Recently the National Association of Hispanic Real Estate Professionals (NAHREP) issued their annual report on the state of Hispanic homeownership which was authored by Marisa Calderon, Executive Director, NAHREP. Below are some of the housing and mortgage related conclusions from this report.

HOUSEHOLD FORMATION

Hispanics formed 485,000 new households in 2018, accounting for 32.4 percent of total U.S. household formations. According to Harvard’s Joint Center for Housing Studies, Hispanics are projected to increase by 4.6 million households between 2015 and 2025. Hispanic household growth continues to outpace that of overall U.S. household growth and is anticipated to do so for the foreseeable future.

HISPANIC CONTRIBUTIONS OVER THE PAST DECADE

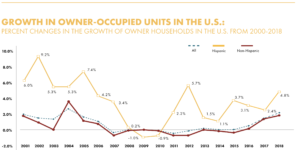

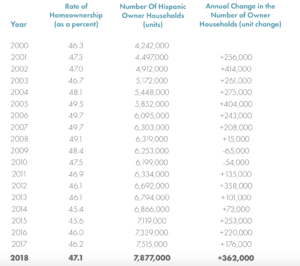

In 2018, Hispanics achieved a net gain of 362,000 homeowners. This raised the Hispanic homeownership rate from 46.2 percent in 2017 to 47.1 percent in 2018.31

Over the past decade, Hispanics have accounted for 62.7 percent of net U.S. homeownership gains, growing from 6,303,000 homeowners to 7,877,000, a total increase of 1,574,000 Hispanic homeowners.32 This growth trajectory for Hispanic homeownership is consistent with projections made by the Urban Institute that Hispanics will account for more than half of all new homeowners over the next several years and for 56 percent of all new homeowners by 2030.33

For the fourth consecutive year, Hispanics were the only ethnic demographic group to raise their rate of homeownership. At 47.1 percent, the rate of Hispanic homeownership is less than three percentage points from its all-time high of 49.7 percent. Hispanic median household income also rose to $50,486, accounting for the largest increase in income (3.7 percent) among all racial or ethnic population groups.34

In nearly every state where Hispanics account for greater than 30 percent of the state’s population, their rate of homeownership is above 50 percent. California is the only exception where Hispanics comprise 38.8 percent of the state’s population and have a 43.07 rate of homeownership. This difference is heavily influenced by the intersection of pervasive affordability challenges and inventory shortages across California.

Hispanic Homeownership by the #'s

HOUSING INVENTORY SHORTAGE

HOUSING INVENTORY SHORTAGE

The U.S. is experiencing record-level housing inventory shortages. According to Zillow, in 2018 there were 10 percent fewer homes on the market than the prior year.39 The impact is greatest in markets where home values are appreciating the fastest, with up to 40 percent fewer homes on the market. The effect is acute in markets with high concentrations of Hispanics such as Los Angeles (22 percent fewer), Las Vegas (24 percent fewer), and Denver (25 percent fewer).40

LABOR SHORTAGES AS AN INFLUENCING FACTOR

A lack of available skilled labor in the construction industry is one of the upstream contributors to the housing inventory shortage. Nearly 80 percent of construction firms plan to increase their headcount in 2019, but an almost equal percentage are concerned about finding qualified workers.41

The skilled labor shortage marks the intersection of housing and immigration policy. Hispanic men represent the largest share of construction workers, and nearly 30 percent of undocumented men work in construction. With no immediate resolution, the U.S. could continue to have a significant skilled labor gap for the foreseeable future which would have a lasting effect on the construction industry’s ability to build new housing stock.

ACCESS TO CREDIT

In 2017, both debt-to-income (DTI) ratio and credit history accounted for 40 percent of mortgage loan denials for Hispanics.51 When asked, Hispanic consumers believe their primary obstacles to getting a mortgage are an insufficient credit score, the ability to afford a down payment, and insufficient income for monthly payments.

From 2017 to 2018, unease increased regarding affordability and income-related obstacles.52 These perceptual changes are directionally aligned with the current market conditions, including increased home prices which materially affect borrower financing limits. Maintaining policy tools like the Qualified Mortgage Patch (QM Patch) in place will help as it provides an alternative calculation for consumers with DTI above 43 percent.

FINANCING VEHICLES

Hispanic home buyers are more than twice as likely (42.8 percent) to have an FHA loan, as compared to non-Hispanics (20.6 percent).53 In contrast, 79.4 percent of non-Hispanic home buyers have conventional financing, compared to 57.2 percent of Hispanics. These differences mean Hispanics are more likely to pay mortgage insurance premiums (MIP) for the life of their FHA mortgage, thereby increasing overall monthly out-of-pocket expenses. OURCE: FANNIE MAE