more-->

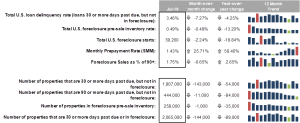

The report also finds that the national delinquency rate fell by 7% in July, offsetting the bulk of June’s calendar-related spike. At 3.46% of the active mortgage universe, delinquencies are near–but just slightly above–the record low reached back in May. It’s also the lowest for any July on record going back to 2000.

The report also finds that the national delinquency rate fell by 7% in July, offsetting the bulk of June’s calendar-related spike. At 3.46% of the active mortgage universe, delinquencies are near–but just slightly above–the record low reached back in May. It’s also the lowest for any July on record going back to 2000.

The impact of rate declines, as prepayments, jumped 26% from June. That puts prepayment activity nearly 60% above this time last year.

Furthermore, both serious delinquencies (-11,000) and active foreclosure inventory (-1,000) fell as well. Serious delinquencies (all loans 90 or more days delinquent, but not in active foreclosure) fell below 445,000 for the first time since June 2006.

*Non-current totals combine foreclosures and delinquencies as a percent of active loans in that state.

Notes:

1) Totals are extrapolated based on Black Knight’s loan-level database of mortgage assets.

2) All whole numbers are rounded to the nearest thousand, except foreclosure starts, which are rounded to the nearest hundred.

The company will provide a more in-depth review of this data in its monthly Mortgage Monitor report, which includes an analysis of data supplemented by detailed charts and graphs that reflect trend and point-in-time observations. For more information about gaining access to Black Knight’s loan-level database, please send an email to This email address is being protected from spambots. You need JavaScript enabled to view it..