rates of recent months, mortgage prepayments also continued to rise, climbing another 16% from September to hit the highest level since May 2013. That puts prepayments up 134% since this time last year as the refinance surge continues.

However, rates have increased modestly in recent weeks. That, together with the typical seasonal slowing in home sales, may slow down prepayment rates over the coming months.

The full Mortgage Monitor report will be released on Monday, December 9th.